PNG—Progress on Papua LNG development brightens economic prospects

COVID-19 restrictions and foreign exchange shortages remain the key constraints on doing business in PNG, according to the 2021 Westpac PNG CEO survey. The survey highlighted that without the support of significant resources projects, the post-pandemic economic recovery will be gradual and vulnerable to any external shocks, including new outbreaks of COVID-19. To that end, recent progress on negotiations of the US$12 billion Papua LNG project (about 60% of PNG’s GDP) between the government and the project’s sponsor, Total, points to positive momentum on gas development. Following stalled negotiations in 2020 due to political headwinds, Total aims to launch front-end engineering and design work in early 2022 ahead of a potential final investment decision in 2023. First gas production is scheduled in 2027, according to Oil Search, a partner in the project.

Progress on development of Papua LNG follows Total’s decision to declare force majeure at its US$20 billion LNG project in Mozambique due to violence and security concerns. This suspension is likely to remain in place for some time, potentially delaying production at Total's Mozambique LNG facility beyond 2025. Realising large resources investments such as Papua LNG, Newcrest Mining’s US$5.4 billion Wafi-Golpu gold, copper and silver project and the US$11 billion Exxon Mobil-led P’nyang LNG project is important to boost PNG’s GDP growth, create employment, generate greater government revenue and increase foreign exchange inflows. The resource industry accounted for roughly 90% of PNG’s total exports and 30% of GDP in 2019.

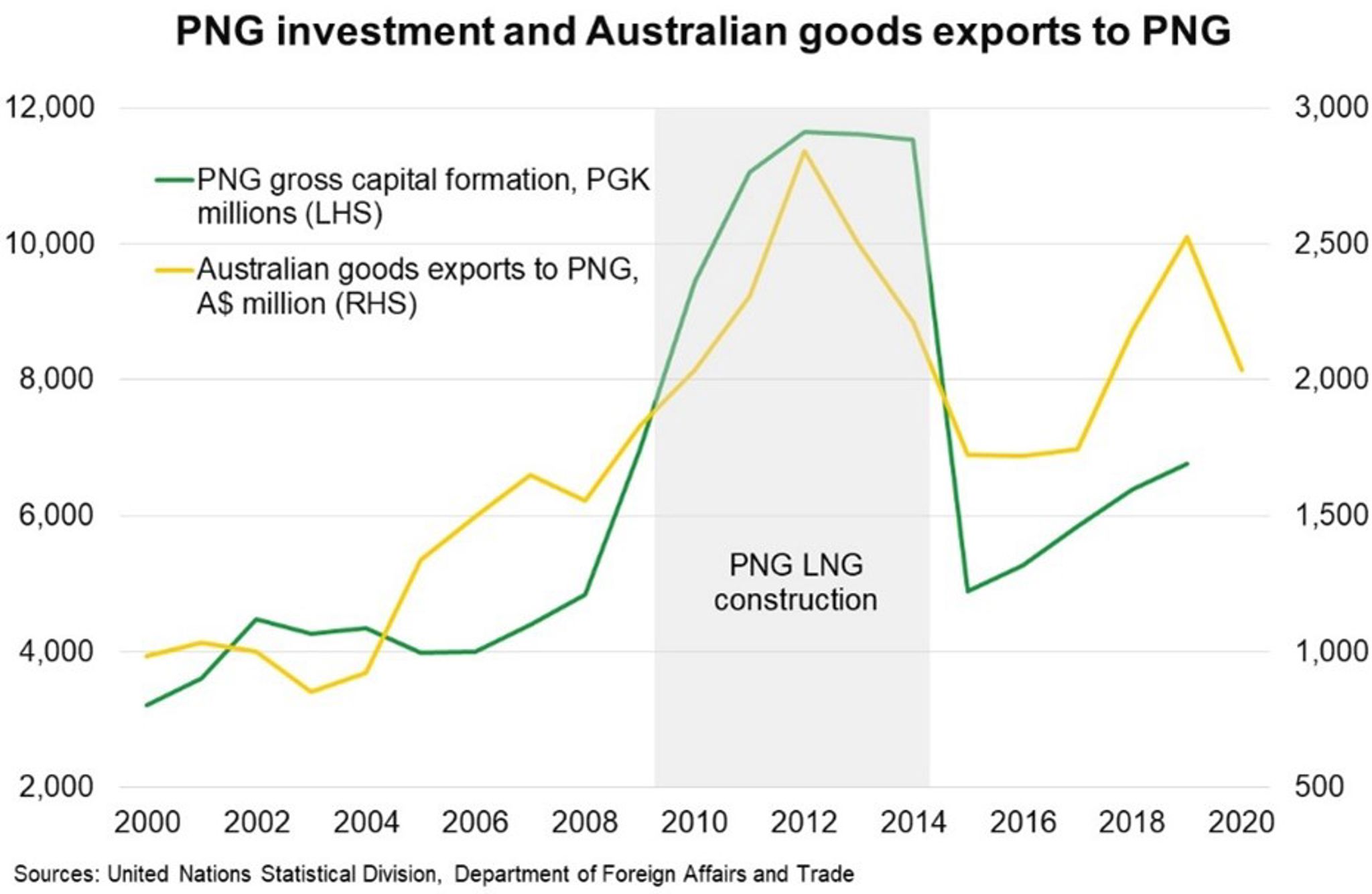

Stronger resources investment and greater availability of foreign exchange would boost opportunities for Australian exporters, including in petroleum, civil engineering equipment and engineering and construction services, as it did during the construction of PNG LNG from 2009 to 2014 (Chart).