Mexico

Mexico

Last updated: January 2022

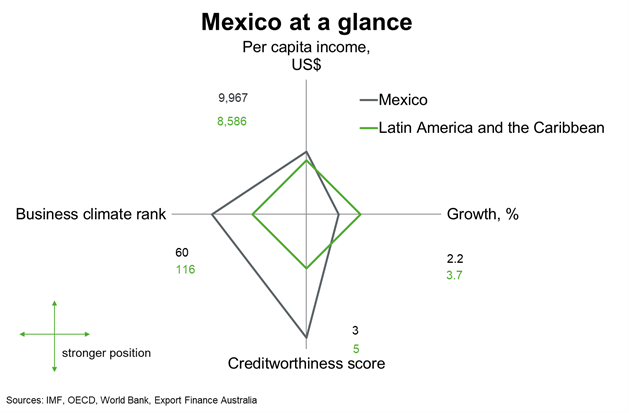

Mexico is Latin America’s second largest economy after Brazil. Mexico outperforms Latin American peers on measures of creditworthiness and business climate. Per capita incomes are slightly higher than the regional average, but growth prospects are lower than its neighbours. Global economic uncertainty, exacerbated by the pandemic, is the chief risk to investment and growth.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2022 and 2026. Business climate is measured by the World Bank’s latest Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic outlook

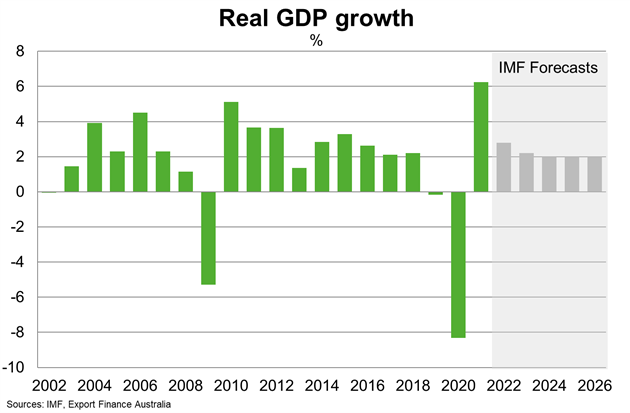

Mexico suffered its worst economic contraction of 8.3% in 2020, before growth of about 6% in 2021. The COVID-19 pandemic continues to hit Mexican firms, employment and households. The IMF expects the economy to grow at 2.8% in 2022. Tight monetary policy, inflation and lower growth in the US, a key export partner, remain key challenges in the near-term.

Beyond the pandemic, Mexico’s medium-term growth prospects have significantly weakened due to chronically weak investments and uneven implementation of structural reforms, including the reversal of private-oriented energy sector reforms. For instance, the current administration’s suspension of auctions for oil blocks has dampened private investment in the energy sector. Such auctions were expected to attract foreign investors in exploration and eventually oil production through significant investment. Chronic structural issues remain, including low levels of education and a large informal workforce.

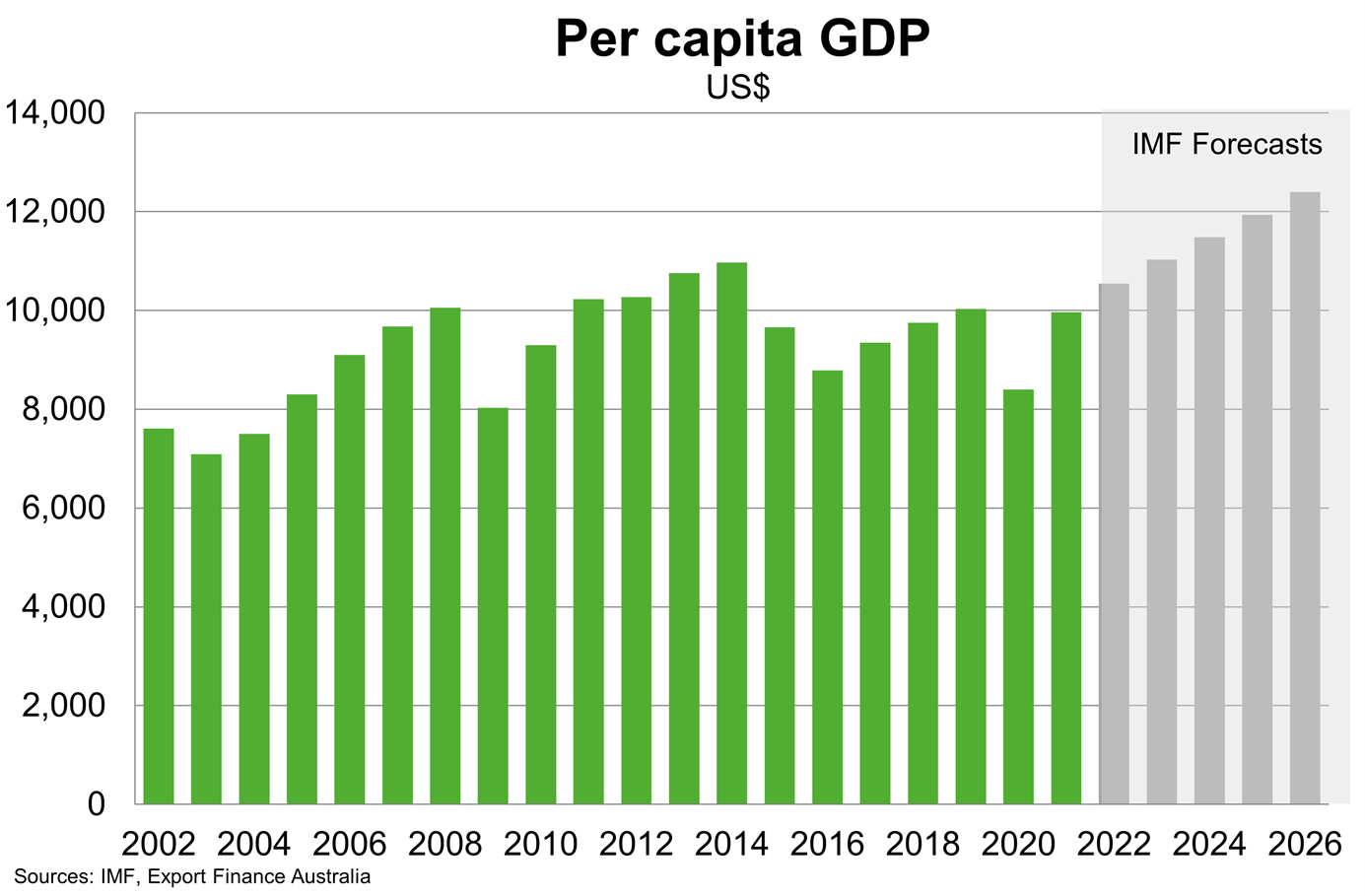

The pandemic caused significant increases in poverty, inequalities and gender gaps. Per capita incomes are gradually recovering as economic growth resumes, reaching an estimated US$10,000 in 2021. Although incomes are likely to continue to rise, they will remain lower than regional heavy weights, Brazil and Argentina, in the foreseeable future.

Country risk

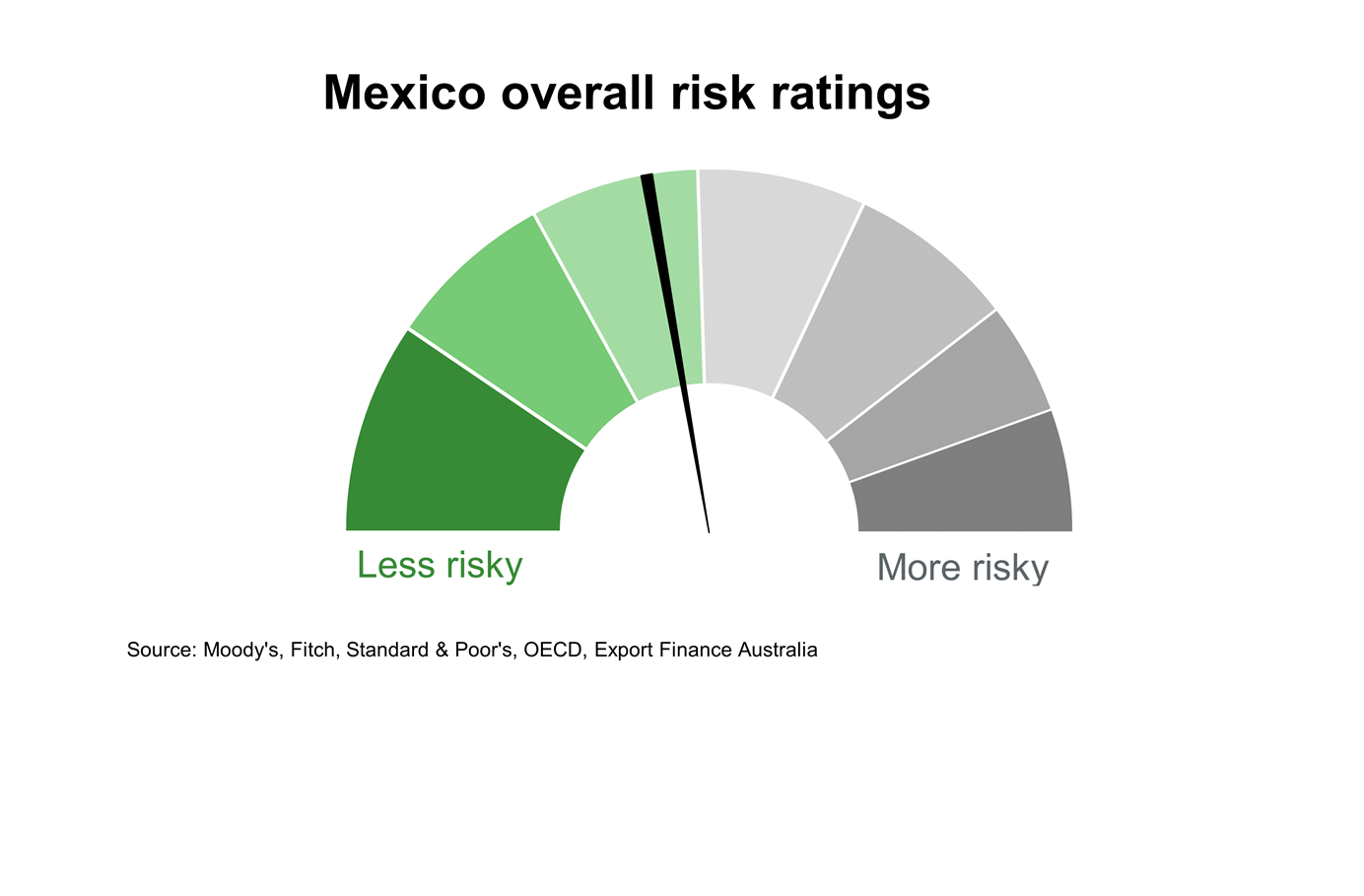

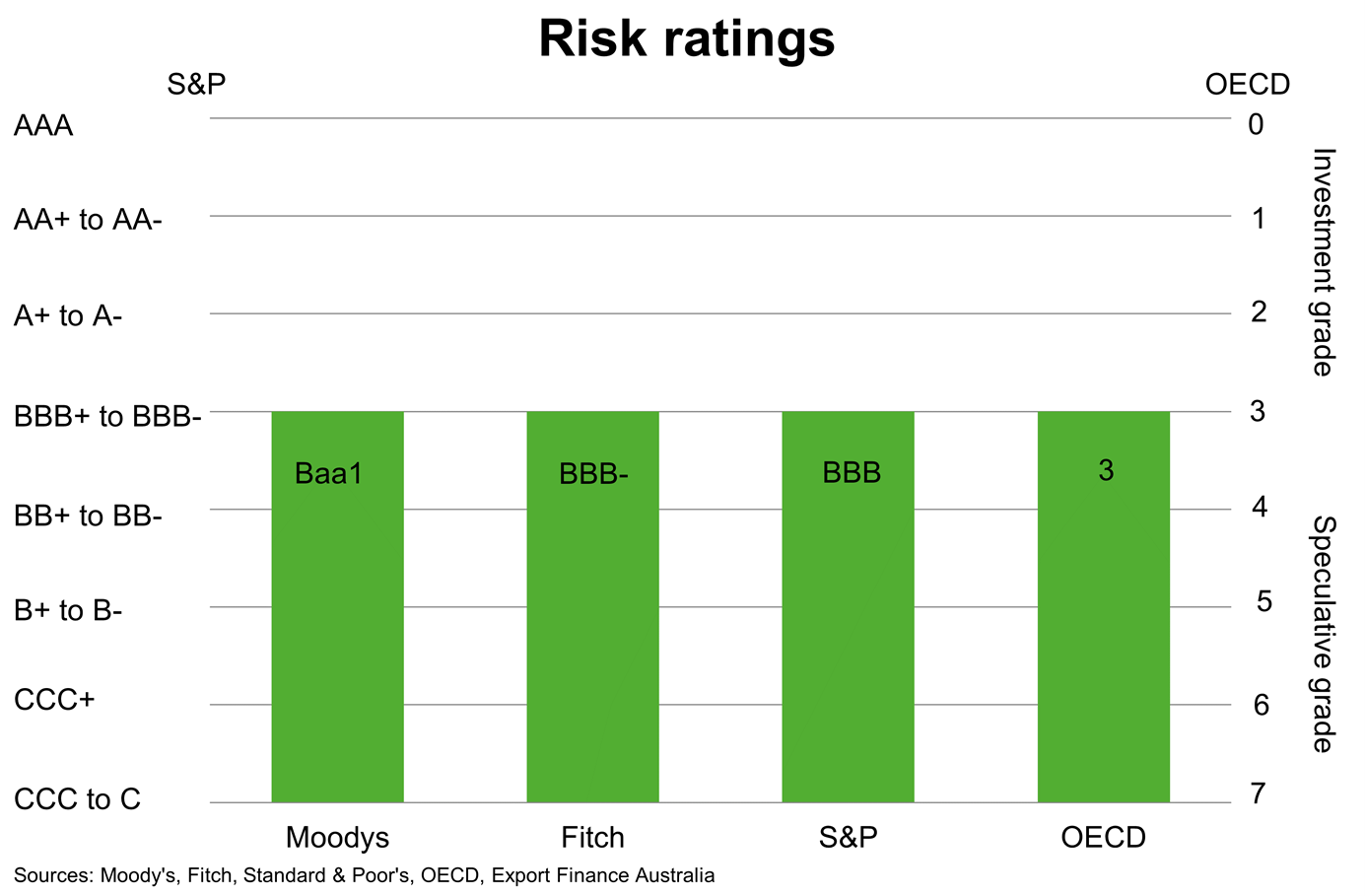

Country risk in Mexico is low to moderate. The OECD country risk rating is 3 which indicates a relatively low to moderate likelihood that Mexico will be unable and/or unwilling to meet its external debt obligations, although private and sub-sovereign debtors can and do default. Mexico’s economic performance will continue to be heavily influenced by external developments, including in the US. The government is continuing efforts to strengthen the rule of law, stamp out corruption and reduce crime. But governance issues, uneven reform implementation, illicit drug trade and high levels of violence remain long-standing constraints on the operating environment for business.

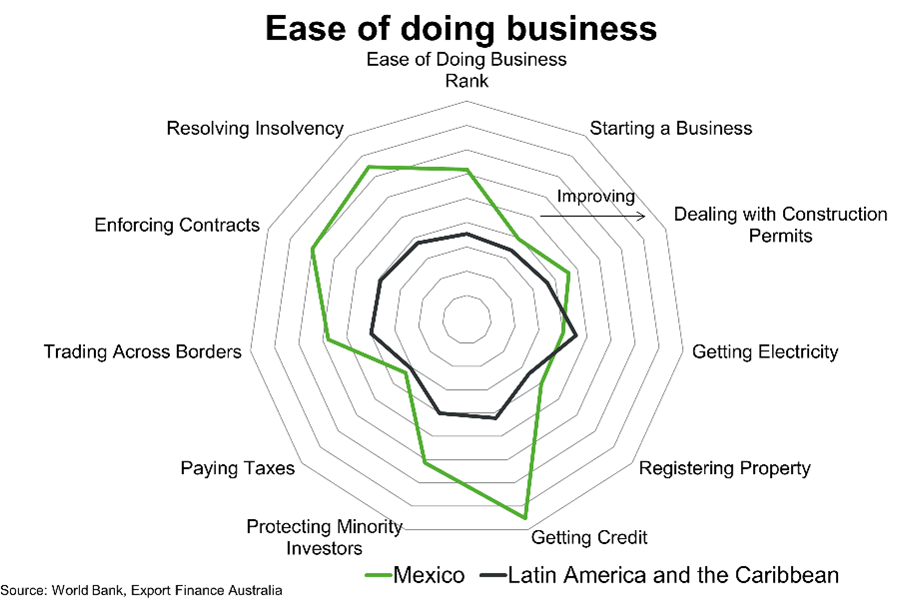

Mexico is ranked 60th out of a possible 190 economies on the World Bank’s ease of doing business scorecard, well above the Latin America and Caribbean average of 116. Mexico outperforms Latin America and the Caribbean in almost all categories. That said, getting electricity is slightly harder in Mexico given the complex nature of the process and economic and geographical factors.

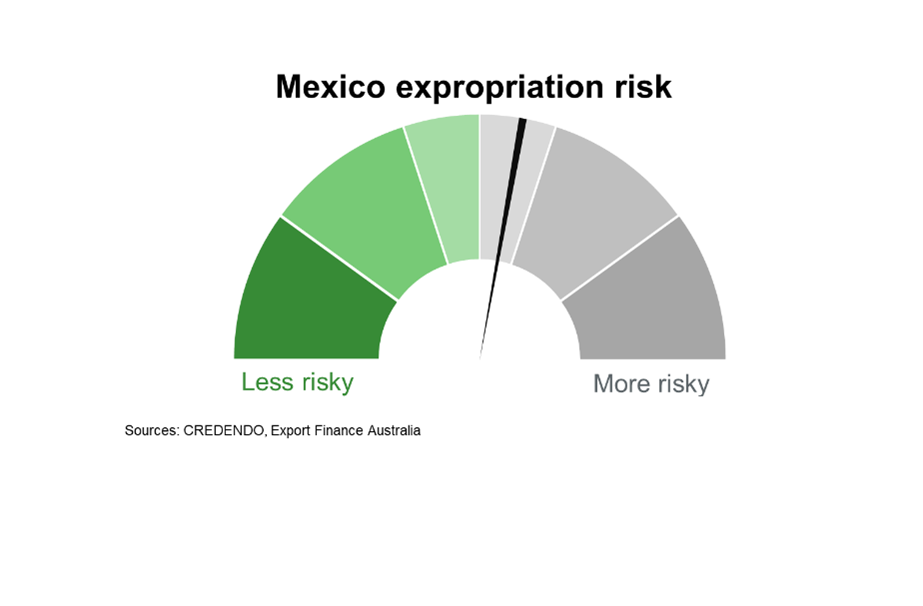

The risk of expropriation in Mexico is low to moderate. Mexico has a history of natural resource expropriation over the last century, and it remains a popular policy mentioned during election cycles across Latin America. The current government favours control of the nation’s oil and energy production.

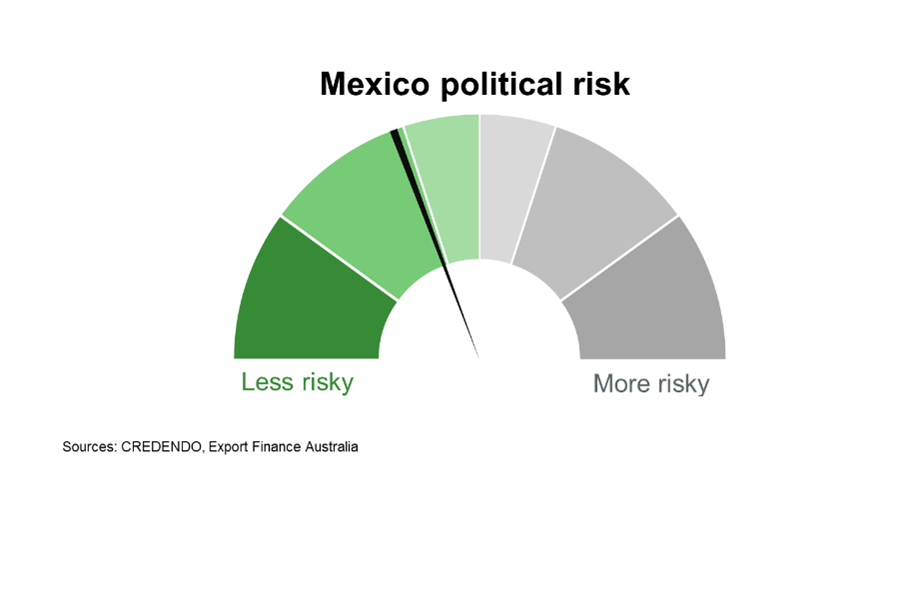

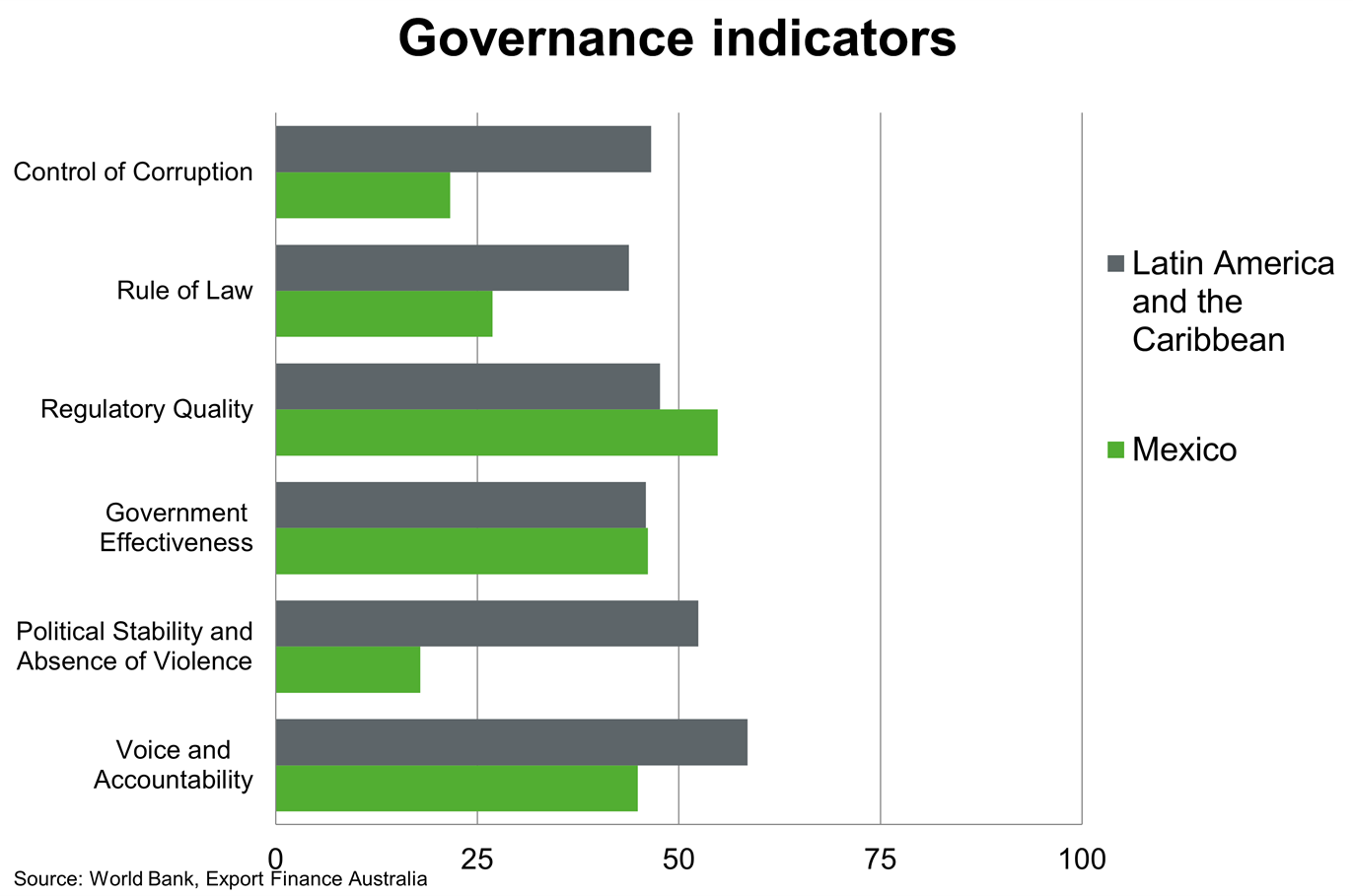

Political risk in Mexico is low. But Mexico’s governance indicators relative to the rest of Latin America and the Caribbean are mixed. Regulatory quality and government effectiveness are the only two categories where Mexico ranks above the regional average. Despite authorities’ ongoing efforts to tackle corruption and reduce crime, measures of political stability/absence of violence and control of corruption are notably below the Latin American and Caribbean average.

Bilateral relations

Mexico was Australia’s 26th largest trading partner in 2020 and largest trade partner in Latin America, ahead of Brazil. Australia’s interests are weighted towards investment, although exports are benefiting from new opportunities under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the first FTA between the two countries. Australia continues to negotiate a Free Trade Agreement with Mexico as a member of the Pacific Alliance (Chile, Colombia, Mexico and Peru).

Total goods and services trade amounted to $3.4 billion in 2020, making up 0.4% of Australia’s trade portfolio. The main Australian goods exports include ores and concentrates, non-electrical engines and motors and flat-rolled iron and steel. Major Australian goods imports include telecommunication equipment and parts, medical instruments and alcoholic beverages.

Mexico’s drive to improve farming productivity is positive for Australian agricultural services exporters, particularly for sensors (enabling real time traceability for crops), automation, robotics, drones, smart irrigation and data analytics. Tariff reductions in the CPTPP agreement will support growing demand for Australian meat and premium food. Australian wine is also becoming increasingly popular and there is scope to raise participation in the processed food industry. The mining industry presents ongoing opportunities for Australian mining and services companies; Mexico is among the world’s largest producers of silver, copper, bismuth and zinc.

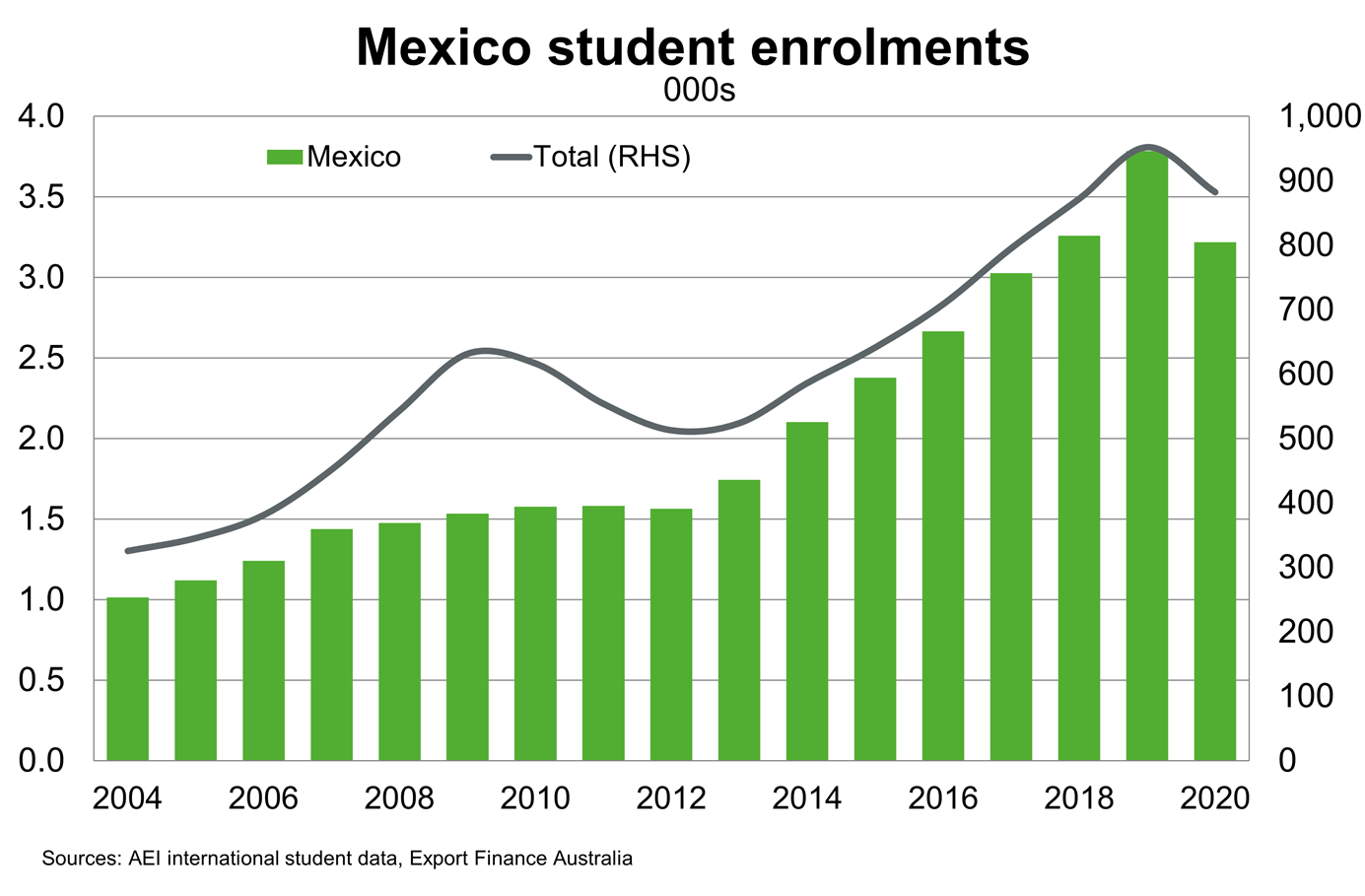

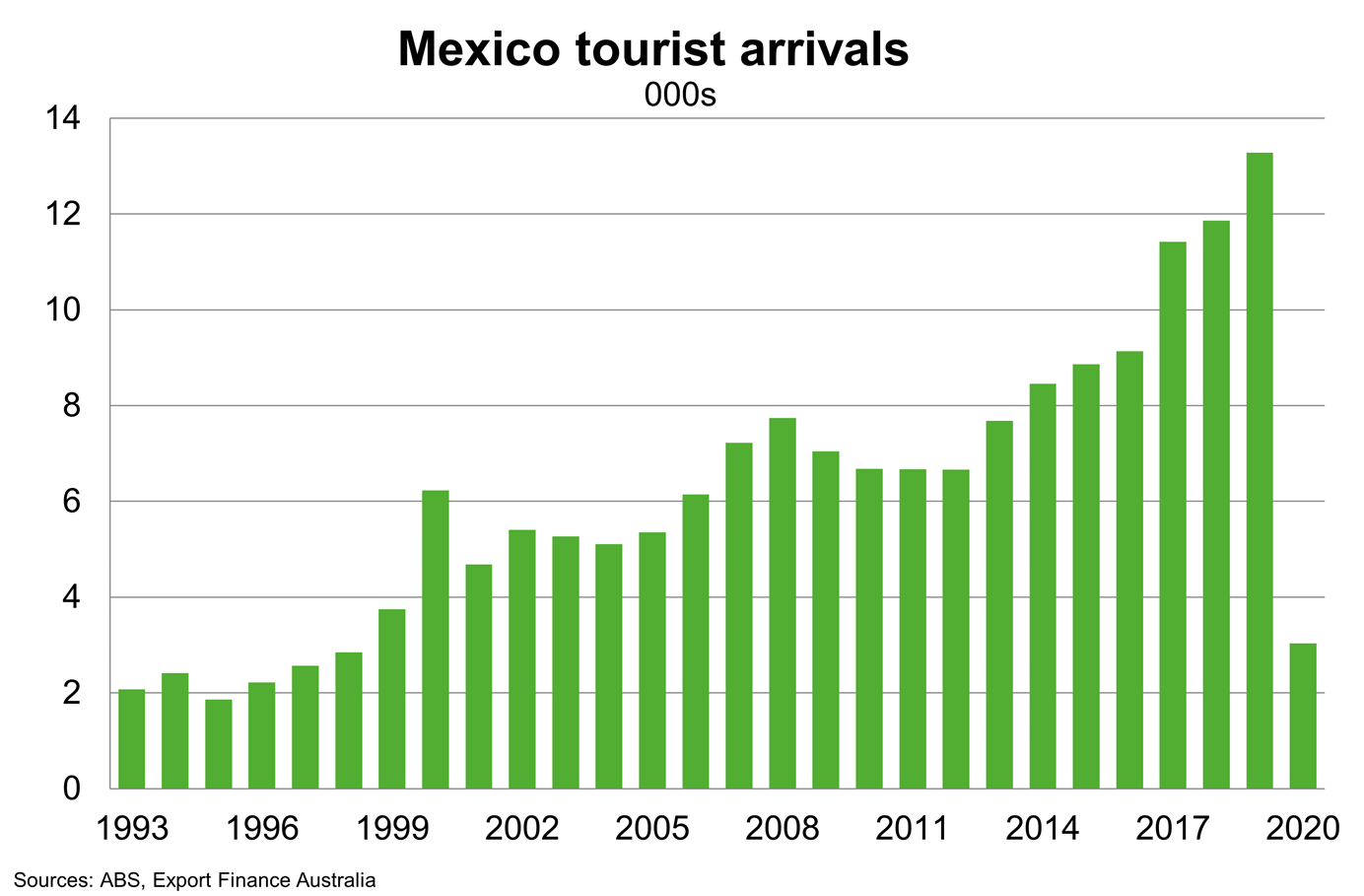

Service exports to Mexico totalled $113 million in 2020, down from $157 million in 2019. The COVID-19 pandemic punctured the strong growth in Mexican students in Australia and tourism arrivals. The ongoing pandemic points to another year of uncertainty for tourism, and broader services exports, in 2022.

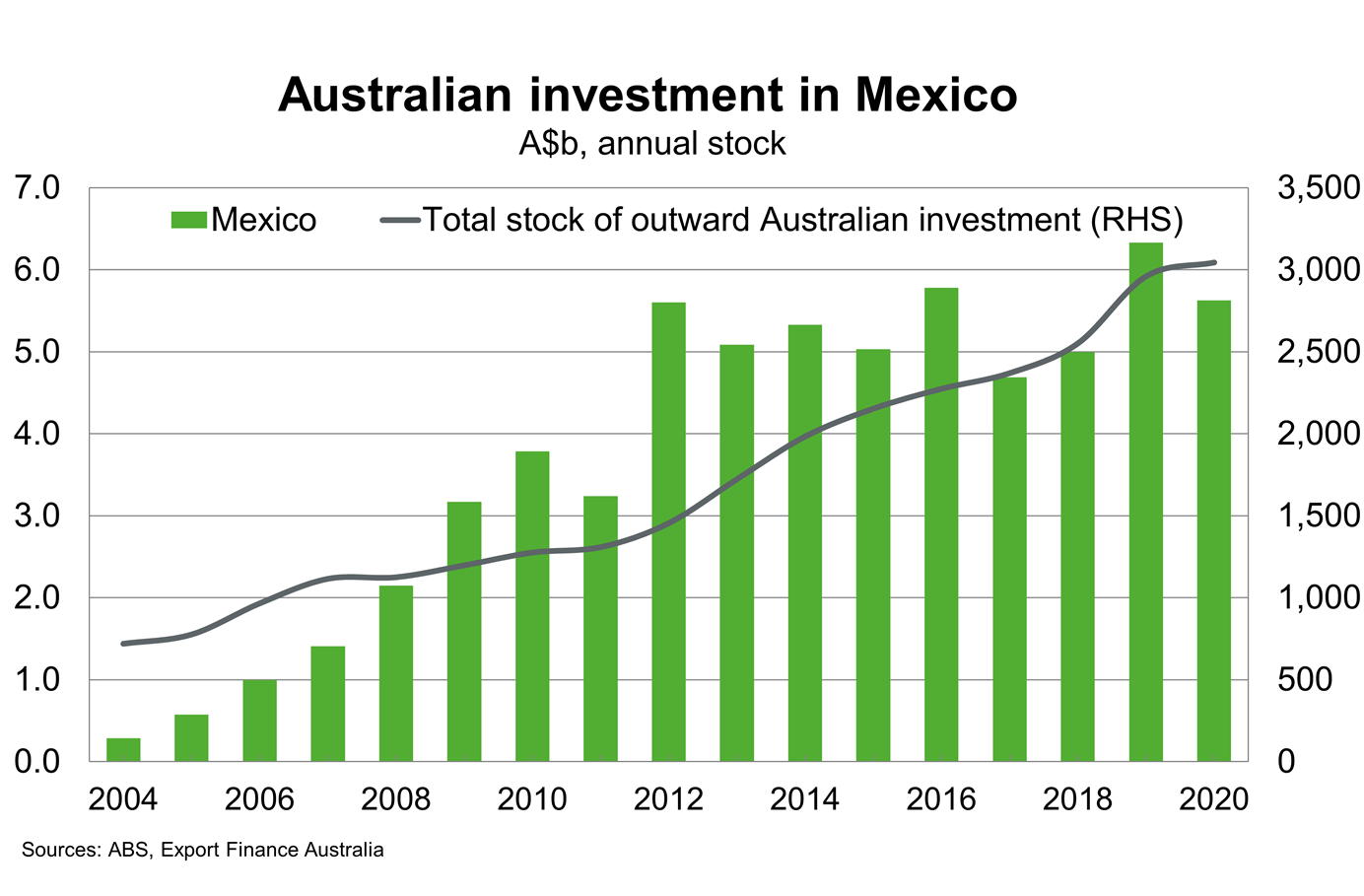

Australia is the seventh largest source of foreign investment in Mexico. As of 2021, there were over 71 operating affiliates of Australian companies in Mexico across a range of market sectors, including mining and related services, infrastructure, health and education. Such firms include BHP Billiton, Macquarie, Worley Parsons, Orica, Cochlear, Ansell, Amcor, Seek and Aristocrat.

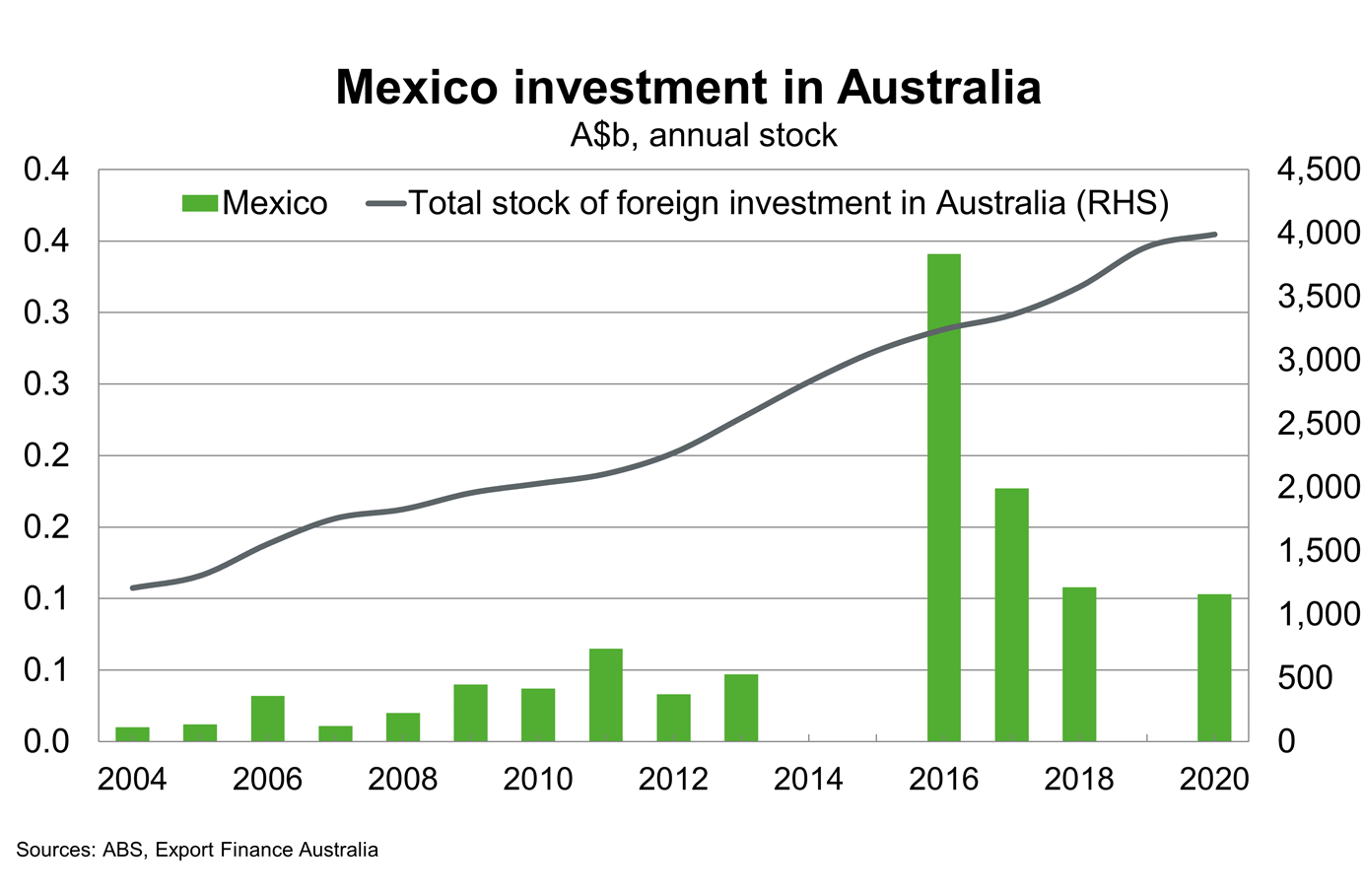

Mexico’s investment in Australia is small, with Gruma (Mission Foods) and Riverina Oils the only major Mexican investors in Australia.

Useful links

Department of Foreign Affairs and Trade

Austrade