China—Ambitious 5% growth target faces headwinds

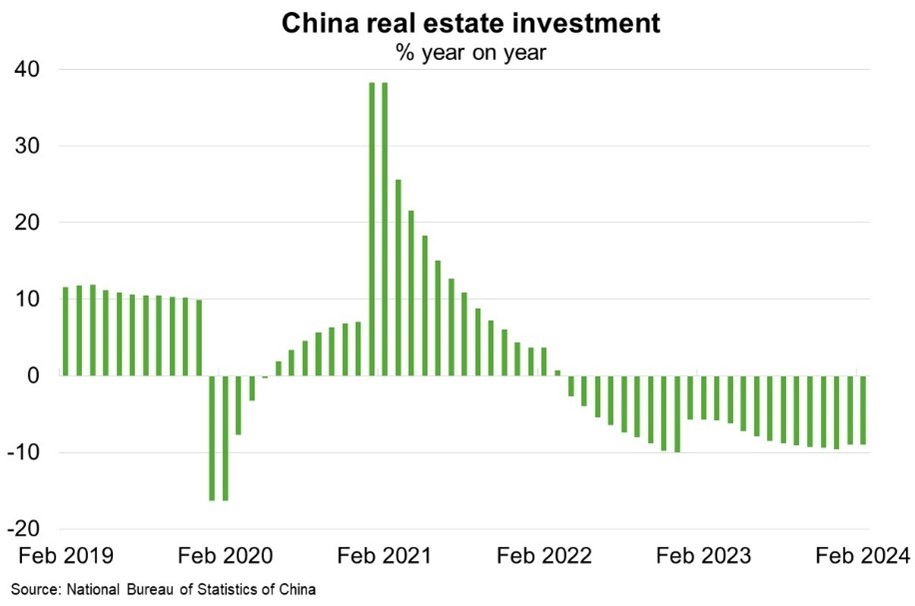

Chinese authorities reaffirmed an economic growth target of ‘around 5%’ for 2024 at the National People's Congress in March. China’s economy grew 5.2% in 2023, supported by the removal of pandemic restrictions and stimulus measures. But maintaining this growth rate faces headwinds. A downturn in the property market (Chart), which accounts for around 25% of GDP and 80% of household wealth, is weighing heavily on consumer sentiment and domestic demand. Less favourable base effects, an ageing population, debt-troubles at state-owned enterprises and corporates, deflation and geopolitical tensions add to the challenges in achieving this year’s growth rate.

To help meet the growth target, authorities announced fiscal expansion; equivalent to about 1% of GDP in 2024 relative to 2023. Although the government lowered the budget deficit target to 3% of GDP, local governments will issue more bonds for infrastructure spending, and the central government will sell CNY1 trillion yuan (US$140 billion) of long term special bonds. Past stimulus measures, such as interest rate cuts, lowering bank reserve ratios’, easing home purchase restrictions and increased infrastructure spending, are yet to meaningfully strengthen property investment and domestic consumption. In the January-February period, retail sales grew at a slower pace, unemployment edged up and new bank lending expanded at the weakest rate on record. But given high economy-wide debt, authorities have been reluctant to embark on large stimulus programs for fear of stoking financial instability.

China’s growth strategy includes a strong financing push to develop ‘strategic emerging industries’; in particular, high-end and clean manufacturing industries, including electric vehicles and semiconductors. Although this could boost exports, the rising competitiveness of Chinese-produced high-tech manufactured goods could exacerbate global trade tensions given Beijing’s state-backed economic model. Recovery in consumer confidence and spending will be important in sustaining economic growth.