© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—Growth expectations upgraded, but deflation and overcapacity persist

Stronger-than-expected activity in H1 2025 and ongoing government support for consumption saw the IMF upgrade China’s GDP growth forecast to 4.8% in 2025 and 4.2% in 2026 (from 4.0% for both 2025 and 2026 in its April 2025 forecasts). China has been subject to the largest US tariff increase and the most volatility in announced tariff rates. Still, a decline in Chinese exports to the US has been more than offset by higher exports to other advanced economies and east Asia. Indeed, Chinese export prices have increased since the start of the year. While activity is likely to soften as export frontloading rebalances, China’s resilience to higher US tariffs is expected to continue. The Reserve Bank of Australia finds the US is largely reliant on imports from China and half of Chinese exports to the US are relatively easy to redirect to other markets.

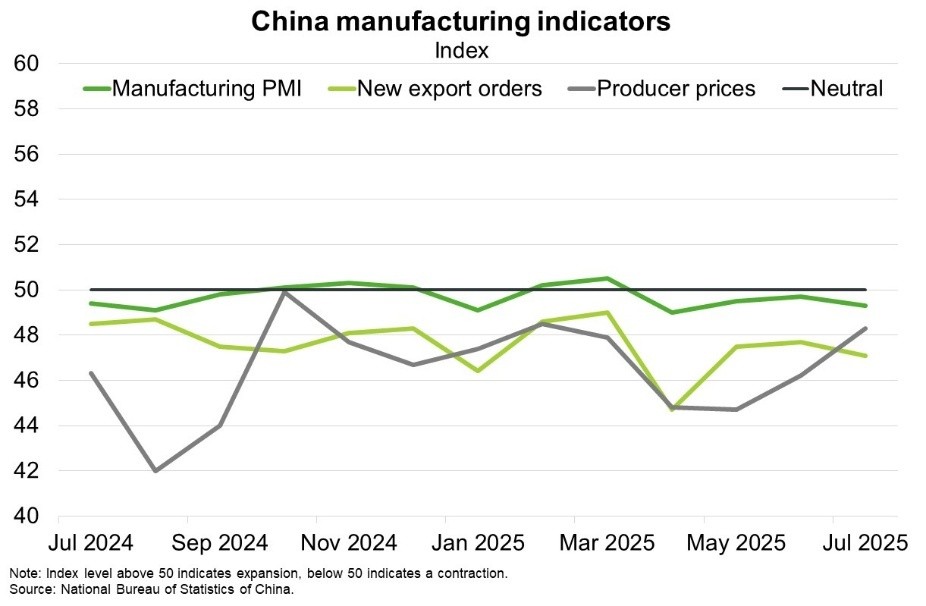

Despite robust external demand and increasingly supportive fiscal policy—including a new subsidy for consumer loans announced this month—China faces persistent internal challenges. Oversupply and excessive competition (known in China as “involution”) are weighing on manufacturing and producer prices remain low (Chart). Authorities have responded with an “anti-involution” campaign, to deter firms sacrificing short term profitability to secure greater market share, which leads to excess capacity and diminishing returns on capital. Anti-involution has included a shift toward industrial consolidation, legislative change to curb predatory pricing, greater oversight of subsidies, and lifting of standards and regulatory oversight.

China’s improved outlook lifts expectations for Australia’s key commodity exports, despite the global economic slowdown. The implications of ‘anti-involution’ are more mixed. Reduced mining production capacity could support prices in oversupplied markets, particularly lithium, nickel and graphite. However, softer Chinese industrial momentum, compounded by the ongoing property market downturn, will weigh on demand for Australian inputs to manufacturing and construction, including copper, aluminium, iron ore and coking coal.