US—Expected stimulus continues to drive global economic prospects

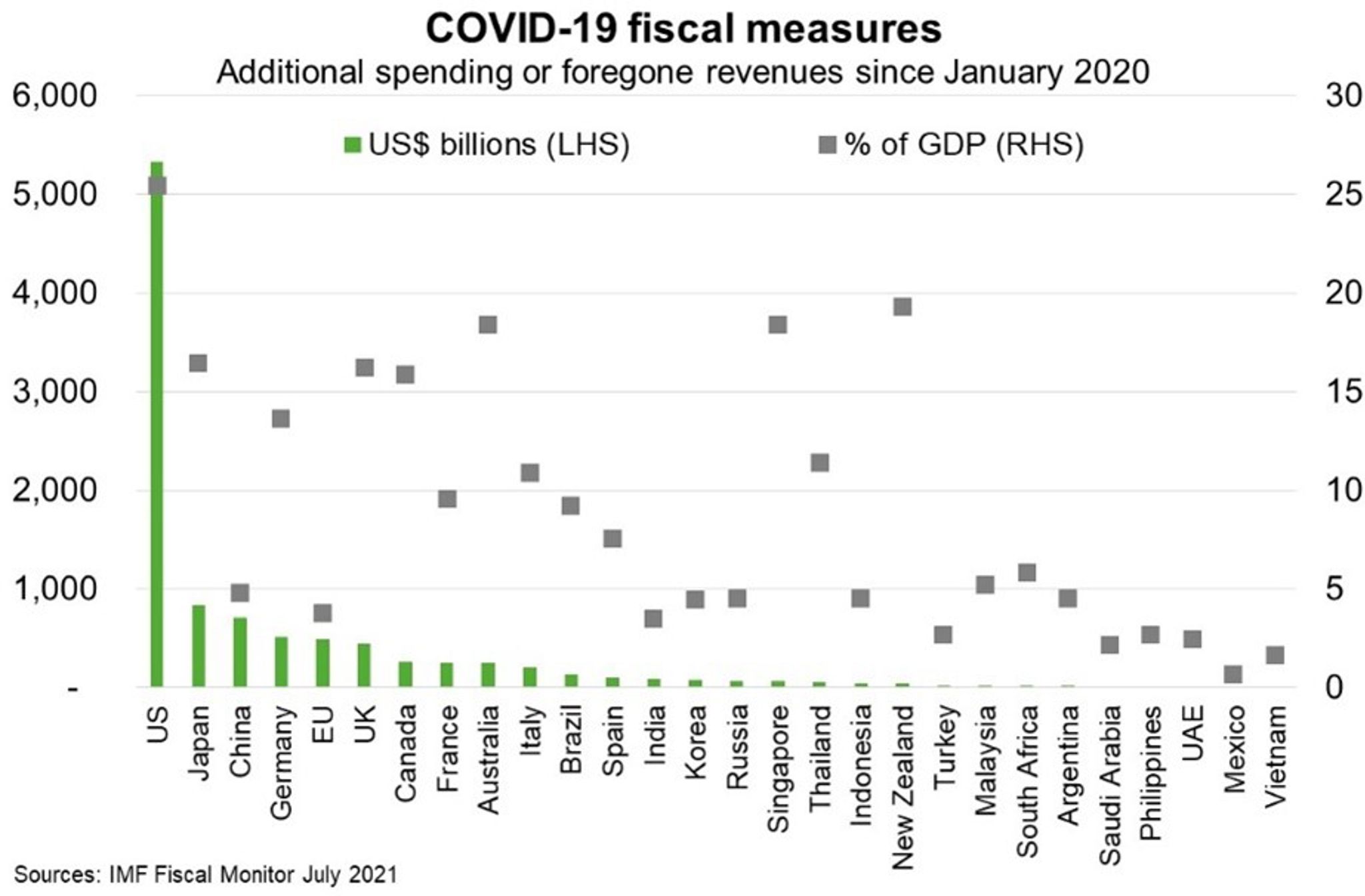

US economic output surpassed its pre-pandemic level in Q2 2021 despite the worst recession in post-war history. The labour market has also made significant strides; 22 million jobs were lost in March and April 2020, with nearly 17 million since recouped. US consumers are driving the recovery, fed by the recovering jobs market, pandemic-induced savings and government spending. Fiscal stimulus of US$5.3 trillion to June 2021 (Chart) is more than six times as large as China’s stimulus following the 2008 global financial crisis as a share of global GDP. The US is the world’s largest economy and consumer market (Australia’s third largest export market), implying positive spillovers for exporters. The OECD estimate the US$1.9 trillion American Rescue Plan alone could raise global output by around 1% in the year following implementation.

While GDP growth has likely peaked, anticipated legislation boosting infrastructure investment and the social safety net saw the IMF raise its July forecast for GDP growth (to 7% in 2021 and 4.9% in 2022). Indeed, a bipartisan US$1.1 trillion infrastructure package passed the Senate this month to fix road and rail networks, improve broadband provision and fund climate change adaptation. Addressing large infrastructure gaps would support demand for Australian steel, copper and aluminium and also improve US productivity and long term growth potential.

However, there are risks to US economic performance. Despite over 50% of the population being fully vaccinated, the US is reporting around 150,000 new daily COVID-19 cases—over half the peak reached in January—and a sharp rise in hospitalisations, concentrated in the unvaccinated population. Further, while temporary factors are driving much of the spike in inflation to a 13-year high in July, the Federal Reserve is signalling it could pare back monetary stimulus given the recovering labour market.