Bangladesh—IMF reforms to help strengthen business environment

The IMF board will consider providing US$4.5 billion in loans to the Bangladesh government (about 1% of GDP). The loans, to be disbursed in 6-monthly tranches over 42 months, will help cushion the economy and external finances from surging import costs, weaker exports and emerging social tensions. Although the IMF typically provides financial support to countries in times of crisis, including most recently for neighbours in Sri Lanka and Pakistan, the Bangladesh government requested IMF loans as a precautionary measure to prevent economic and financial instability. Bangladesh has enjoyed a long period of strong economic growth (over 6% per annum on average since 2000), external debt is low, and social indicators and health outcomes have improved.

But economic momentum has been punctured by rising global food and energy prices that have swelled the import bill, raised inflation and dragged on foreign exchange reserves (down 22% over 2022 to US$36 billion in October). The global slowdown and high inflation are reducing demand for Bangladesh’s garment exports (85% of total exports), while weakening remittances from eight million overseas workers is weighing on private consumption. Rising fuel prices have prompted protests while power cuts have hit manufacturers and public services. IMF funds will help Bangladesh implement reforms aimed at improving public finances, containing inflation, strengthening the financial sector, building climate resilience and enhancing the business environment to expand trade and foreign investment.

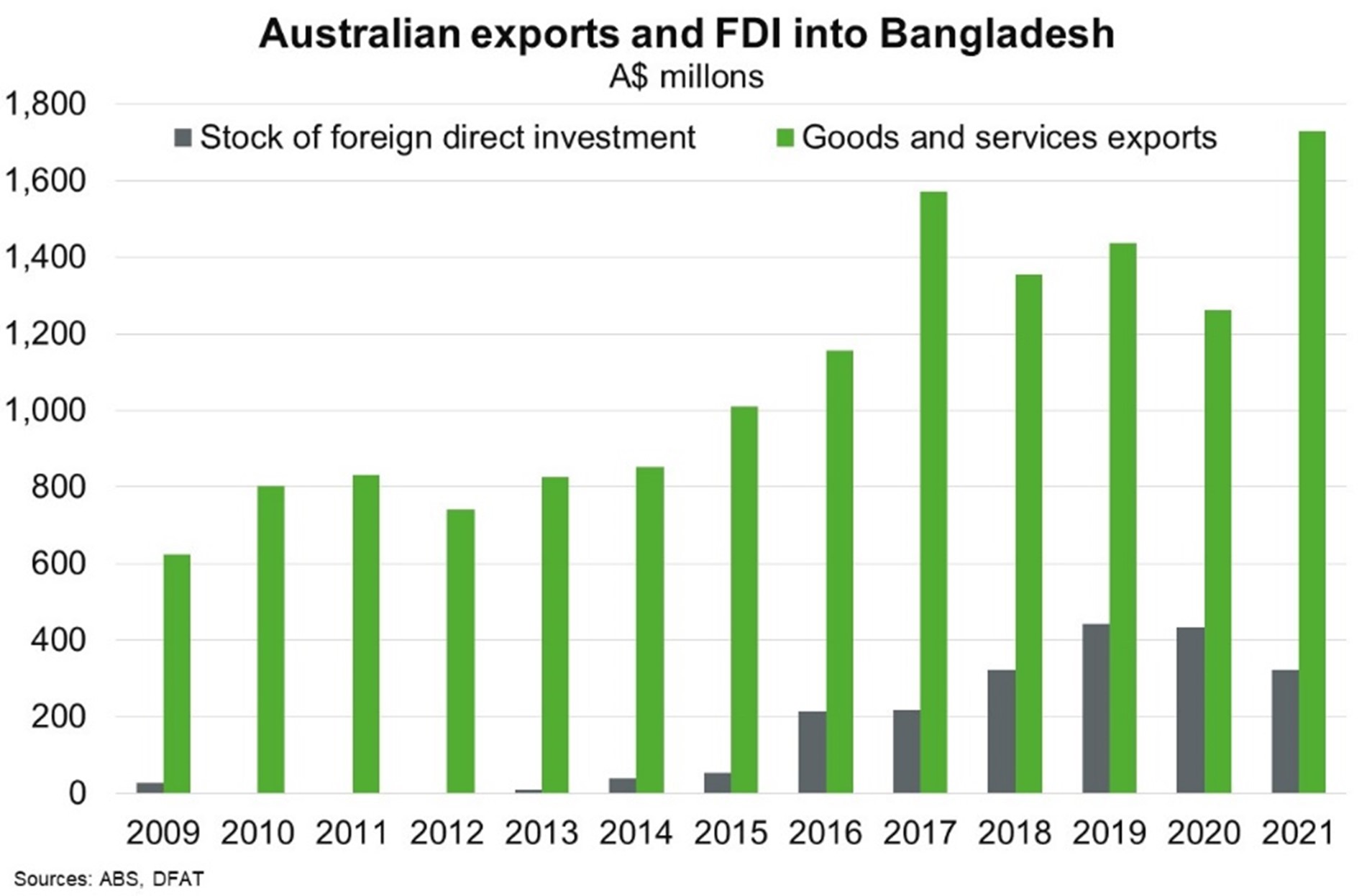

Bangladesh is a small but growing market for Australian exports and investment (Chart). Exports of goods and services amounted to $1.7 billion in 2021, making Bangladesh our 27th largest export market. Despite economic headwinds, efforts to enhance the business environment, in addition to increasing spending on physical and social infrastructure, will ensure significant opportunities for energy, telecommunications and infrastructure-related exports ahead.