Australia—Iron ore to China drives export performance

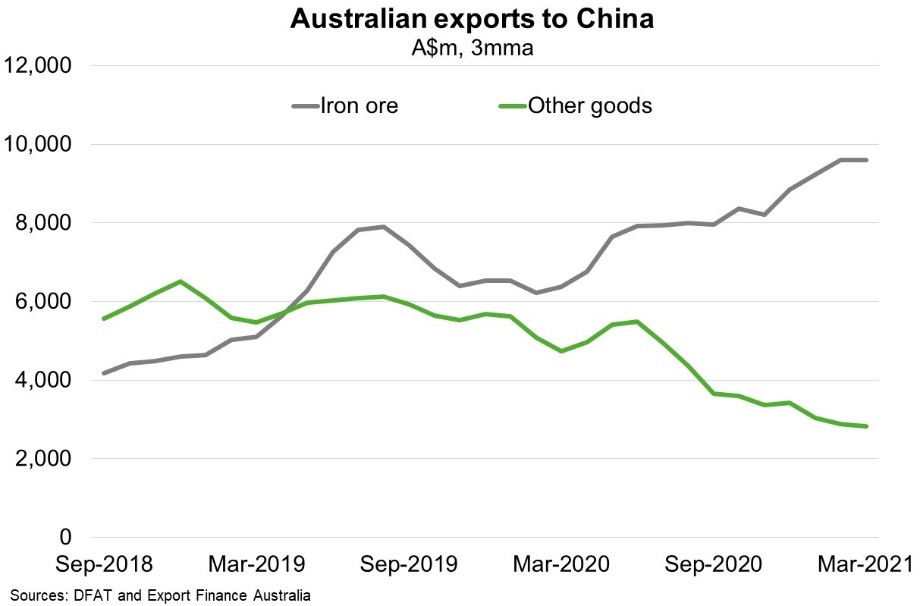

Despite the COVID-19 induced global recession, Australian export values were just 0.7% lower in Q1 2021 relative to Q1 2020. However, this strong performance is largely attributable to record iron ore receipts—up 65% year-over-year to $38 billion in Q1 amid record high global prices and robust Chinese demand. Surging iron ore exports conceal weaknesses elsewhere (Chart). Iron ore aside, goods exports to China fell 40% year-over-year in Q1 (and 10% to the rest of the world). As such, iron ore accounted for 38% of Australian goods exports and 77% of goods exports to China in Q1 (up from 20% and 48% respectively two years ago). Services exports fell by $8.6 billion (35%) year-over-year to $15.7 billion in Q1, mainly due to international travel restrictions that are now expected to last until mid-2022.

Prospects for export diversification by product and market remain challenging. While China’s GDP growth is on track to reach consensus expectations of 8–9% in 2021, the consumption recovery continues to lag industry and will depend on the degree to which authorities tighten policy to ensure medium term financial stability. China’s transition to a more consumption-based economy will also be complicated by recent census data which showed annual average population growth falling to 0.53% in the past decade—the slowest rate since records began in 1953.

Whilst bulk commodities targeted by Chinese trade restrictions can easily be diverted to other markets, premium consumer products rely on their strong reputation and market presence, which takes time to develop. Therefore, increased wine and lobster exports to markets outside China could likely fail to offset weaker exports to China in the short term. High shipping costs, the resilient Australian dollar (which has appreciated almost 40% against the USD since last March), supplier delivery delays and the spread of COVID-19 further complicate the diversification outlook.