© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

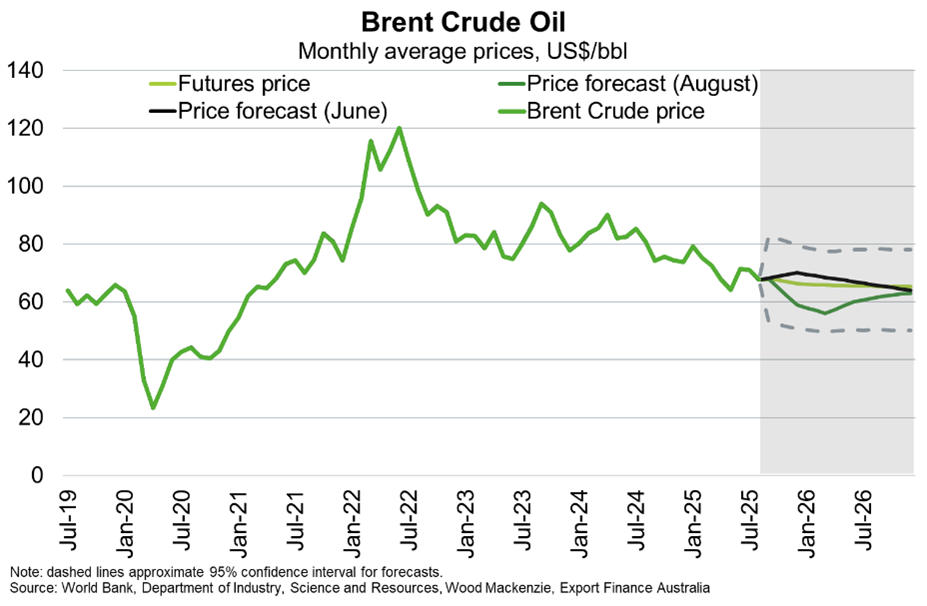

World—Lower oil prices benefit energy importers

Global oil prices have trended down since mid-2022, despite a short spike in June when escalation in Israel-Iran tensions revived geopolitical risk in the region. The downward trend in prices is driven by OPEC+ producers unwinding production cuts and weaker demand growth with a slowing global economy and continued adoption of clean energy technologies. The continued combination of weaker global demand and growing supply is expected to drive higher inventories in 2025 and 2026, and prices below US$70/bbl through to the end of 2026 (Chart).

Globally, lower oil prices shift purchasing power from oil producers to importers of hydrocarbon energy. Net importers—which constitute the bulk of Australia’s large export markets, including China, India, Thailand, Philippines and South Korea—will experience an improvement in their terms of trade and current account balances. Lower oil prices will also reduce inflationary pressures, which are especially pertinent in Bangladesh, Pakistan and Türkiye. On the other hand, net exporters, including Gulf Cooperation Council countries, Brazil, Argentina and PNG, will experience weaker terms of trade and fiscal pressures from lower oil export values, unless export volumes grow enough to offset price declines. Fiscal balances in Middle East countries are especially sensitive to oil price fluctuations, with Bahrain, Iran, Iraq, Kuwait and Saudi Arabia likely to experience fiscal deficits at forecast price levels.

While prices are expected to continue their downward trend, re-escalation of tensions in the Middle East could put upwards pressure on prices. China’s energy security policies could drive expansion of inventories while prices are low, absorbing some of the market surplus and attenuating price falls. Tighter application of sanctions on Russia and measures aimed at buyers of Russian oil could impact its flow into global markets, but China’s ongoing consumption of sanctioned oil would limit the effect on world prices.