© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Korea—Political stability and strong fundamentals, but weak growth

A six-month period of political uncertainty ended in June with Lee Jae-myung’s election as President of the Republic of Korea (ROK). The result was decisive with the highest level of voter turnout since 1997 and Mr Lee attracting 49% of all votes cast. Mr Lee, from the liberal Minjoo Party, campaigned as a moderate and pragmatic liberal leader pledging to boost stock market returns, invest in AI, maintain close ties with the US and China, and strengthen cooperation with Japan. Australia and ROK agreed to continue economic and security co-operation during a meeting between Prime Minister Albanese and Mr Lee on 16 June.

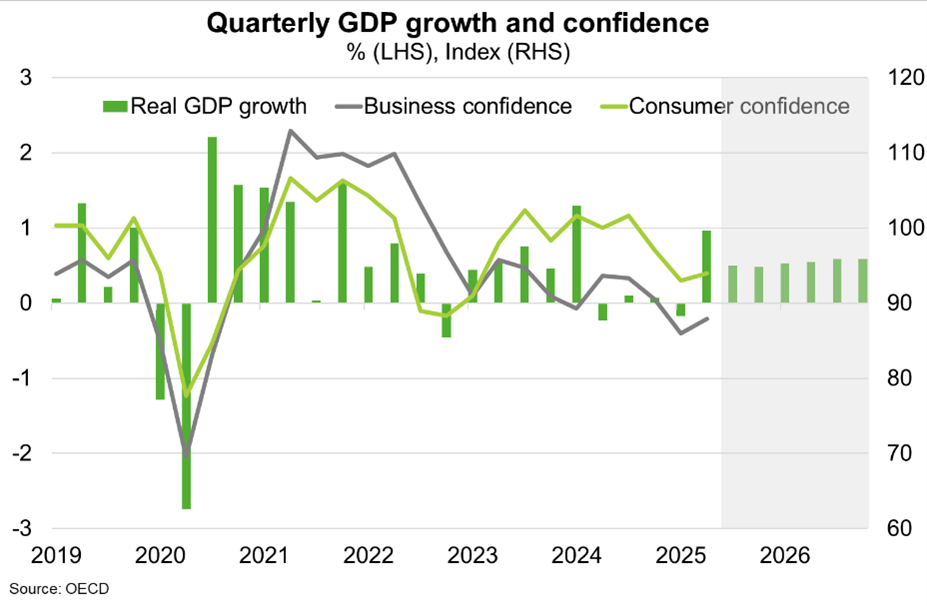

Consumer and business confidence will be boosted by the resolution of former President Yoon Suk Yeol’s impeachment case. ROK’s strong governance framework helped maintain economic stability, but it faced trade headwinds during this period of political uncertainty while the government was in a state of flux. The economy, already under long-term structural pressure, contracted in Q1 2025. ROK is particularly exposed to trade tensions as an exporter of items subject to high US sectoral tariffs—cars, steel and aluminium—and through its role in global value chains. ROK faced an effective tariff rate of 16% in early June, up from 3% at the start of the year, a figure set to increase with the doubling of duties on steel and aluminium. ROK’s exports to the US, which account for around 18% of total exports, fell 8% y/y in May and total exports fell 1.3%.

Headwinds from trade policy and uncertainty dominate the outlook for ROK, especially if business investment falters. The Bank of Korea adjusted its GDP growth forecast for 2025 to 0.8% in May, down from 1.5% February assuming a 10% baseline tariff and 25% sector tariffs would be maintained. The OECD expects GDP growth to weaken to 1.0% in 2025 before picking up to 2.2% in 2026 (Chart), supported by lower interest rates, rising consumer and business confidence, falling unemployment and political stability. However, falling property prices and an ageing population weigh on medium term prospects in Australia’s third largest export market.