Advanced economies—Risks to buoyant markets threaten real economy

Advanced economy stock markets are trading near record highs. Investor confidence has been buoyed by expectations that major central banks will cut interest rates this year amid historically low unemployment and resilient economic growth. Indeed, recent forecasts from US Federal Reserve Board members suggest the Federal funds rate will fall 75 basis points by end-2024. The Bank of Japan (BoJ) is an outlier. Strong wage growth and inflation exceeding the 2% target for 22 months allowed the BoJ to raise interest rates for the first time in 17 years last week, to between 0.0% and 0.1%. That said, monetary settings will remain highly accommodative. Strong artificial intelligence (AI) propelled corporate earnings have also bolstered the stock rally. In particular, bumper profits have seen Nvidia gain over 90% this year. Investors are betting that AI will provide transformative productivity gains, fuelling economic growth.

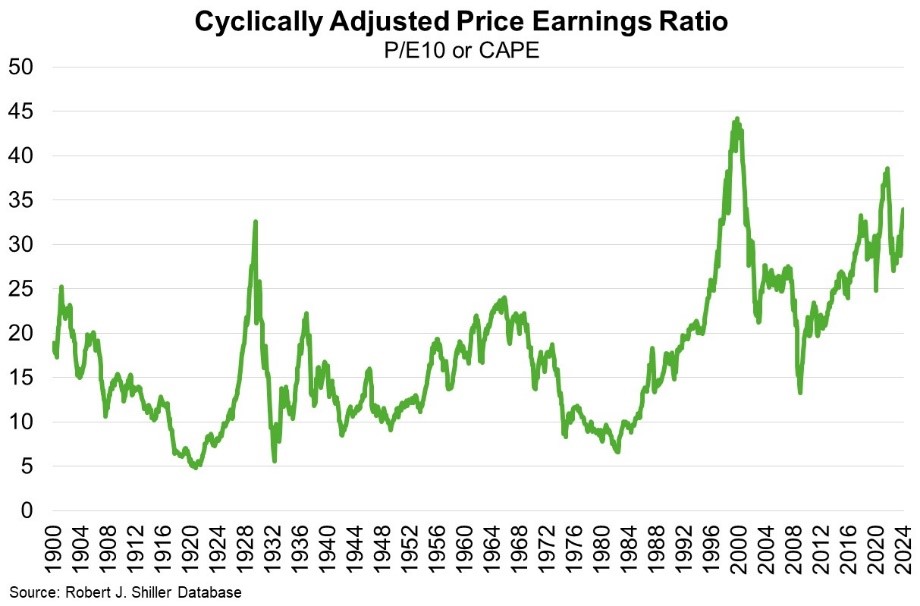

However, stock valuations are historically high, raising risks to the sustainability of the rally. The cyclically adjusted price-to-earnings ratio previously peaked at 44 in 1999, during the dotcom bubble, and at 31 in 1929. It now stands around 34 (Chart). The outlook for corporate profits is challenging, with Michael Smolyansky of the US Federal Reserve warning of ‘significantly lower profit growth and stock returns in the future’. Smolyansky calculates that lower interest expenses and corporate tax rates mechanically explain over 40% of the growth in real corporate profits over the three decades to 2019. However, risk-free interest rates in advanced economies are about twice as high as in 2019. Analysis from The Economist suggests that the median statutory corporate tax rate increased for the first time in decades in 2022 and 2023. The nascent nature of AI technology, volatile geopolitics, and manifold financial risks also cloud the outlook.