© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

Australia—AI investment boom brings export opportunities and risk

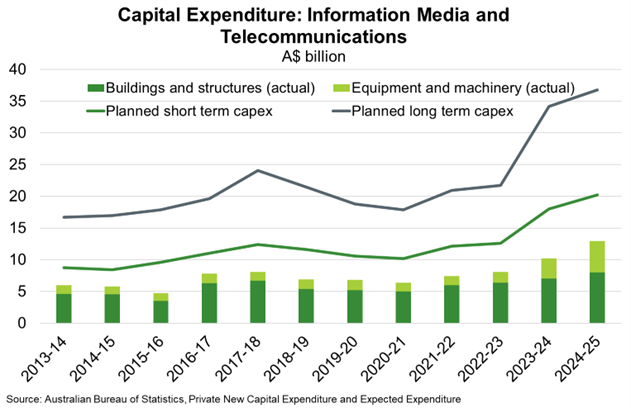

A global investment boom in AI-related infrastructure is driving global growth and expanding Australian export opportunities. Capital largely flows to locations where enabling conditions are strongest, currently the US and China, which lead in AI infrastructure and data center capacity. That said, Australia’s abundant renewable energy, stable regulatory environment and skilled workforce make it an attractive location for regional infrastructure. Indeed, capital expenditure in information media and telecommunications in Australia rose 27% y/y to a record $12.9 billion FY2025 (Chart), contrasting against growth below 4% across all sectors. Australia now hosts 282 data centres, making it a top 10 country by number of centres (despite lagging on computational power and scale). This should support continued strong growth in Australia’s ICT services exports ($4 billion or 3% of services exports in FY2024). Rapid growth in AI-related physical infrastructure also supports demand for copper and critical minerals used in network construction and energy supply systems dominated by renewables. Global power demand from data centres is expected to double by 2030.

Labour market impacts will vary by sector and function, but historically, labour-creating effects of new technology have outweighed displacement. AI’s impact on the labour market will be fourfold: 1) direct replacement of labour through automation, 2) creation of new tasks and roles, not currently performed by human workers, 3) increased productivity of existing workers and demand for workers in complementary non-automated tasks, and 4) firms passing AI-gains through lower prices and higher real wages. While longer term productivity gains and economic benefits are expected, the risk of AI asset repricing is a key downside risk to the global economic outlook given elevated valuations and concentrated equity benchmarks. This would heighten financial stability risks and is particularly acute where debt is highly leveraged.