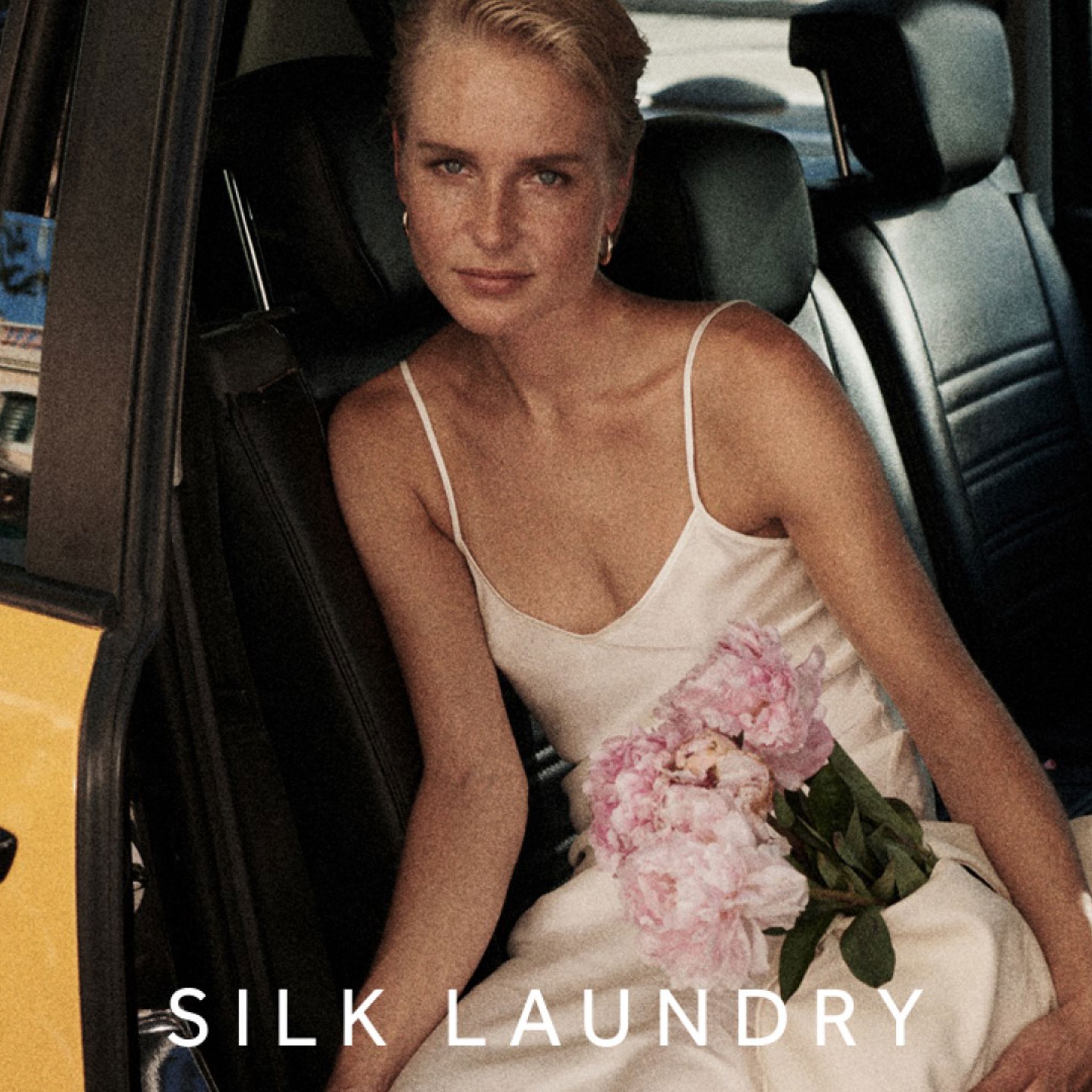

Silk Laundry

Women’s fashion label Silk Laundry specialises in producing and exporting silk garments to more than 30 countries.

Need

Silk Laundry wanted to expand its e-commerce offering but faced cash flow gaps with manufacturing, production and delivery times. The business needed a cash flow boost and working capital and approached us for support.

Solution

With our support, Silk Laundry is using the $500,000 Export Line of Credit facility to manufacture a large portion of customer orders upfront. This allowed the business to focus on its e-commerce strategy and grow its presence in new markets.

Fashion label Silk Laundry has a clear purpose - to design pieces for conscious consumers of style and purpose.

With a vast international presence, their story is one of humble beginnings.

“It’s one of those small garage start-up stories,” said Reece Rackley, Chief Executive Officer of Silk Laundry. “Back in 2015, launched by my wife and myself - we started with just four items in two or three colours because we wanted to focus on timeless styles that innovated upon classic ideas, items that were thoughtfully made to complement and update wardrobe staples.”

Fast forward to today, Silk Laundry has grown in size and scale. Its focus on e-commerce and international expansion resulted in Australian and Canadian storefronts, and shipping and wholesaling to more than 30 countries.

However, in such a fluctuating industry, cash flow is heavily reliant on manufacturing, production and delivery times.

Silk Laundry recognised the need for financial support to help accelerate its business growth. Its corporate advisor previously worked with our Queensland Business Development team through another customer and saw an opportunity for Silk Laundry to work with us.

Overcoming the seasonal challenges

Because Silk Laundry was able to meet our criteria and our team worked with them directly to understand their business, Reece said it was a smooth process.

“We had the documentation and due diligence and away we went – it was actually pretty seamless and quick.”

After a successful loan application, Silk Laundry is grateful for our support – not only because of the financial solution, but also for our straightforward process.

Reece also shared that because fashion brands are commonly large in scale and mass produced, the timing structure can be intensive on working capital.

“Wholesalers going into production, factories requiring deposits, pre-advancing on fabric purchasing … once we’ve landed stock and can launch a collection online, from that point forward we’re cashflow positive,” said Reece. “But it’s the three months pre-that which is a challenge.”

With our support, Silk Laundry is overcoming its cash flow gaps. Our A$500,000 Export Line of Credit facility is playing an instrumental role in Silk Laundry’s expansion plans.

“The finance will be able to grow our market internationally and in wholesale marketing specifically. We’ll be able to finance the manufacturing portion of a large chunk of our orders upfront, prior to being able to distribute.”

Export Finance Australia is not just a financier. There’s a partnership there in helping us grow this business. We’ve got someone there that is trying to facilitate and encourage us to do so.

Reece Rackley

Chief Executive Officer, Silk Laundry

Confidence to grow

Silk Laundry is continuously producing a range of new accessories to incorporate into the label. The team also intends to continue expanding and exporting into international markets.

“Our plan is also for our e-commerce to continue to grow for the next 6-12 months,” said Reece. “We would like to start looking at new market entries: wholesale, retail and e-commerce, and into the European market.

“The fact that this sort of financing exists gives us as a business a lot more confidence and a strategy of growth to target these markets. I would absolutely recommend Export Finance Australia.”