© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

ASEAN—Economic momentum weakening, but fundamentals intact

On 1 August, a White House Executive Order confirmed US “reciprocal” tariffs; at levels lower than announced in April, but much higher than 2024, for major ASEAN economies. In addition, elevated sector-specific tariffs on steel, aluminium and copper will persist. While part of the cost of tariffs will be borne by US consumers, lower US demand and tighter margins will weigh on manufacturing production and confidence in tariff-hit countries, particularly as front-loading and inventory accumulation fades. As such, despite the avoidance of broader tit-for-tat retaliation, recent WTO forecasts suggest world trade will grow by just 0.9% this year and 1.8% next year, down from 2.9% last year.

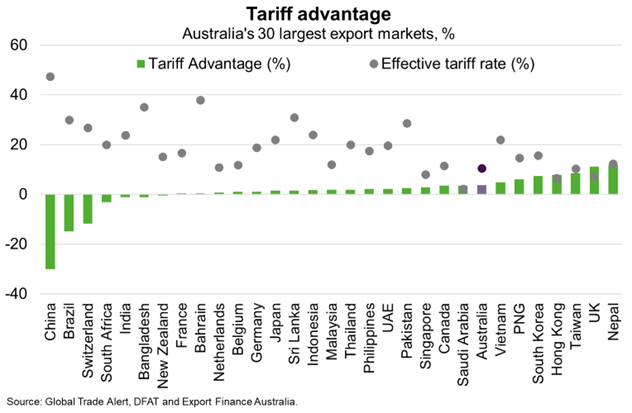

Still, Asia will continue to contribute the large majority of world trade growth and major ASEAN economies will remain competitive export manufacturing bases. Global Trade Alert (GTA) calculates trade-weighted effective tariff rates on major ASEAN economies ranging from 8% (Singapore) to 24% (Indonesia), well below that of China (47%). As such, the “tariff advantage”—the trade-weighted average tariff for a country compared to its competitors selling the same products to the US—is currently positive across ASEAN (Chart).

That said, ASEAN remains exposed to potential tariffs once Section 232 investigations are complete, particularly on semiconductors, pharmaceuticals, electronic products, wood products and critical minerals. The region is also susceptible to a 40% tariff on goods “trans-shipped to evade applicable duties”, given strong trade and investment links with China and relative complexity of the region’s manufacturing supply chains. Despite uncertainty regarding implementation of this provision, economies with relatively low domestic value added in exports—Vietnam, Malaysia, Thailand, and Singapore—are particularly vulnerable. These economies are also export-heavy relative to the Philippines and Indonesia where domestic demand will provide additional resilience. In response, ASEAN members intend to further integrate regionally, even though some of them have received US trade deals.