Export outlook – More moderate growth

Despite the IMF’s sanguine projections for economic growth, further slowing in global industrial production and lingering drought suggests moderating Australian export growth. Prices for Australia’s major resource exports will likely drift down, after hitting seven-year highs in June 2019. Offsetting this to some extent is the weaker Australian dollar, which will continue to support export competitiveness and Australian dollar export receipts.

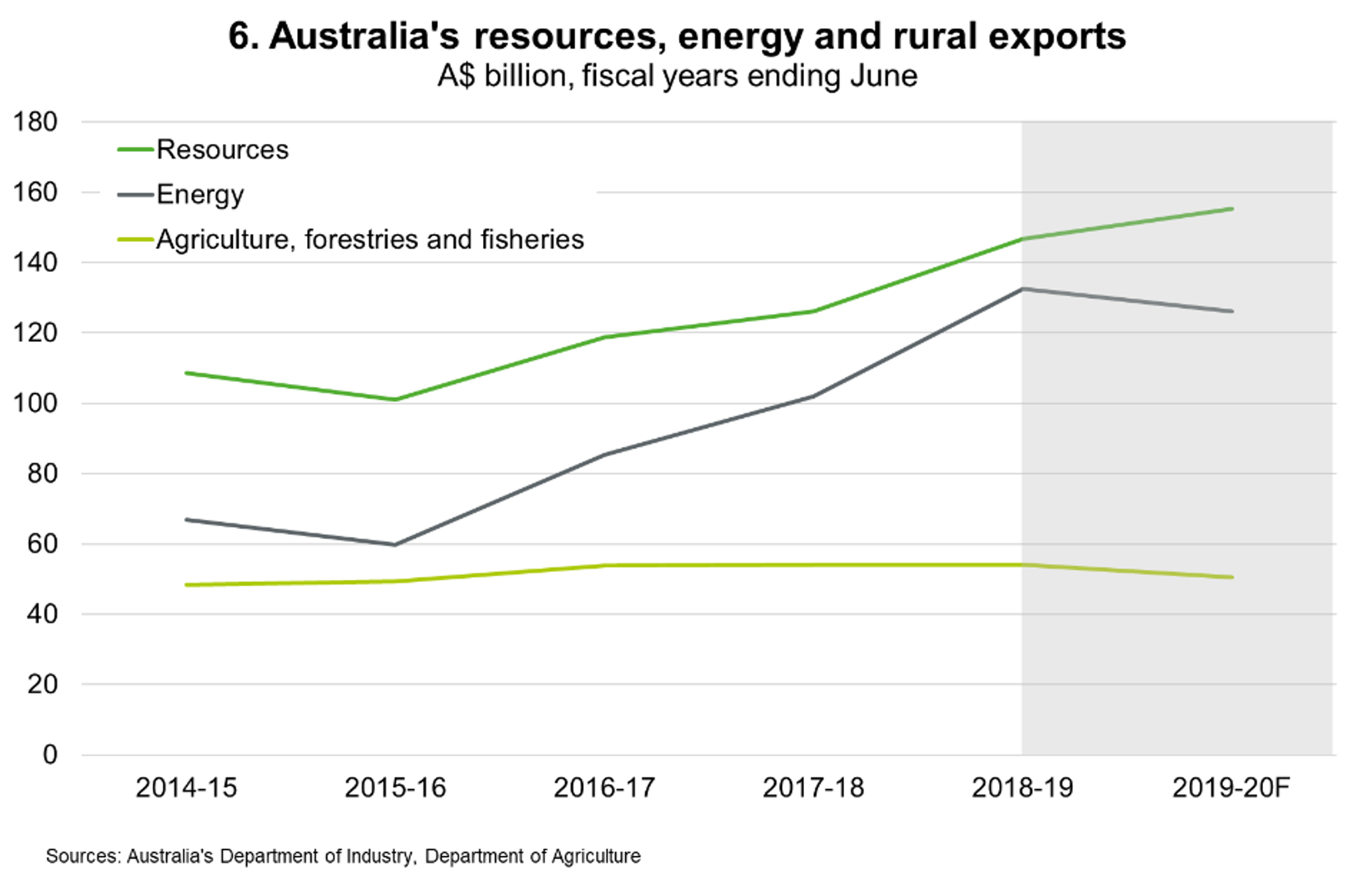

Resources and energy exports are expected to peak at around $280 billion in June 2020 (Chart 6) amid still-high resources prices and a weaker Australian dollar, according to the Department of Industry.

China’s efforts to stimulate infrastructure development will continue to support demand for essential ingredients like iron ore and aluminium, although export values are then projected to decline over the year to June 2021 as prices weaken. Metallurgical coal exports, used in the production of steel, will follow the same path. Following years of LNG infrastructure investment in Australia, the ramp up in LNG exports is likely to continue for a little longer, before beginning to taper off from late 2020. Thermal coal exports are likely to gradually decline, as low LNG prices and environmental issues prompt growing demand for gas relative to coal.

Gold exports will benefit from investors demand for haven assets in the face of rising economic and geopolitical risks. US-China trade tensions and slowing global industrial demand will pressure exporters of base metals; the exception is nickel exports, which will continue to grow on the back of rising global investment in electric vehicles.

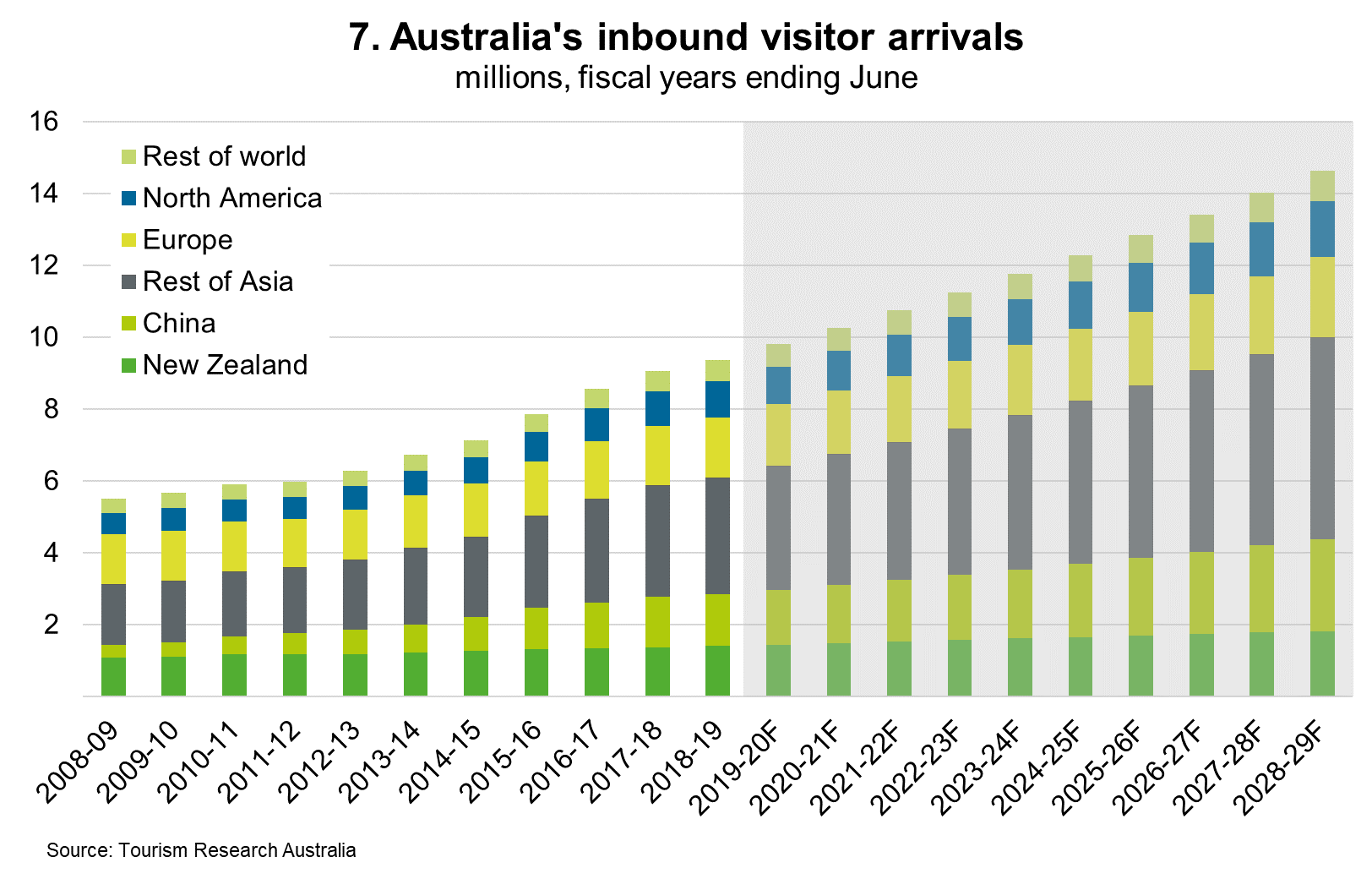

Services exports are expected to continue growing steadily according to the RBA, underpinned by overseas student enrolments and the boost to competitiveness from the lower Australian dollar over the past year. Tourism Research Australia indicates international tourism arrivals will increase further thanks to rising demand from Asian markets (Chart 7).

Agriculture exports will weaken as the ongoing drought hits crop and livestock production, according to the Department of Agriculture. Strengthening global production will result in some softening in prices. Producers have seen some trade opportunities due to the US-China trade dispute. However, ongoing global trade disruptions will lower incomes and demand from Asia in the longer term.

The RBA expects manufacturing exports to continue increasing steadily, especially exports of medicinal and pharmaceutical goods and professional and scientific instruments. Lower Chinese tariffs on Australian pharmaceuticals as a result of the China-Australia Free Trade Agreement (ChAFTA) will continue to support demand there, while growing medical research supports development of new vaccines and drugs. Longer term, demand for Australian pharmaceutical products, including vitamins and nutritional supplements, will be supported by an ageing population in Asia, increased appetite for consumer healthcare products, and Australia’s reputation as a high-quality producer.

Futures contracts suggest the Australian dollar is likely to stay in a range of US68 to US70 cents next year. The broadly stable range reflects upward and downward currency pressures. Prospects for even lower Australian interest rates and moderating commodity prices puts downward pressure on the Australian dollar. However, the shift to current account surpluses provides support for the local currency.