South Korea

Last updated: February 2023

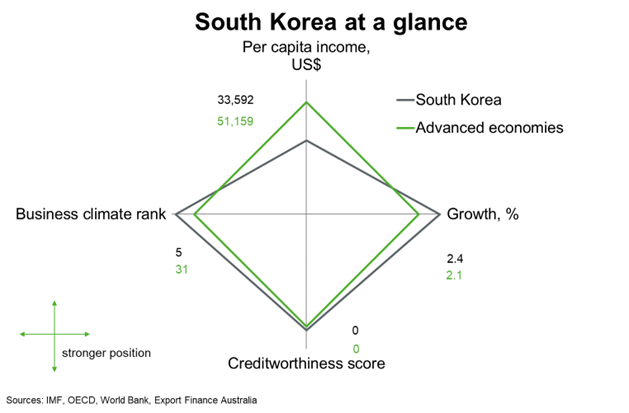

South Korea is the tenth largest economy in the world and the fourth largest in Asia. Even though per capita incomes in South Korea lag behind most advanced economies, the business climate and growth outperform advanced economy peers. Creditworthiness is high, as is the case in many advanced economies.

| This chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2023 and 2027. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other regional countries. |

Economic outlook

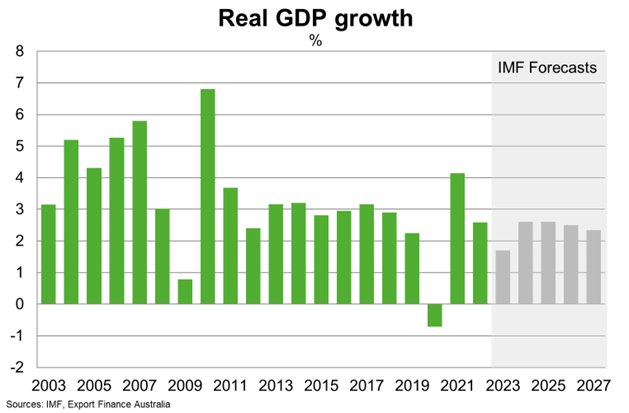

Economic growth slowed to 2.6% in 2022 from 4.1% in 2021. Consumption and investment lost momentum amid weak income growth, rising interest rates and a sluggish housing market. Manufacturing exports declined 16.6% year-on-year January 2023 due to weakened global demand for semiconductors and chemicals and supply disruptions related to China’s zero-COVID-19 policy.

Growth will further moderate to 1.7% in 2023, driven by slower growth in major export markets, and rising interest rates further dampening consumption and increasing household debt obligations. Household debt is high in Korea, reaching 206% of household disposable income in 2021; further interest rate hikes pose downside risks to household debt serviceability. China's economic reopening will ease supply issues for Korean manufacturers, and support production and export demand.

Regarding risks, higher energy prices, further supply chain disruptions and regional geopolitical tensions remain notable threats to the outlook. On the upside, growing regional trade on the back of free trade agreements, like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and Regional Comprehensive Economic Partnership (RCEP), could help support stronger regional trade and economic growth.

Longer term, the South Korean authorities’ proactive planning to identify new growth engines opens possibilities to boost future economic potential. The “Korean Green New Deal” aims to increase investment in green and digital sectors (including solar panels and wind turbines, electric vehicles, cloud computing and artificial intelligence) and strengthen the employment safety net. That is balanced against ongoing demographic pressures that continue to pose economic and fiscal challenges over the longer term.

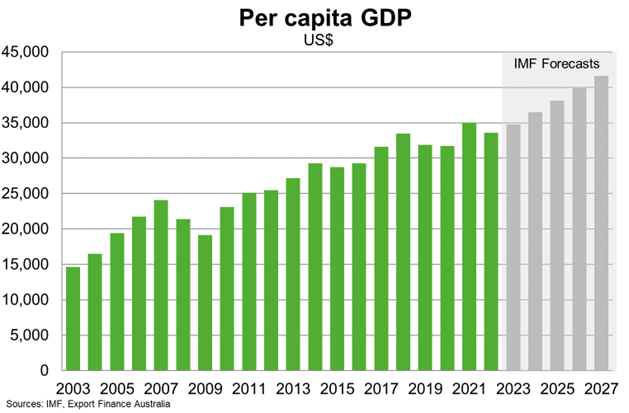

South Korea is one of the few countries that has successfully transformed itself from a low-income to a high-income economy, although income inequality remains high. The government recently increased minimum wages, provided basic pensions for the elderly and greater unemployment benefits for the youth to help tackle income inequality. But current high inflation is squeezing household budgets, hitting the vulnerable particularly hard. As the economy grows and government measures gain traction, the IMF projects GDP per capita to rise toward US$42,000 in 2027 from an estimated US$34,700 in 2022.

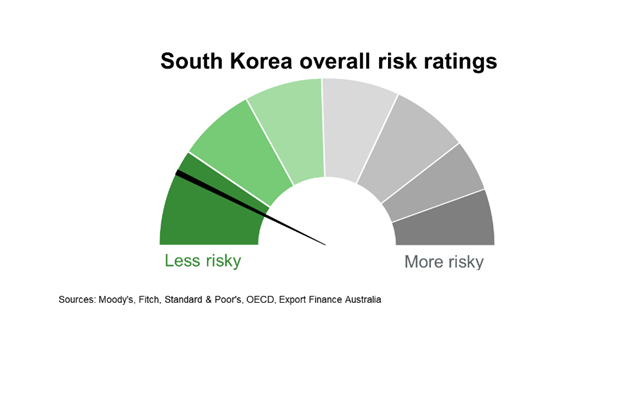

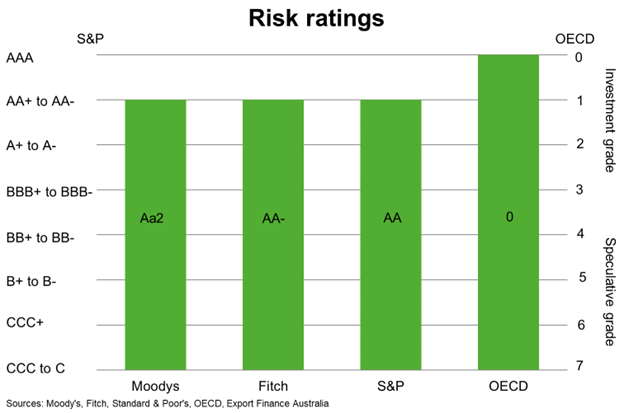

Country risk

Country risk in South Korea is low, suggesting a low likelihood that it will be unable and/or unwilling to meet its external debt obligations. The three private ratings agencies have high investment grade credit ratings for South Korea.

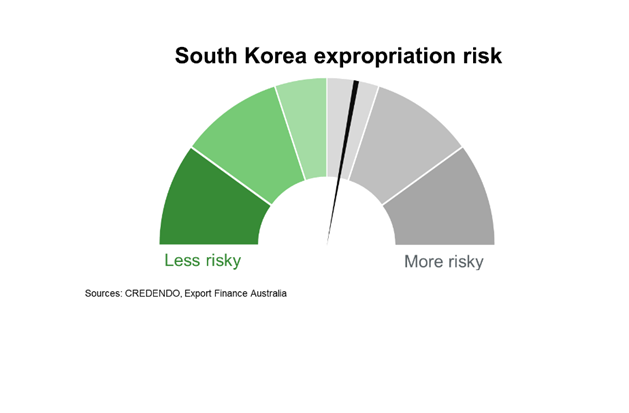

The risk of expropriation is moderate. According to the US investment climate statements, South Korea follows generally accepted principles of international law with respect to expropriation. South Korean law protects foreign-invested enterprise property from expropriation or requisition. Private property can be expropriated for a public purpose—like urban redevelopment, building new industrial complexes, or constructing roads. Property owners are entitled to prompt compensation at fair market value.

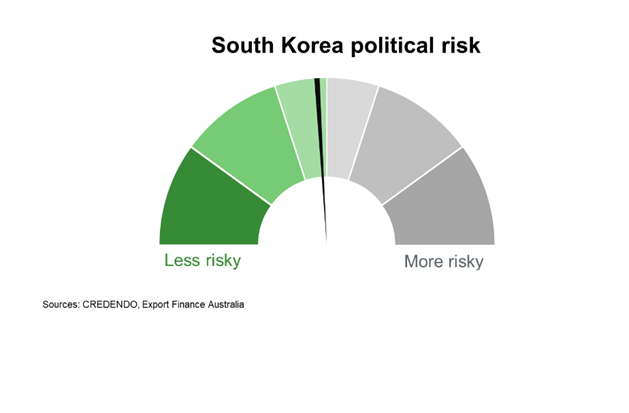

Political risk is also moderate and is mainly driven by long-standing tensions with North Korea. Periodic tensions in South Korea's bilateral relations with larger neighbours, including China and Japan, have led to occasional disruptions to the economy. The domestic political environment remains relatively stable.

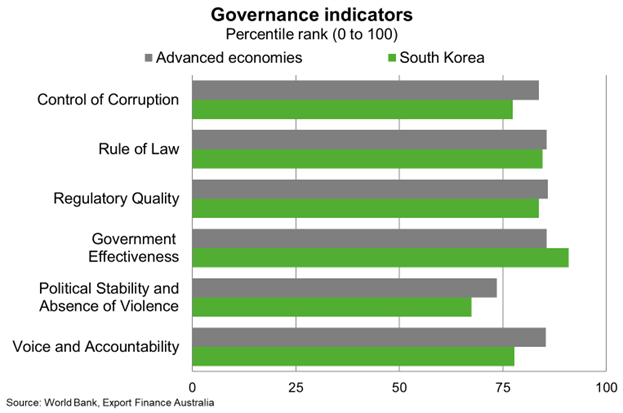

Fiscal, monetary and regulatory institutions are very strong, as reflected in a long-track record of robust economic and fiscal management. But governance indicators are slightly lower than most other advanced economies. Corruption remains a significant constraint on the institutional environment and doing business. This reflects, in part, perceptions of the disproportionate influence of the country's chaebol on the economy and government. Ongoing government efforts to reduce corruption could strengthen governance standards over the medium to long term.

Bilateral relations

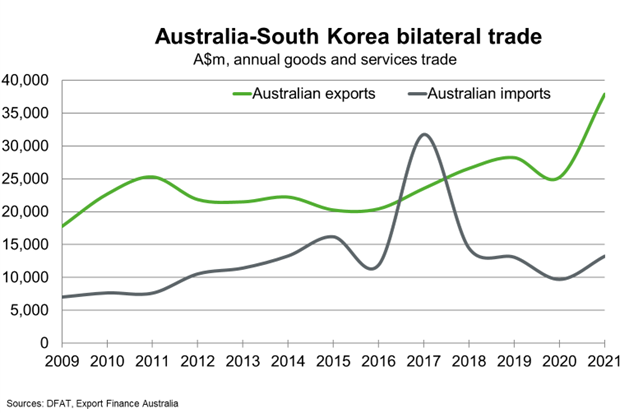

South Korea is Australia’s fourth largest trading partner, after China, Japan and the US. Bilateral trade accounted for around $51 billion of Australia’s international trade in 2021, almost 50% higher than in 2020. The increase in two-way trade in 2021 was largely driven by increased iron ore, coal and LNG demand, as South Korea’s economy recovered from the pandemic. Australia is also among the world’s biggest suppliers of agricultural and food related products to South Korea. Australian imports have risen and fallen sharply in the past few years, reflecting the one-off purchase of Korean-made ships in 2017 (around $18 billion). Australia’s main goods imports from South Korea included cars and refined petroleum in 2021.

The KAFTA—Australia’s bilateral trade agreement with Korea—which came into force in December 2014, lowered tariffs between the two countries and has significantly strengthened trade relations.

Over the longer term, South Korea’s focus on boosting “green” and “digital” investments is positive for Australian exporters, particularly of iron ore, copper, food and beverage. It also opens opportunities for aerospace, automotive, shipbuilding, electronics and machinery exporters to supply South Korea’s strong manufacturing base.

Services trade between the two countries is smaller than goods trade. Total services trade stood at $1 billion in 2021, more than 30% lower than in 2020, having been hit hard by the pandemic. The bilateral FTA supports opportunities for suppliers of legal, accounting and telecommunications services and enhances market access for other services, including financial services and education.

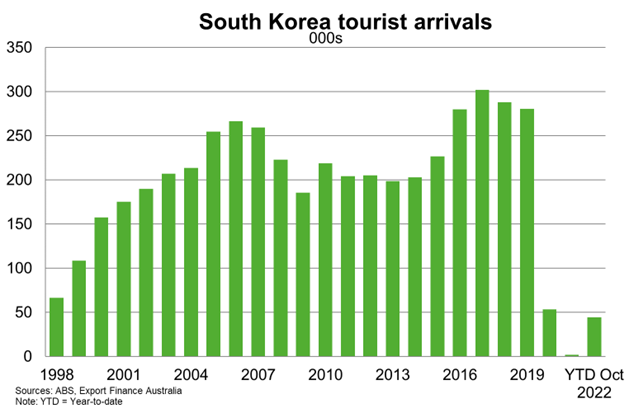

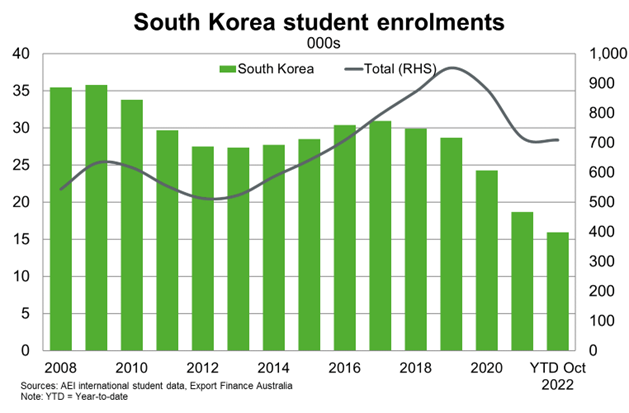

South Korea was Australia’s 12th largest source of international students as of October 2022, down from 6th in 2016. South Korean student enrolments in Australia have been falling since 2018, due in part to students’ preference to study in other regional and more affordable destinations. Recovery in Korean tourism to Australia has been sluggish due to international border closures. But a full year of open international borders in 2023 and pent-up demand for travel should support recovery in South Korean tourism to Australia, and broader services exports.

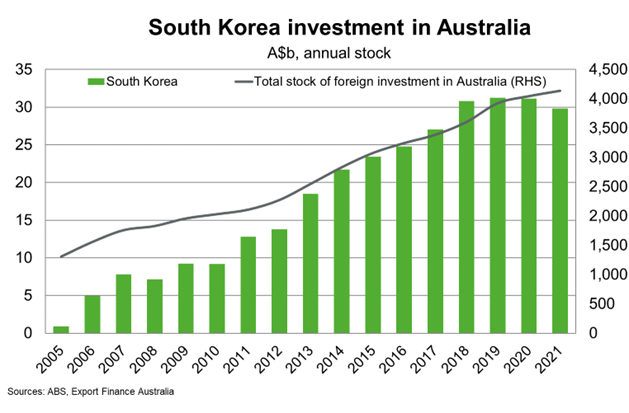

South Korean direct investment in Australia has grown sharply over the past 15 years, totalling around $30 billion in 2021. Major South Korean investors include POSCO, the Korean Gas Company (KOGAS), SK E&S and Korea Zinc. Opportunities exist for Australian critical minerals as South Korea invests in low-emissions technology to achieve its net zero carbon emissions target by 2050.

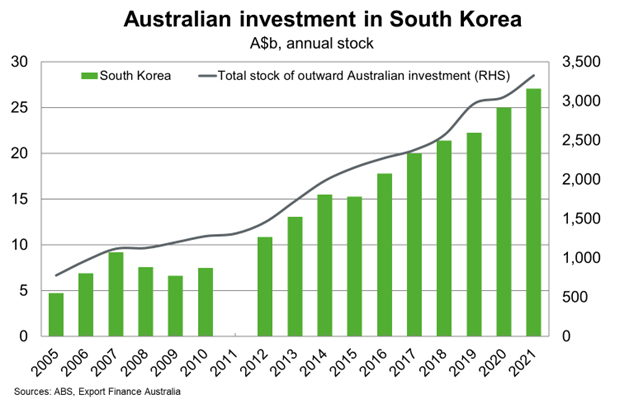

Australian investment in South Korea, at more than $27 billion in 2021, has been growing solidly over several years. A large proportion of this Australian investment has been made by financial and infrastructure firms.