© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Australia—Higher lithium exports supported by strong mine output

A dramatic rise in lithium prices in 2022 was reversed in 2023 as electric vehicle (EV) sales growth slowed and additional production came online. While the current oversupply in lithium markets is expected to diminish over the next five years, prices are forecast to recover only modestly. Still, Australia’s lithium exports are forecast to increase in real terms from $5.2 billion in FY2025 to $8.2 billion in FY2030 (3% of total resources and energy exports), driven mostly by higher volumes. Indeed, Australia accounted for 36% of lithium extraction in 2024 and is expected to remain a leading lithium supplier, despite North America and Africa increasing market share, and strong competition from China. Strong Australian exploration expenditure—up from US$1.4 million in 2015 to US$298 million in 2024 (27% of the global total)—supports the outlook.

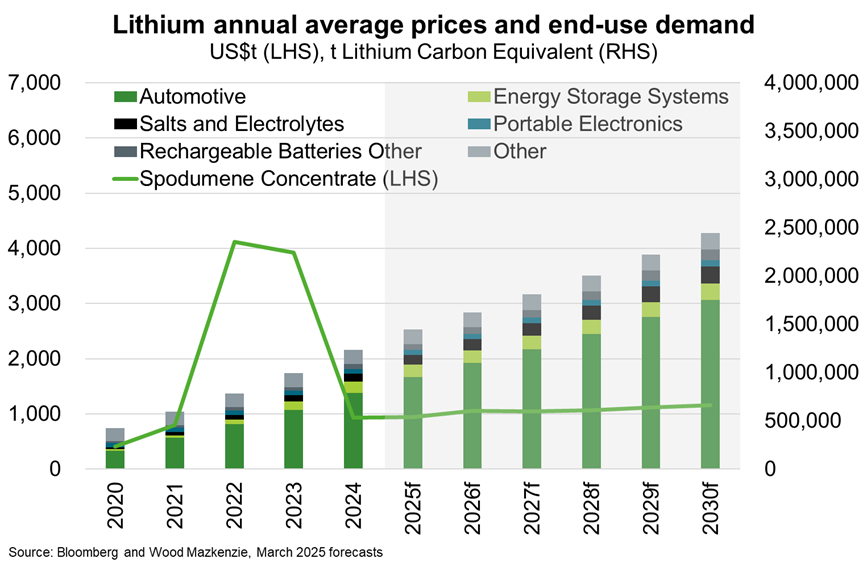

Energy transition is expected to support 13% annual growth in global lithium demand (Chart), with the predominant application being EVs and battery energy storage systems. Global EV sales rose by 26% to more than 17 million in 2024, driven by rising adoption rates in China. More moderate EV sales growth is expected to continue through to 2030. Despite US demand growth being revised down, increasing adoption in the EU and China is supported by emission performance standards, and price competitiveness alongside a continuation of trade-in incentives, respectively. However, supply also remains strong, with lithium extraction forecast to grow by almost 10% annually until 2030.

Risks to EV uptake include uncertainty about future trade and industrial policies, lower oil prices, and a subdued economic outlook. Further, China accounted for about two-thirds of global refined lithium supply and 95% of Australia’s lithium exports in 2024. However, policy support to diversify lithium refining and EV manufacturing in Europe and the US will help reduce market concentration risk.