© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Trade tensions see economic growth forecasts downgraded

Substantial increases in trade barriers, heightened policy uncertainty, weaker confidence and geopolitical tensions are weighing on global economic prospects. The OECD lowered its global growth forecast to 2.9% this year and next, from 3.3% in 2024, assuming tariff rates are sustained at mid-May levels. World Bank forecasts are less optimistic, at 2.3% in 2025 and 2.4% in 2026, implying the slowest average global growth in the first seven years of this decade relative to any decade since the 1960s. Still, despite the World Bank lowering forecasts in nearly 70% of economies and across all regions, a global recession is not expected.

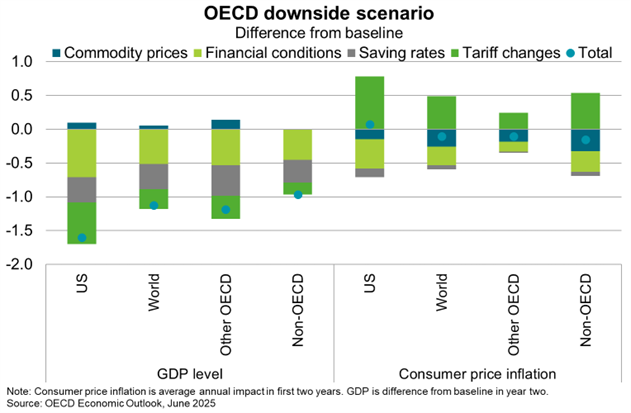

The highly uncertain outlook hinges on the evolution of global trade policies and geopolitical tensions. The effective tariff rate on US goods imports was estimated at 15.6% this month, the highest since 1937. This will see weaker global business investment and a sharp slowdown in trade growth over the next two years, following a front-loading of export orders. However, even higher tariffs, and potential retaliatory measures, could intensify risk repricing in financial markets, further weaken corporate and household spending, and weigh on global commodities demand. The OECD estimates that raising US bilateral tariffs by an additional 10 percentage points on all countries could push global output down by 1.2% and US output down by 1.6% (Chart).

Conflict in the Middle East could also drag on the global economy via prolonged higher oil prices and freight costs, which have risen as Israel-Iran escalation revives geopolitical risk premia. While conflict remains contained to Iran, the impact on oil prices is expected to be limited as Iranian oil exports are relatively small (2% of global consumption) and the global oil market is oversupplied. However, disruptions to strategic infrastructure or the Strait of Hormuz—a maritime laneway which transmits 20% of global oil trade—while unlikely, would amplify stagflation risks.