PNG—IMF loan to improve business climate, economic diversification

The IMF approved a US$918 million (3.5% of GDP) 38-month financing package last month that will support reforms to address long-standing structural impediments to growth. PNG has been hit by multiple shocks in recent years—including low commodity prices in 2014-20, a severe drought in 2015-16, an earthquake in 2018, and the COVID-19 pandemic in 2020-21—which have added to foreign exchange shortages and the build-up of public debt. Economic recovery is now underway—real GDP is estimated to have grown 4.5% in 2022—to exceed pre-pandemic levels—supported by the removal of COVID-related restrictions and higher commodity prices. The IMF forecasts growth to be sustained at 3.7% in 2023, driven by the non-resource sector, and accelerate to 4.4% in 2024, driven by the reopening of the Porgera gold mine. The medium term outlook is supported by good prospects for new major resources investments. However, downside risks dominate given PNG’s undiversified export base, small revenue base and vulnerability to political instability.

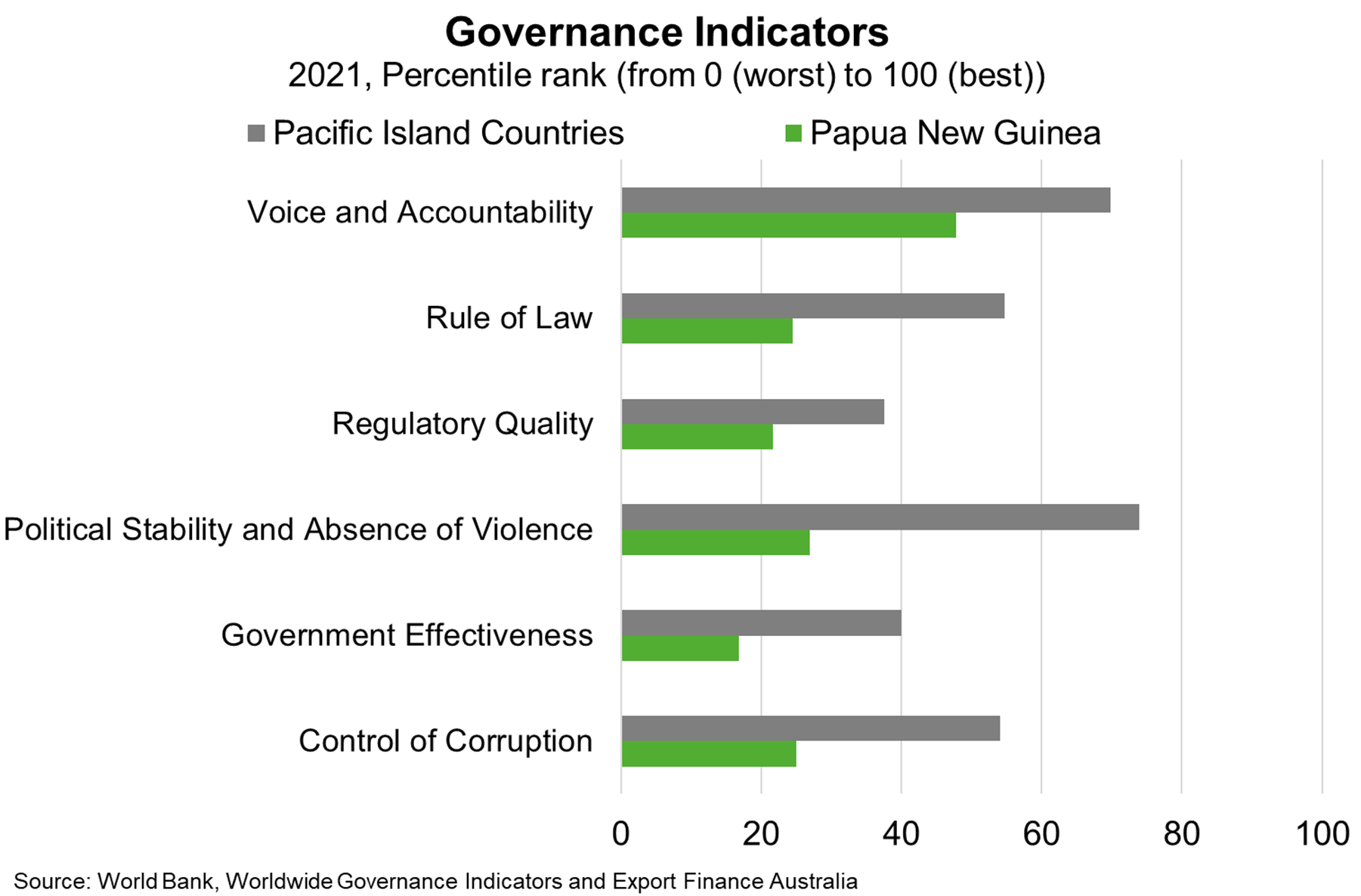

To increase PNG’s resilience, the IMF program prioritises three reforms. First, addressing a high risk of debt distress via sustained fiscal consolidation. Second, operationalising anti-corruption frameworks—helping to improve weak scores in Worldwide Governance Indicators (Chart). Third, gradually alleviating foreign exchange shortages by transitioning to a market clearing exchange rate (estimated to be overvalued by 13% in 2022). These reforms are critical to strengthen the business climate and diversify the economy (resources accounted for 87% of exports and 30% of GDP last year). Indeed, the Westpac PNG 100 CEO Survey 2023 found lack of access to foreign exchange is the most critical impediment to PNG businesses. Reform progress is key to improving opportunities in Australia’s largest export market in the Pacific ($2.6 billion in FY2022, 23rd largest market overall).