Papua New Guinea

Last updated: February 2023

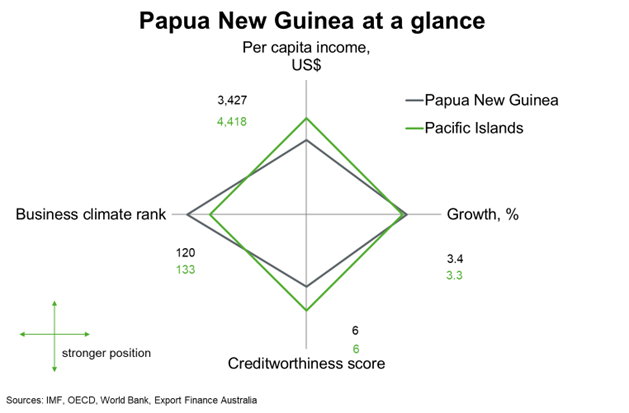

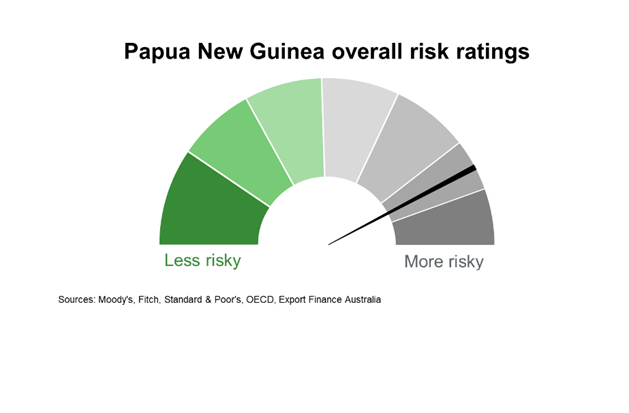

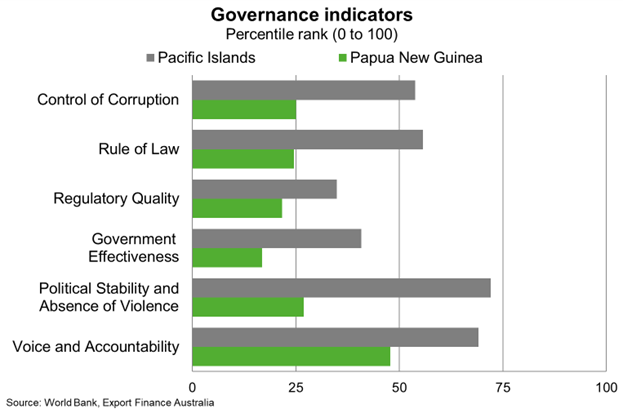

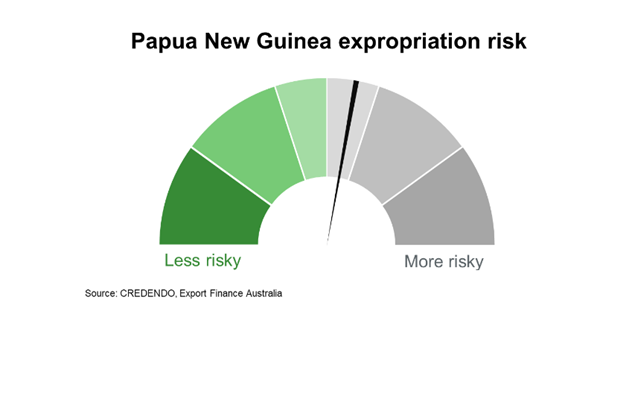

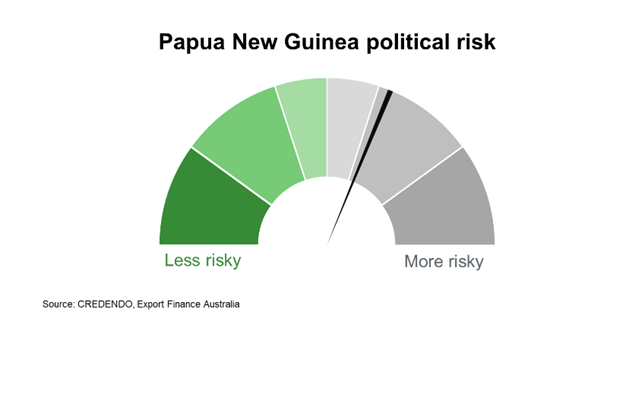

Papua New Guinea’s (PNG) per capita income lags most of its Pacific Island peers, while indicators of the business climate and growth are slightly stronger than in other Pacific Islands. Creditworthiness is on par with other Pacific Island countries. PNG’s natural resources wealth and continued support from bilateral and multilateral development partners remain important for economic prospects, business conditions and creditworthiness.