World—Sticky inflation raises business costs and hobbles consumption

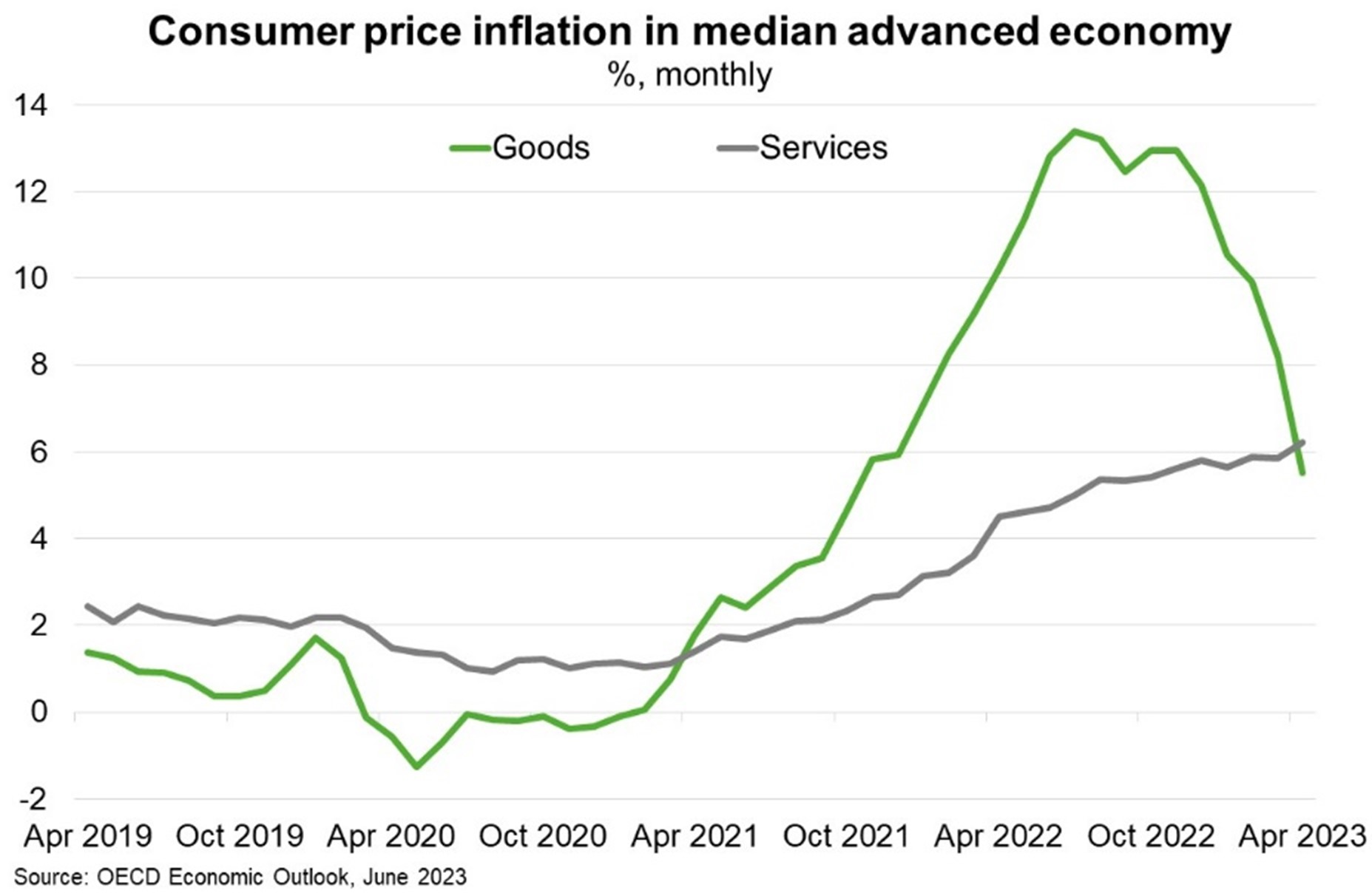

Lower energy prices and easing supply bottlenecks have reduced headline inflation in most economies. However, core inflation—excluding food and energy and dominated by services—remains high. Rising services inflation (Chart) reflects higher business profits in some sectors, elevated labour costs, and rebounding services demand as spending patterns normalise post-pandemic. Core inflation is only expected to ease towards target in major advanced economies by end 2024.

Faced with persistent above-target inflation, central banks are likely to keep interest rates higher for longer. The US Federal Reserve left its main policy interest rate unchanged at 5.0%—5.25% this month, to allow time to assess the impact of 10 consecutive hikes over the last 15 months. However, the median Federal Reserve Board member expects rates to end 2023 at 5.6%, up 50bp from the March estimate. Meanwhile, the European Central Bank raised interest rates to 3.5% this month, their highest level in 22 years. Higher interest rates are pinching property and financial markets and credit conditions are tightening as investors reassess risks.

High inflation, tight monetary policy, and more restrictive credit conditions are increasing business costs and weighing on economic performance. Recent OECD forecasts suggest global GDP growth will moderate from 3.3% in 2022 to 2.7% in 2023 and 2.9% in 2024. The World Bank is more bearish—forecasting growth of 2.1% this year and 2.4% next year. Inflation has eroded real wages and household disposable incomes in many countries. House prices are falling in countries that constitute over half of global activity. And the full effects of interest rate hikes in 2022 will only appear from late 2023. The toll on consumption worldwide will weigh on demand for Australian exports, despite strong labour markets and savings buffers left over from the pandemic.