© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Pacific—Global economic uncertainty has mixed impact

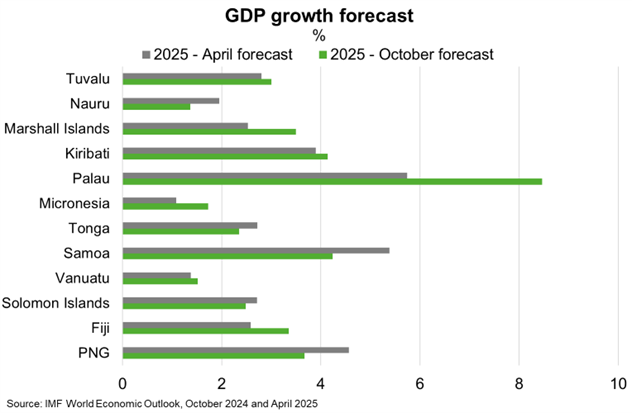

Growth in the Pacific was forecast to accelerate to 3.4% in 2025 and 3.7% in 2026, from 1.9% in 2024, prior to new tariffs being announced in April. However, Pacific economies face asymmetric outlooks in the face of global trade uncertainty and slowdown (Chart). Most are insulated from the direct effects of US tariffs, with exports weighted towards Asia and Oceania. Some exporters also benefit from products with few direct substitutes. However, exporters in Fiji, Nauru and Vanuatu face uncertainty while respective ‘reciprocal’ tariffs of 32%, 30% and 23% are paused.

Despite lower prices for most commodities, Pacific exporters are supported by continued high cocoa and coffee prices, while record gold prices support producers in PNG, Solomon Islands and Fiji. The outlook for PNG—Australia’s largest export market in the Pacific—is further strengthened by higher copper production, improved prospects for new energy projects, kina depreciation and easing foreign currency shortages. Weaker demand for international tourism is expected to dampen prospects for Palau, Fiji and Vanuatu, however, countercyclical remittance flows support the outlook for Tonga and Samoa. Reconstruction efforts following recent natural disasters in Vanuatu will support economic growth. Most Pacific economies will benefit from lower global fuel prices, which constitute a substantial share of imports.

Risks abound for the small, open economies of the Pacific. Price volatility is expected to persist, potentially amplified by currency movements. To the extent that USD weakness continues, economies using or pegged to the US dollar will face higher imported food costs and interest on USD denominated debt. Conversely, Pacific economies using or weighted towards the AUD and NZD may prove insulated, but debt denominated in other currencies (e.g. CNY, JPY and EUR) introduces additional risk. Further risks include ever-present natural hazards and political volatility.