China—Historically high corporate bond defaults underscores financial risks

China’s large corporate debt burden (150% of GDP) remains a threat to financial stability, with the large swathe of bond defaults suggesting risks are on the rise. Corporate bond defaults quadrupled between 2017 and 2018, reaching a record US$18 billion. Tighter monetary conditions in 2018 and the crack-down on the shadow banking sector have made it difficult to refinance corporate bonds.

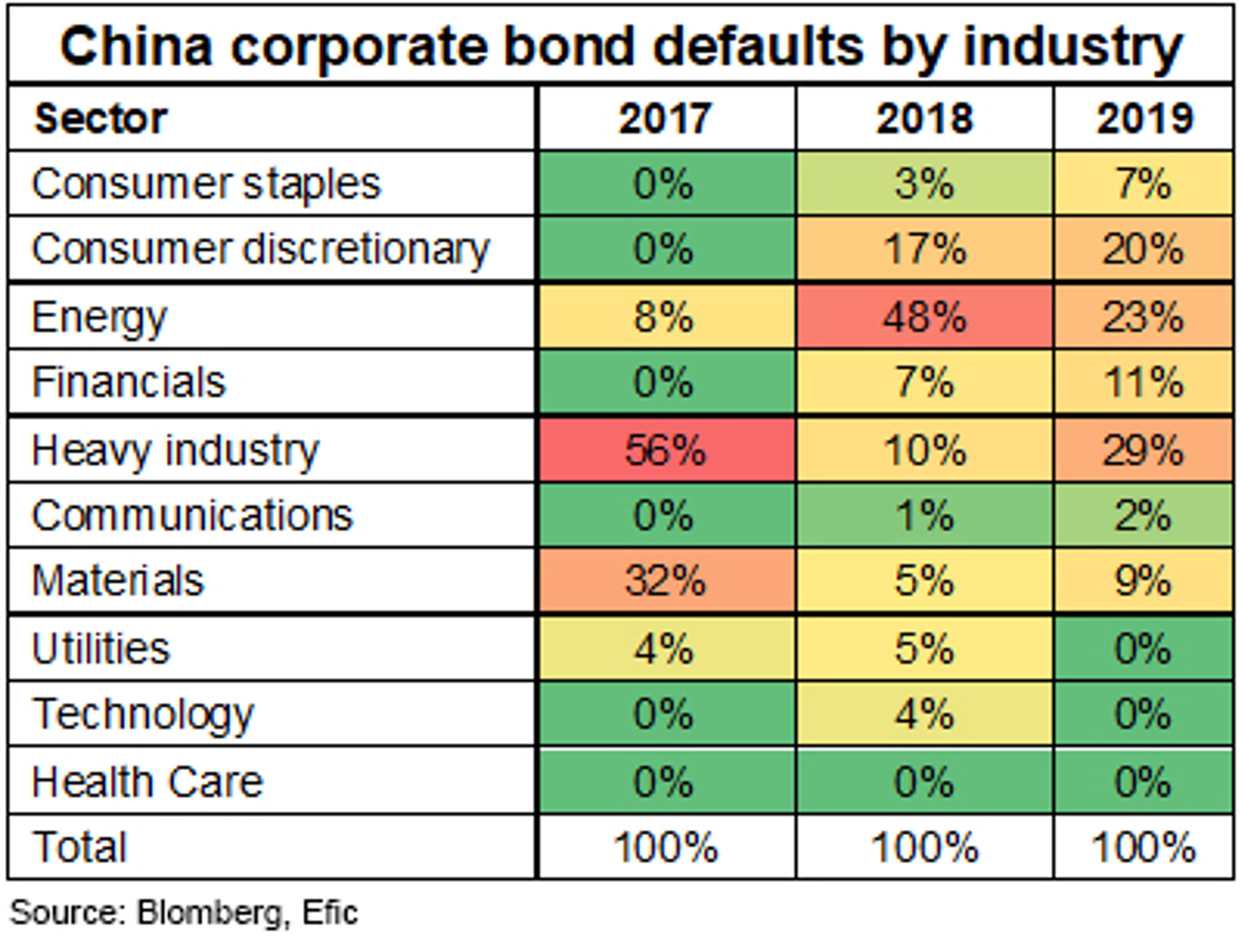

Defaults occurred largely in RMB-denominated bonds, but there were also defaults on US dollar denominated debt. By industry, the energy sector accounted for almost half of defaults in 2018 (Table). The pace of defaults doesn’t appear to be easing this year, with reports suggesting defaults in the first quarter have reached US$3.9 billion, compared to US$1 billion during the same period a year ago.

The defaults in the consumer sector are particularly worrying as it suggests consumer-oriented firms, particularly those that sell discretionary goods and services, are not generating sufficient revenues. Persistent defaults in the sector could be a signal of weak household spending, undermining the government’s rebalancing efforts toward a consumer-oriented economy.