© Export Finance Australia

The views expressed in World Risk Developments represent those of Export Finance Australia at the time of publication and are subject to change. They do not represent the views of the Australian Government. The information in this report is published for general information only and does not comprise advice or a recommendation of any kind. While Export Finance Australia endeavours to ensure this information is accurate and current at the time of publication, Export Finance Australia makes no representation or warranty as to its reliability, accuracy or completeness. To the maximum extent permitted by law, Export Finance Australia will not be liable to you or any other person for any loss or damage suffered or incurred by any person arising from any act, or failure to act, on the basis of any information or opinions contained in this report.

World—Gold price remains elevated amid strong investor demand

Gold prices reached all-time highs in October underpinned by safe-haven demand. High prices and volumes mean gold exports are expected to increase by $12 billion to $60 billion in FY2026, overtaking LNG as Australia’s second largest export. Further, tracking high gold prices, exploration spending rose 34% y/y in Q2 2025 to $400 million (40% of total mineral exploration).

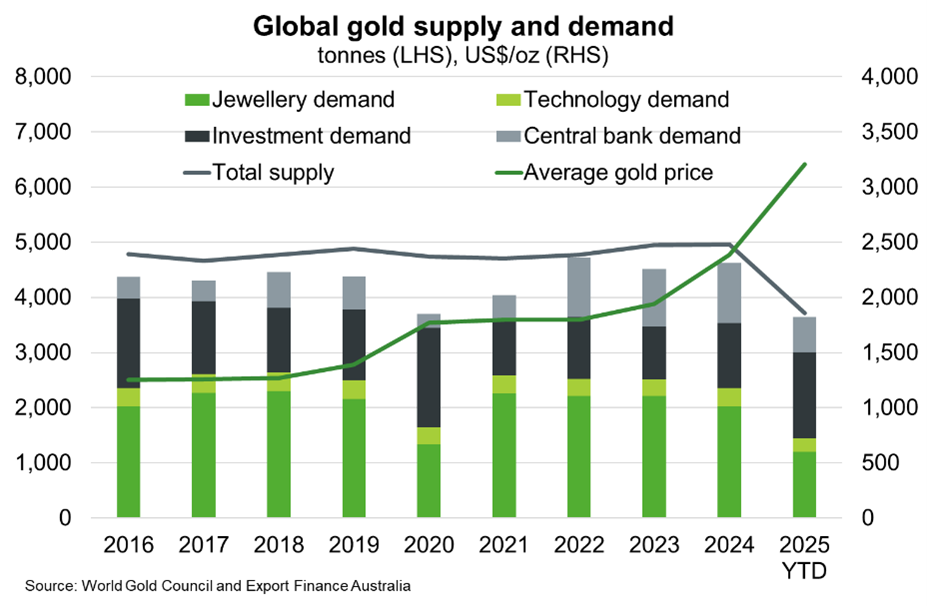

Global demand reached a record 1313 tonnes in Q3 2025, driven by investment (up 87% YTD y/y) and central bank demand, while jewellery and industrial volumes eased in response to high prices (Chart). Owing to higher prices, central banks now hold more of their reserves in gold than in US treasuries for the first time since the mid-1990s. However, demand is expected to stabilise as markets adapt to prolonged economic uncertainty and higher trade barriers, despite lingering concerns about geopolitical instability and the US fiscal situation. Meanwhile, global supply is forecast to peak in 2026 at 5,300 tonnes as new projects ramp up and existing operations increase output. Scrap gold supply is forecast to increase to a 14-year high of 1,460 tonnes in 2026 and then drop gradually.

Prices are forecast to remain at near-record highs until H2 2026, according to the Department of Industry, Science and Resources, driven by lower interest rates and safe haven demand. Prices are then expected to fall slowly to average around US$3,250 in 2027. Upside risk dominates the outlook with concerns about inflation reemerging and a weaker US dollar. Gold prices typically have an inverse relationship with US interest rates, as investor demand for gold, a non-yielding asset, tends to benefit from a fall in rates. With the US resuming interest rate cuts, mounting fiscal deficits and surging ETF investment, pressure for prices to remain elevated persists.