Australia—China’s economic reopening buoys commodity demand

China’s unexpected economic reopening after nearly three years of strict COVID-19 restrictions is lifting the domestic and global growth outlook, and providing a boost to demand for, and prices of, commodities. An easing in borrowing limits for some property developers and a ramp up in infrastructure investment (worth over US$1 trillion or roughly two-thirds of Australia’s GDP), will also stimulate global growth and commodity demand—given China comprises almost 20% of the global economy and is the world’s top importer of many commodities. Prospects for fewer global supply disruptions will also help Australian businesses that rely on imported Chinese inputs in their production processes.

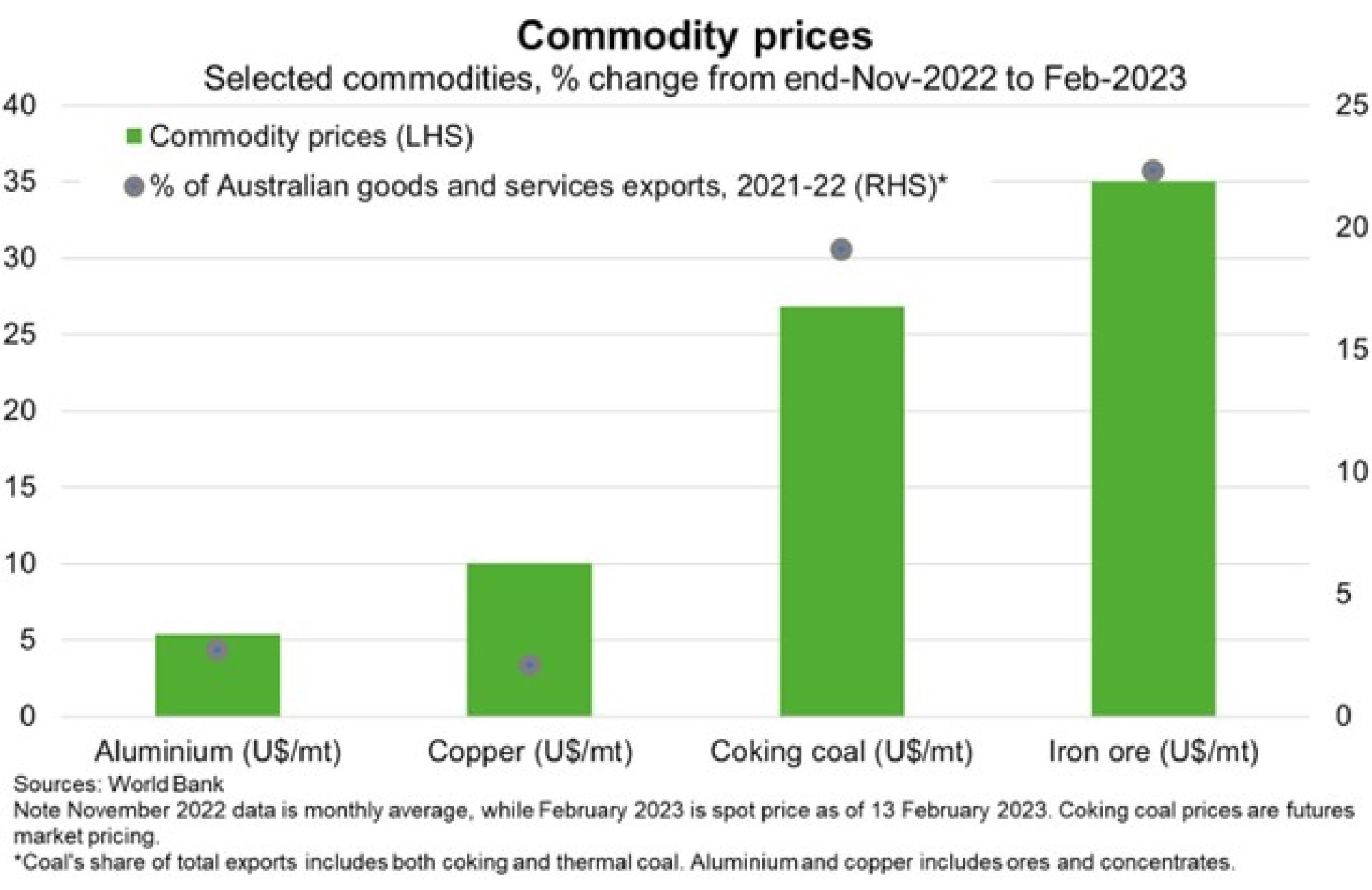

Since China began easing COVID-19 restrictions in early December, the price of iron ore—a key input into steel used in Chinese construction and manufacturing and Australia’s largest export—has jumped 35% to its highest level since June 2022 (Chart). Copper and aluminium prices have also risen in the past few months.

The extent to which these price trends continue remains uncertain. Concerns about China’s reopening further boosting world inflation and keeping interest rates higher for longer has dampened some commodity prices through February. But prices for many commodities are still higher through early 2023 (in contrast to forecasts of price declines) amid China’s reopening. This suggests Australia’s resources and energy exports may outperform the record $459 billion forecast in December for FY2023. Similarly, Australia’s agriculture exports may exceed the record $72 billion forcast for FY2023.