© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Critical mineral markets remain volatile and concentrated

Australian exports of critical minerals are expected to decrease 30% to $14 billion in FY2025. Global lithium demand rose nearly 30% in 2024, while nickel, cobalt, graphite and rare-earths demand rose 6 to 8%. Strong demand reflected continued adoption of clean energy technologies including electric vehicles (EVs), battery storage systems, renewables and grid networks. However, many critical minerals’ prices declined due to even stronger supply growth, improved cost competitiveness and government support. Lower prices saw mine closures for producers unable to operate in the low-price environment. However, Australian mines tend to be at the lower end of the cost curve, so production volumes remained strong, and may increase.

With existing, committed and pipeline projects, clean energy applications are expected to increase critical minerals exports to $21 billion in FY2030 (6% of total resources and energy exports). Energy sector demand is expected to rise steadily, especially for data centres and EV uptake. Of the new energy capacity to meet this demand, approximately 81% will come from solar and battery storage, with infrastructure for this supply being heavily reliant on critical minerals.

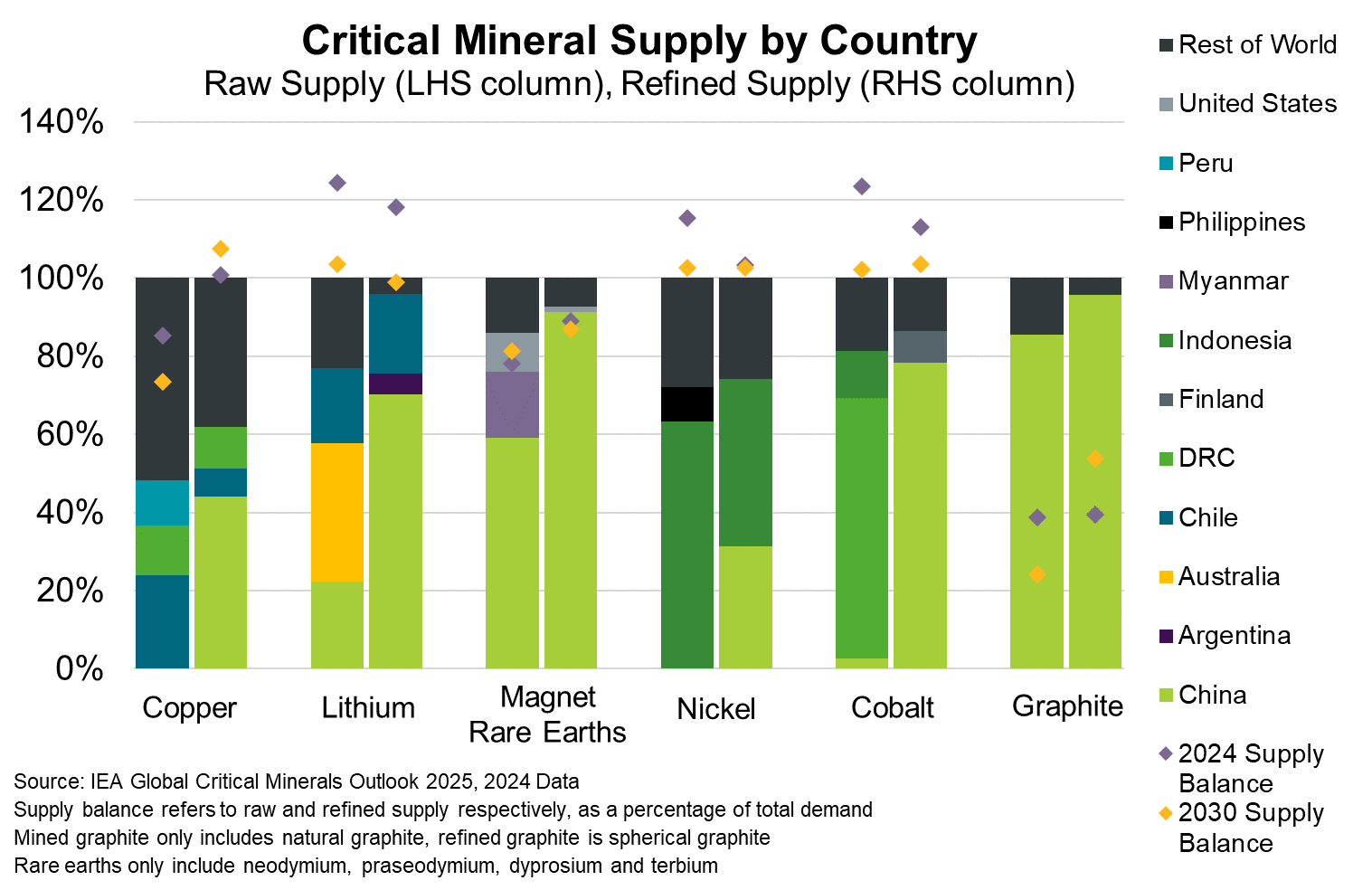

For some critical minerals, including lithium, markets are opaque and volatile with a majority of supply traded through long-term offtake contracts rather than open markets. Production capacity is geographically concentrated and subject to increasing export restrictions. Indeed, new export restrictions more than doubled between 2022 and 2025. This exacerbates price volatility, especially in shallow markets. Concentrated supply chains (Chart) also expose the critical minerals sector to high volatility, including through geopolitical uncertainty, weather impacts and export controls. Additional risks stem from uncertainty in the pace of the global energy transition, shifting battery chemical compositions and the speed of technological innovation. Continued government support is therefore likely in this important and nascent industry.