Vietnam—Bright economic outlook raises investment opportunities

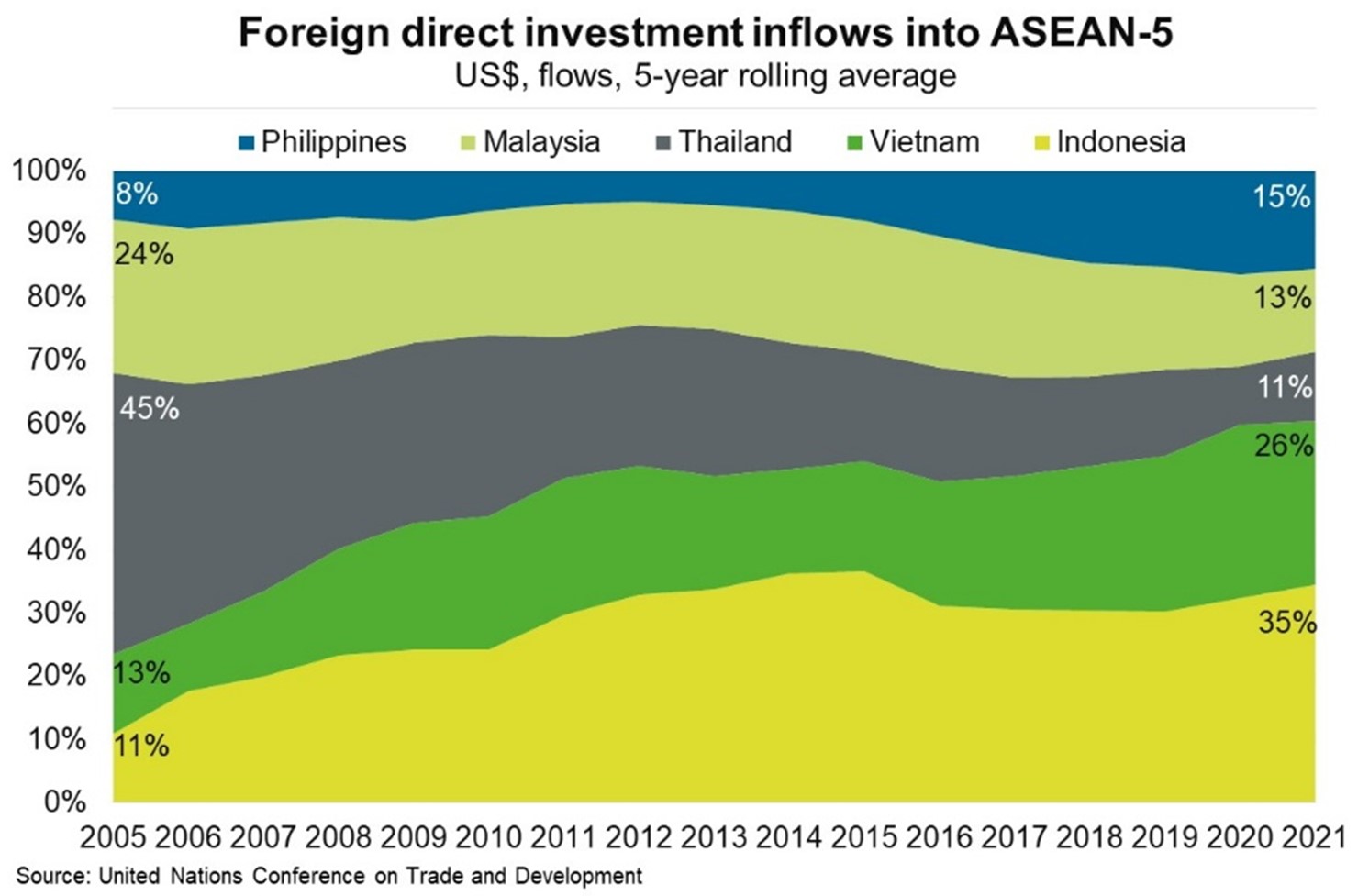

As many Asian economies feel the pinch from slowing external demand, Vietnam’s economic outlook remains upbeat. The IMF expects real GDP growth of 7% in 2022 and 6.7% in 2023, placing Vietnam among the fastest growing Asian economies. Although Vietnam remains vulnerable to the global slowdown, the country is attracting more foreign direct investment (FDI) than many regional peers—reflecting its growing competitiveness as a manufacturing and exports hub. Vietnam received 26% of FDI inflows in the ASEAN-5 region on average over 2017-21, up from 13% in 2001-05, at the expense of Malaysia and Thailand (Chart).

Vietnam is widely seen as an alternative destination for FDI amid supply-chain disruptions from China’s COVID-19 lockdowns, the Russia-Ukraine crisis, and lingering trade tensions between the US and China. Low labour costs, an educated workforce and a large and growing population further support FDI in Vietnam. The business environment has steadily improved alongside global economic integration and trade liberalisation through participation in multiple international trade deals. A track record of stability in the political and security environment is also conducive for doing business. Reflecting these factors, Apple is planning to move manufacturing of the Apple Watch and MacBook to Vietnam, building on the range of Apple products already produced there.

Vietnam’s FDI-led growth provides significant opportunities for Australian businesses. Vietnam’s consuming class is expected to rise from 40% of the population in 2020 to 75% in 2030 (equivalent to 36 million more consumers). An expanding middle class bolsters prospects for agriculture exports, including dairy and meat. High Vietnamese demand for education and training services could benefit Australian providers in areas such as the English language, information technology and business management. As Vietnam’s economy develops, investment opportunities will also exist in construction, manufacturing, logistics, financial and professional services.