© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

India—Strong economic prospects despite trade headwinds

India is expected to remain among the best performing economies globally; the IMF forecasts GDP to expand 6.4% p.a. this year and next, little changed from 2024 despite a broad global slowdown. Solid growth prospects—underpinned by public investment, consumer spending and services exports—are resilient to trade disruptions.

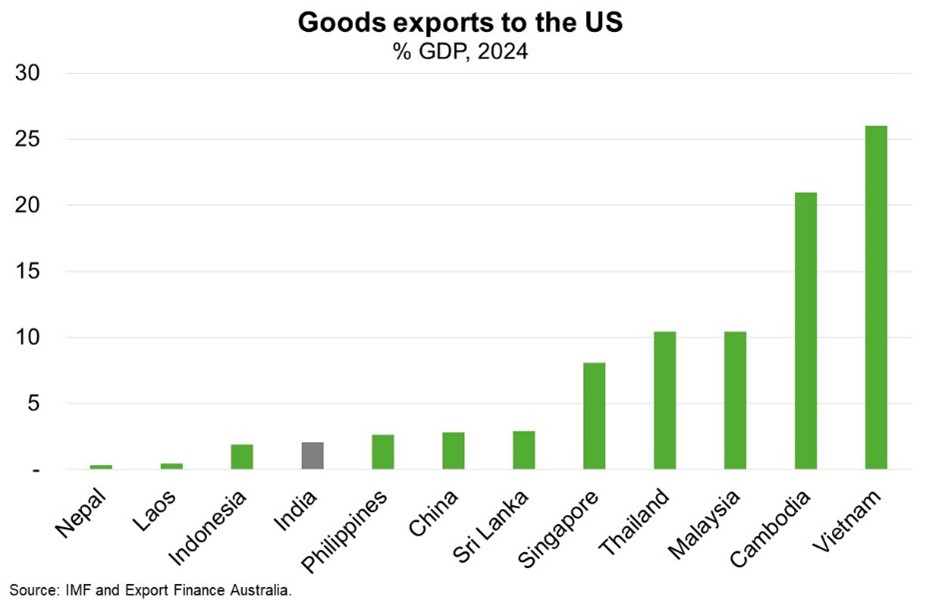

On 6 August, the White House announced an additional 25% tariff (for a total tariff rate of 50%) on India for purchasing Russian oil, effective 27 August. If sustained, this tariff would see Indian manufacturers disadvantaged relative to competitors, including Bangladesh, Indonesia and Vietnam. This could scupper Prime Minister Modi’s ‘Make in India’ push that aims to offer a manufacturing supply chain alternative to China. However, India’s economy is less reliant on goods exports than many Asian peers. While the US is India’s largest trading partner, US goods exports were worth just US$81 billion (2.1% of GDP) last year (Chart). Factoring in exemptions for pharmaceuticals and consumer electronics, Indian exports subject to tariffs are 1.2% of GDP. As such, the direct impact of tariffs is likely to be minimal. India’s potential shift from Russian oil imports would also be manageable. According to the Institute of International Finance, forgoing the discount of US$20/b offered by Russian producers would dent the current account by just -0.2% of GDP.

India’s economy is significantly more resilient to external shocks thanks to continued strong services exports, spurred by the rise in offshoring following COVID-19. Meanwhile, political commitment to consolidate public finances and reduce the burdensome debt stock, while maintaining a strong infrastructure drive, will enhance long term growth potential. The dynamic and fast-growing economy, alongside progress on structural reforms and structural advantages—including healthy demographics and competitive labour costs—saw S&P raise its sovereign credit rating for India to 'BBB' on 14 August, despite trade headwinds and reinforces opportunities for Australian exporters.