World—Long term growth slowdown reflects structural challenges

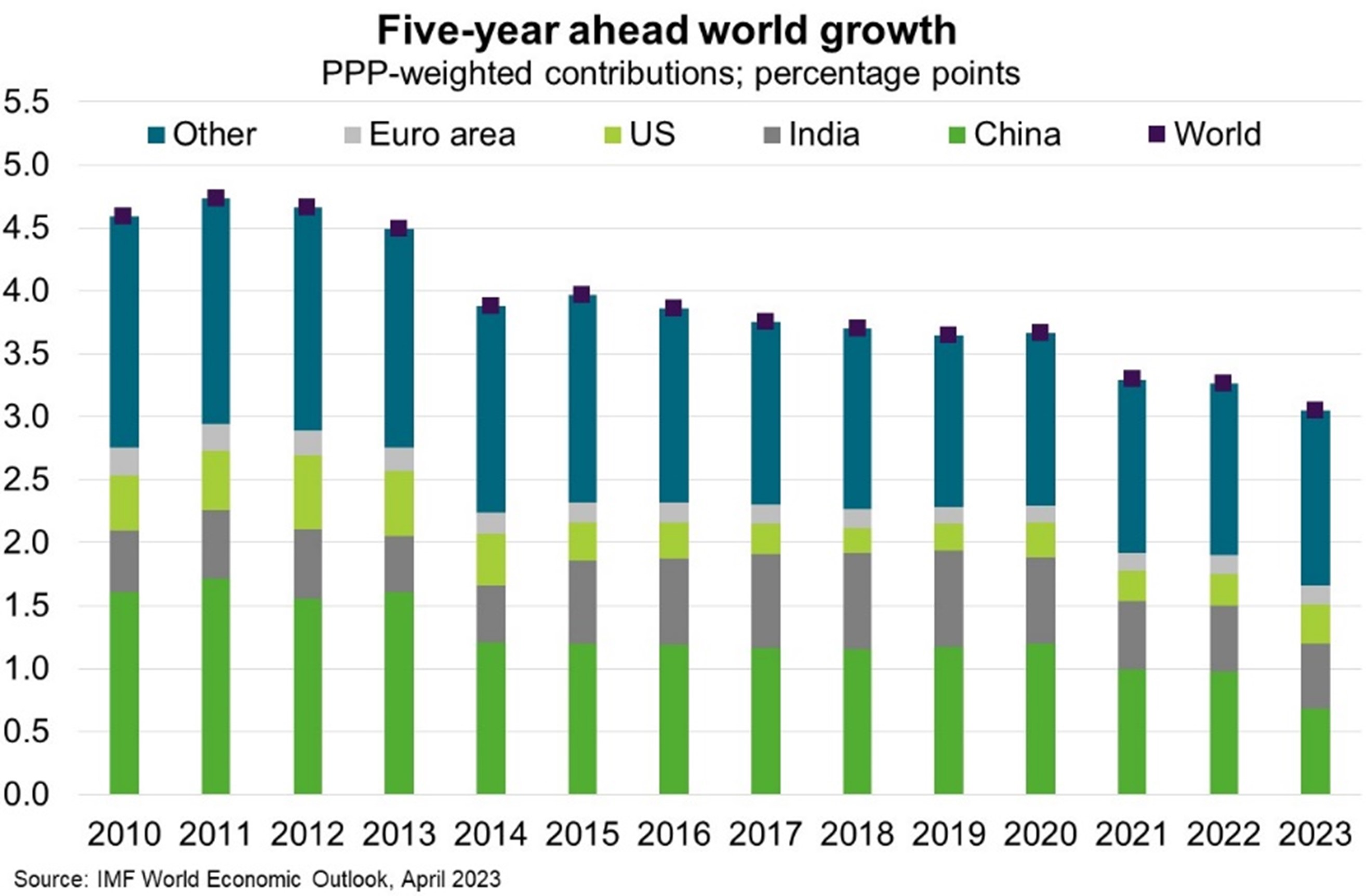

New IMF forecasts suggest global economic growth will bottom out at 2.8% this year. China’s reopened economy is rebounding, supply chain disruptions are unwinding, and market dislocations following Russia’s invasion of Ukraine are receding. However, the IMF’s medium term global growth forecasts are their lowest since 1990. The World Bank similarly warns that the global economy is undergoing a structural growth slowdown, with considerably weaker underlying growth prospects in both advanced and emerging markets (Chart). Lacklustre performance reflects slower growth in labour productivity and weaker capital investment, an ageing labour force, ‘supercharged’ growth in China reverting to more normal levels, and economic fragmentation amid geopolitical tensions.

According to the IMF, the chances of a ‘hard landing’ have risen sharply. Inflation has proved stickier than anticipated, even a few months ago. Despite the sharp reversal in global energy and food prices, core inflation (which excludes energy and food) is yet to peak in many countries. The IMF expects core inflation to end 2023 at 5.1%, a sizeable upward revision from January forecasts, and well above target. While no apparent contraction in credit has emerged following recent US banking sector turmoil, the IMF cautions that higher-for-longer interest rates to counter inflation could amplify financial risks. In a severe downside scenario, banking sector fragility amplified through risk-off behaviour, could see a sharp tightening of global financial conditions and precipitate large capital outflows. That would reduce global growth to about 1%, effectively leaving much of the world in recession. The IMF attributes a 15% probability to this scenario. Meanwhile the IMF see a one in four probability of global growth falling below 2% in 2023—an outcome that has occurred on only five occasions since 1970.