China—Weak domestic demand and external headwinds drag on growth

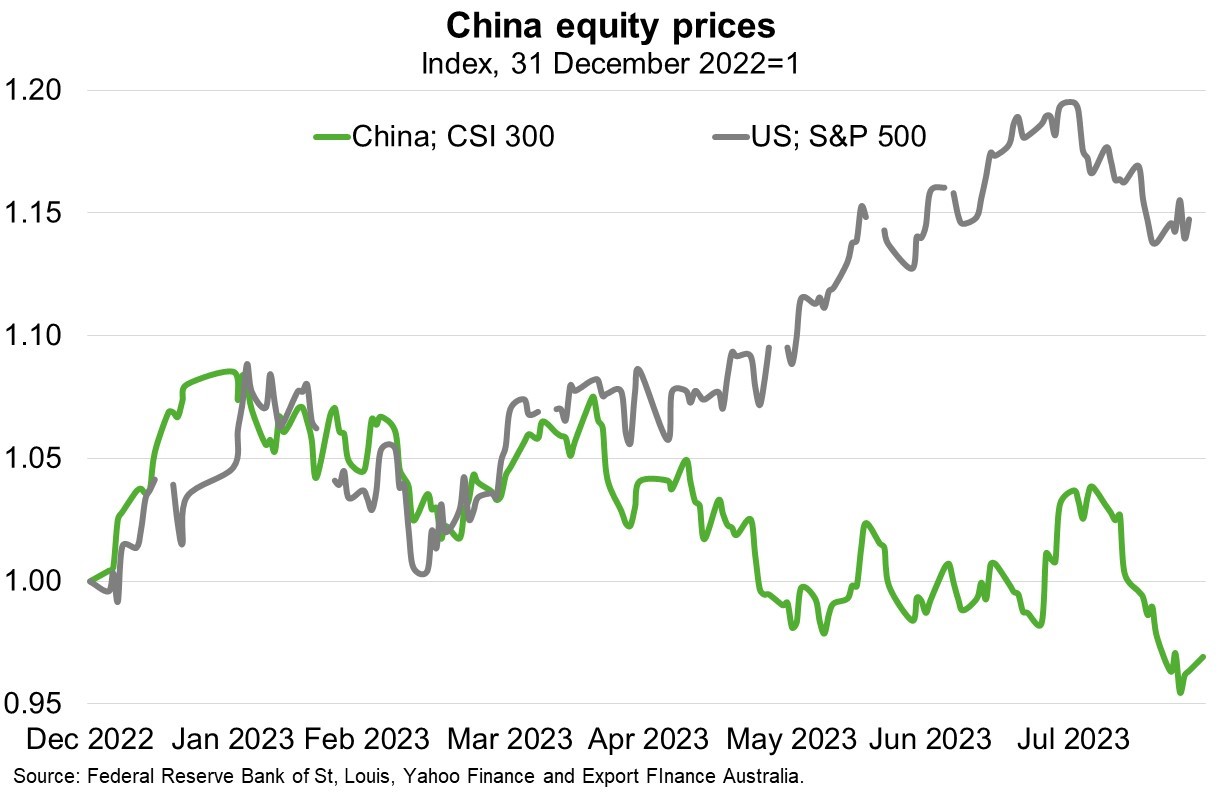

China’s post-pandemic economic reboot is fading due to consumption and property sector weakness and sharp declines in exports and foreign investment. Disappointing July data highlighted weak domestic demand in the world’s second-largest economy. Growth in retail sales eased to 2.5% y/y, missing market estimates of 4.5%, while consumer prices fell 0.3% y/y, after registering no change a month earlier. Industrial output also slowed while Chinese bank loans fell to their lowest level since 2009. Meanwhile, authorities announced youth unemployment data will be temporarily suspended after it reached a record 21.3% in June (equivalent to around 6 million people, double the pre-pandemic level). The moribund property sector is dragging on economic activity and financial markets (Chart). Property investment fell by 8.5% y/y in July while new construction starts were down 24.5% y/y in the January-July period. Fears of financial contagion have increased after property developers warned of widespread losses and Country Garden, China’s largest private homebuilder, missed payments on international bonds.

The global economic slowdown and geopolitical tensions are also dragging on China’s economic performance; China’s exports fell 14.5% and imports fell 12.3% y/y in July. Meanwhile, inward foreign direct investment plunged 87% y/y to a historical low of US$4.9 billion in Q2. The Biden administration’s recent executive order restricting US investment in Chinese technology presents an additional headwind.

The People’s Bank of China has responded with only modest cuts to various interest rates, likely due to concerns about the weakening currency, capital outflows and financial stability. Meanwhile, new guidelines have been announced to spur foreign investment, including increased investor protections and fiscal support and tax incentives for foreign-invested enterprises. However, a sustained economic rebound will likely require more stimulus to boost confidence and encourage consumers and private businesses to increase spending.