© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Thailand—Exposure to trade tensions exacerbates growth challenges

Thailand’s economy expanded a stronger-than-anticipated 3.1% y/y during Q1 2025 with support from government investment and export front-loading. However, growth momentum in Southeast Asia’s second largest economy and Australia’s 14th largest export market is expected to moderate as intensified global headwinds weigh on export performance, business sentiment and private investment. The global backdrop will exacerbate a downward trend in potential growth that reflects domestic structural challenges, including a contracting (and relatively low-skilled) working age population and weaker competitiveness and export sophistication relative to ASEAN peers.

The World Bank recently downgraded its 2025 GDP growth forecast for Thailand’s export-oriented economy from 2.9% to 1.8%, assuming tariffs in place as of May prevail, the second lowest forecast among ASEAN, after Myanmar. Similarly, the Bank of Thailand (BoT) forecasts 2025 GDP growth of 2% if US tariffs remain close to current rates. However, Thailand would be among the most exposed countries in the region if US ‘reciprocal’ tariffs of 36%, announced on 2 April and subsequently paused until 9 July, are implemented. In this scenario, the BoT forecasts the Thai economy would expand just 1.3% in 2025.

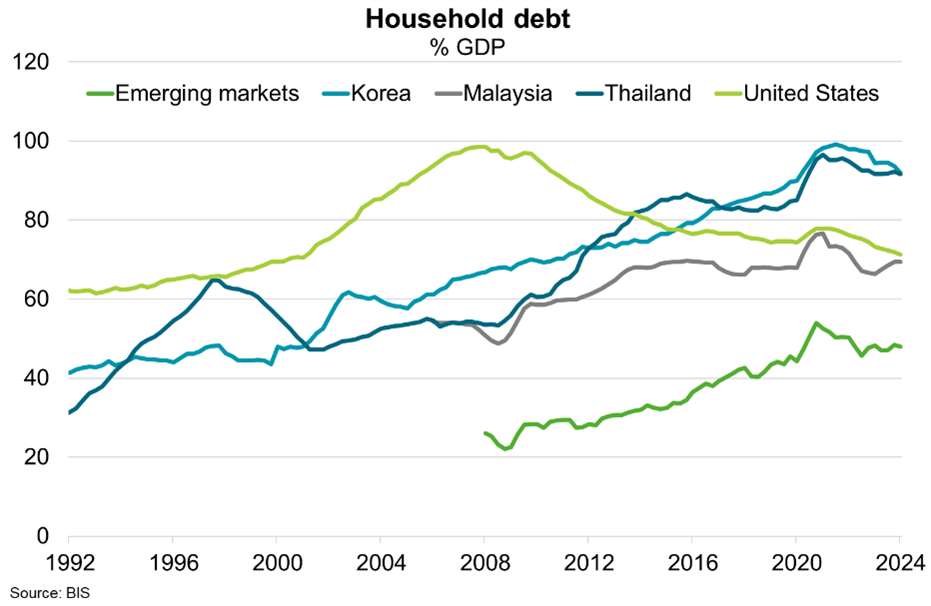

While a widened fiscal deficit is planned to cushion the economy, public debt has risen to 64% of GDP, 20 percentage points above pre-pandemic levels and close to the debt ceiling of 70%. Similarly, while the BoT cut policy rates to 1.75% in April to tame growth risks, high household debt will limit further monetary easing. Thai household debt is equivalent to 92% of GDP, just shy of the 99% ratio the US reached in 2007 (Chart). The IMF warns that alongside external risks, on the domestic front, the private debt overhang could impair bank balance sheets and lower credit supply, negatively affecting growth. Renewed political uncertainty could also undermine confidence.