© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Trade restrictions and policy unpredictability weigh on outlook

Swift escalation of trade tensions and extreme policy uncertainty saw the IMF lower its global growth forecast last month, to 2.8% in 2025 and 3.0% in 2026, a cumulative downgrade of 0.8 ppts from forecasts made three months earlier and well below the historical (2000–2019) average of 3.7%. The downgrades impacted most countries and were driven by three key factors.

1. Uncertainty causes businesses and households to postpone investment and spending, with effects amplified by tighter financial conditions and exchange rate volatility.

2. Tariffs are a supply shock on tariffing countries, reducing productivity and increasing costs. Indeed, US consumer sentiment has fallen almost 30% since January 2025 to its second-lowest level on record, while GDP shrank at an annualised rate of 0.3% in Q1 2025. Still, the Federal Reserve held interest rates steady this month given the increased risk of higher inflation.

3. Tariffs are a demand shock on tariffed countries, via weaker exports. As such, highly tariffed countries also saw large downgrades.

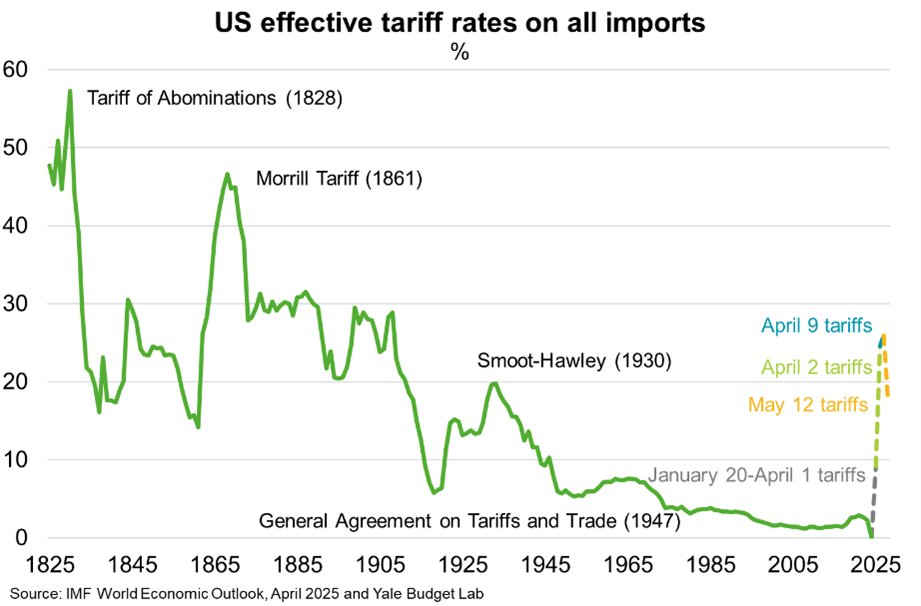

While IMF forecasts are based on reciprocal tariffs announced on 2 April, other modelled tariff scenarios did not materially change the outlook, reflecting the substantial influence of uncertainty. However, the 12 May announcement that the US and China will reduce prohibitively high tariffs by 115 bps (the 34% US reciprocal rate was suspended for 90 days and subsequent increases on 8 and 9 April cancelled), reduced the estimated effective tariff rate to 17.8% (Chart). The reduction, to the extent it persists, will see US and global growth forecasts revised upwards. But elevated policy uncertainty and effective tariff rates (compared to 2.3% at end-2024) will continue to weigh on global prospects.

The outlook presents intensifying risks. An escalating trade war would further weigh on confidence, investment and growth, fuel inflation and erode policy buffers. Geopolitical fragmentation also raises financial vulnerabilities, particularly for emerging markets with limited fiscal space.