Almost three years on from Britain’s decision to quit the world’s largest trading bloc there are increasing signs of economic damage. GDP grew by 0.2% in Q4 2018—rounding off the weakest year since the GFC. The Bank of England (BoE) now sees a 25% chance of recession this year in Australia’s 9th largest export market. Uncertainty created by the ‘fog of Brexit’ has been blamed for businesses reining back investment. Indeed, UK business investment contracted in every quarter of 2018. Economic momentum also slowed sharply in the Eurozone in the second half of 2018—for instance, Italy recently fell into recession while German GDP growth fell to just 0.6% y/y in Q4—the weakest outcome since 2013.

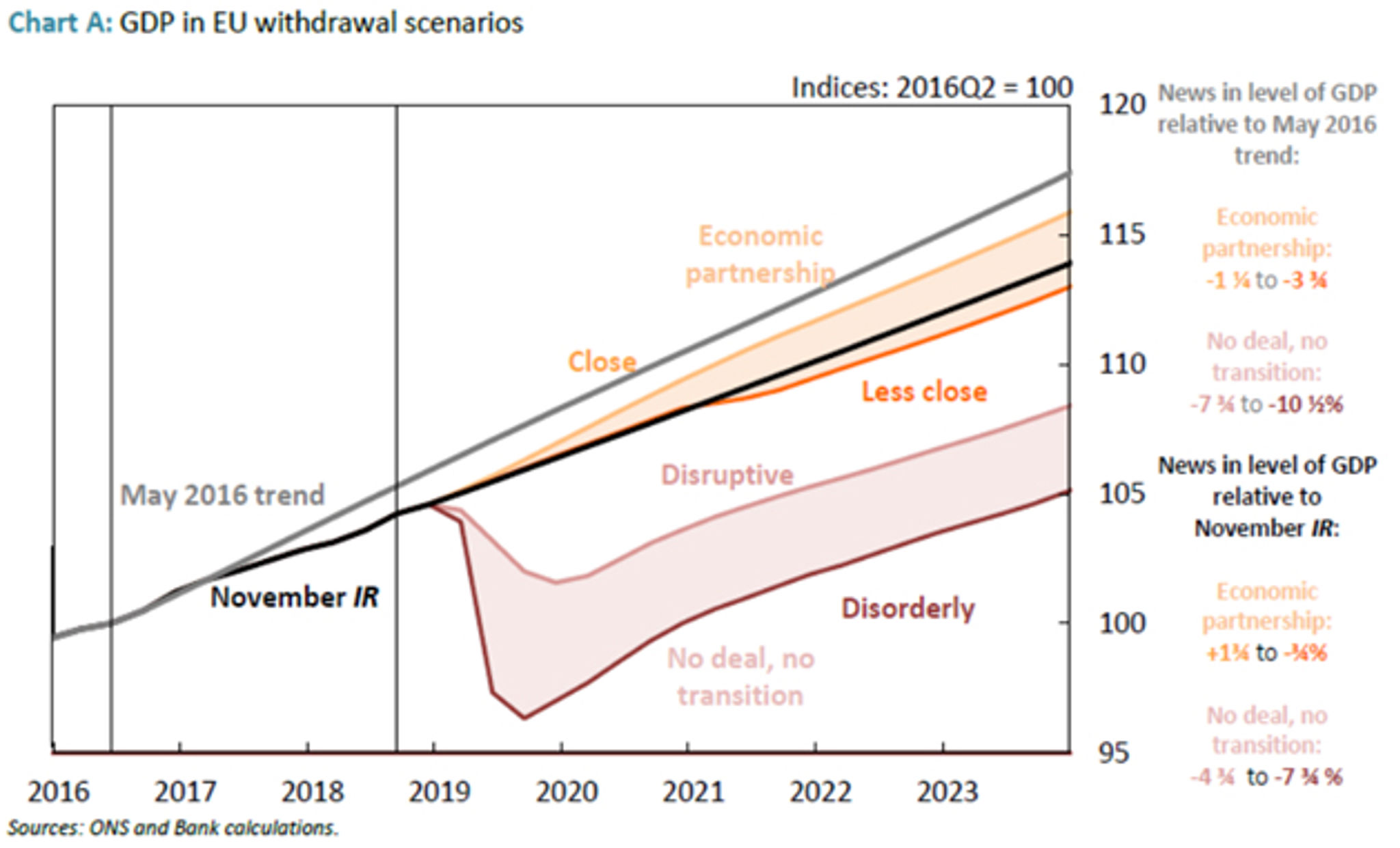

After the UK parliament in January overwhelmingly rejected the Withdrawal Agreement that Prime Minister May brokered with the EU, there is no clear Brexit pathway. With Britain due to leave in just 30 days, postponing the date of departure looks increasingly likely. This would prolong the uncertainty but stave off the threat of a disruptive ‘no deal’ Brexit—which the BoE estimate could see UK GDP 7.75% lower than the May 2016 trend by the end of 2023 (Chart). A delay would allow for a) renegotiations with the EU that extract concessions amenable to the UK parliament, b) a general election, or c) second referendum. Alternatively, the May administration may yet be successful in building a majority for the current deal ahead of the deadline on 29 March. The BoE estimates that if Britain can engineer a close economic partnership akin to the current deal, GDP will be only 1.25% lower than the May 2016 trend by the end of 2023.