© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

China—Economy resilient despite strong trade headwinds

China’s economy is showing resilience despite trade tensions, with real GDP growing 5.4% in Q1 2025. Policy stimulus and trade diversion are expected to continue to offset the impact of lost US trade. Indeed, the World Bank recently forecast China’s growth to decelerate to 4.5% by end-2025, affirming its January forecast, despite increased tariffs and uncertainty in its largest export market. The forecast assumes baseline US tariffs of 30% and additional sector tariffs continue at their early May 2025 levels, and contrasts with significant recent downgrades to US and global GDP growth forecasts.

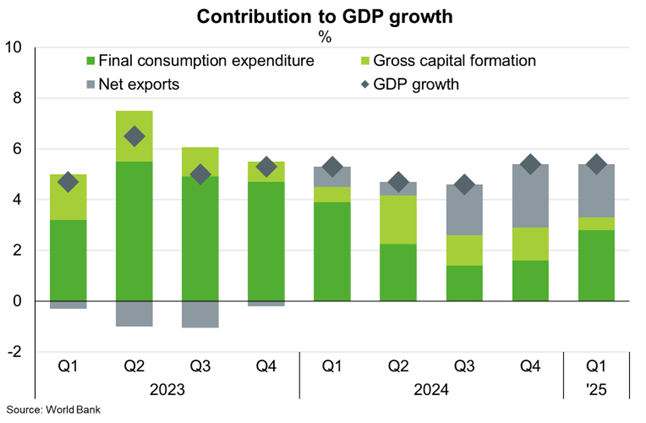

March stimulus measures targeting household consumption through subsidies and social spending supported stronger-than-expected retail growth of 6.4% y/y in May, cushioning the effect of China’s deflated property market. Property investment was down 10.7% and prices down 3.5% y/y in May, but the falls appear to be slowing. Sustained infrastructure and manufacturing investment have also supported the construction sector, underpinned growth and lowering costs of production. Continued incremental rollout of fiscal support is expected throughout 2025, maintaining momentum towards China’s growth target of ‘around 5%’. However, despite efforts to shift towards a consumption driven economy, achievement of the target also relies on trade and investment (Chart). To that end, in May, while exports to the US fell 34%, strong export growth to the rest of Asia, Europe and Latin America saw the trade surplus hit US$103 billion, up from US$83 billion per month in 2024.

Steady growth in Australia’s largest export market will continue to support demand for Australian commodities exports and provides insulation from slowing global growth. Upside risks could emerge if the US and China strike an enduring trade agreement, while downside risk from uncertainty, volatility and trade fragmentation cloud the outlook globally.