Risks to the outlook — Skewed to the downside

1. Further disruptions in trade and technology linkages

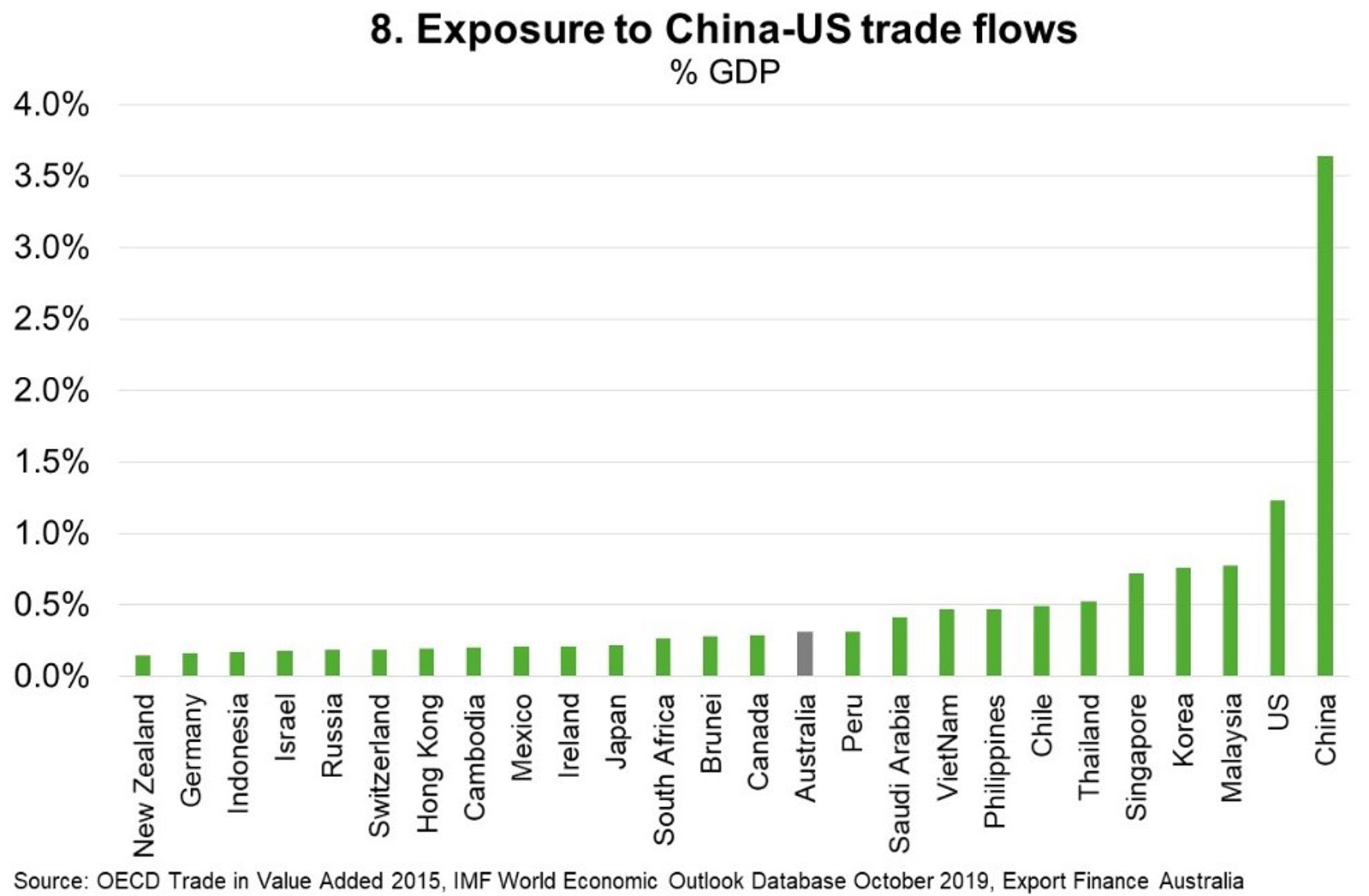

A prolonged period of unresolved trade and investment tensions would further increase uncertainty, disrupt global supply networks, lower productivity and depress business confidence. The negative consequences of any escalation of the US-Sino trade dispute would be widespread, taking the largest toll on the United States and China and export-oriented economies in east Asia (Chart 8). Bilateral trade tensions could also spread to more economies or sensitive sectors. While the service sector remains a relative bright spot in the global economy, there is the risk that protracted weakness in global manufacturing could eventually see business-facing services—like logistics, finance and legal—cut back on hiring, thereby denting consumer confidence and spending. That would in turn lower demand for consumer-oriented services, like retail and hospitality. The rules-based international trading order will also need to contend with an ineffective WTO appellate body in 2020, stifling the dispute-resolution mechanism.

Given the Conservative victory in UK general elections last week, Brexit is expected by 31 January. However, if the UK and EU cannot agree a formal trade deal, cross-border trade will be based on WTO terms. That would significantly diminish prospects in the UK and Europe and add to global economic uncertainty. Indeed, the OECD estimates that UK GDP could be 2-2½% lower while Euro area GDP could be ½% lower in the first two years if trade shifts to being on WTO terms. The largest effects would be felt by smaller economies with relatively strong trade links with the UK, including Ireland, the Netherlands, Belgium and Denmark.

2. Abrupt decline in financial market risk appetite

An extended period of central bank stimulus has induced a sharp decline in risk premiums. Government and corporate bonds with negative yields have increased to a whopping US$15 trillion. And asset valuations are stretched—for instance, US and Australian share markets recently hit new record highs. This indicates that market participants expect global financial conditions to remain supportive for some time. But financial markets are susceptible to abrupt drops in sentiment. And there is a myriad of possible triggers that could see heightened financial market volatility. Indeed, the disconnect between investors’ optimism and economists’ pessimism is increasingly pronounced. An abrupt repricing of underlying risk could expose financial vulnerabilities accumulated during years of low interest rates. This could perpetrate via two key channels.

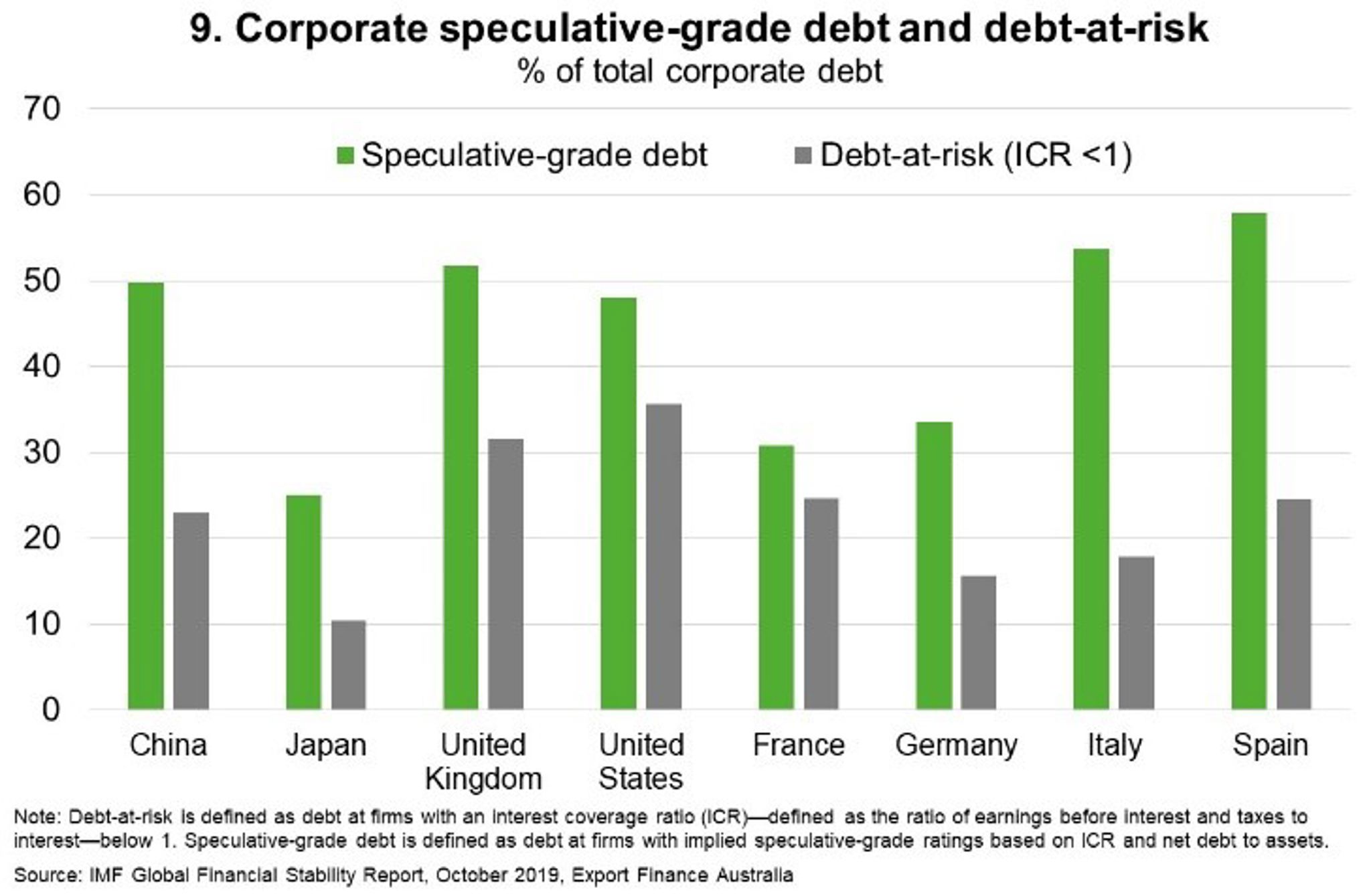

- Highly leveraged corporate borrowers could struggle to roll over debt. Speculative-grade debt now constitutes nearly 50% of total corporate sector debt in China and the US and is even higher in Italy, Spain, and the UK (Chart 9). The IMF estimate that a material economic slowdown—one that is as half as severe as the GFC—would see corporate debt-at-risk rise to US$19 trillion.

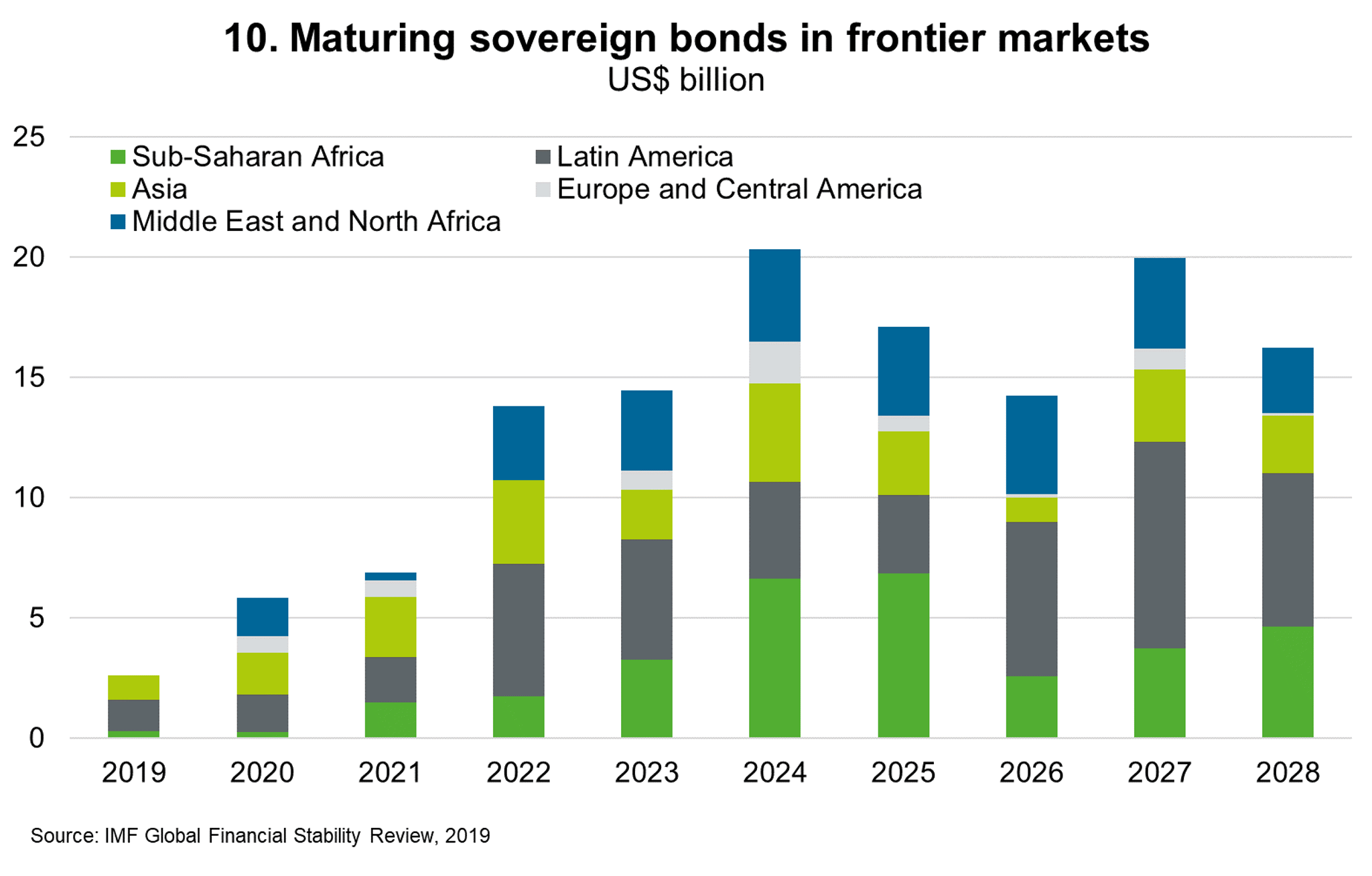

- Capital flows could retreat from emerging markets. The increasing reliance on external market borrowing in emerging markets and rising refinancing needs as sovereign bonds mature in coming years (Chart 10), exposes these countries to rising interest rates. A sharp tightening in financial conditions and higher borrowing costs would make it harder for vulnerable economies to service their debts. Argentina provides a recent reminder of this potential disruption. The surprise landslide loss of former business-friendly President Macri in primary elections in August saw Argentina’s stock market and currency (against the USD) plunge over 30%. This increased the cost of servicing Argentina’s debt and raises the risk of default. There is a risk that any resulting financial market volatility could spread to other emerging markets.

3. Sharper-than-expected slowdown in China

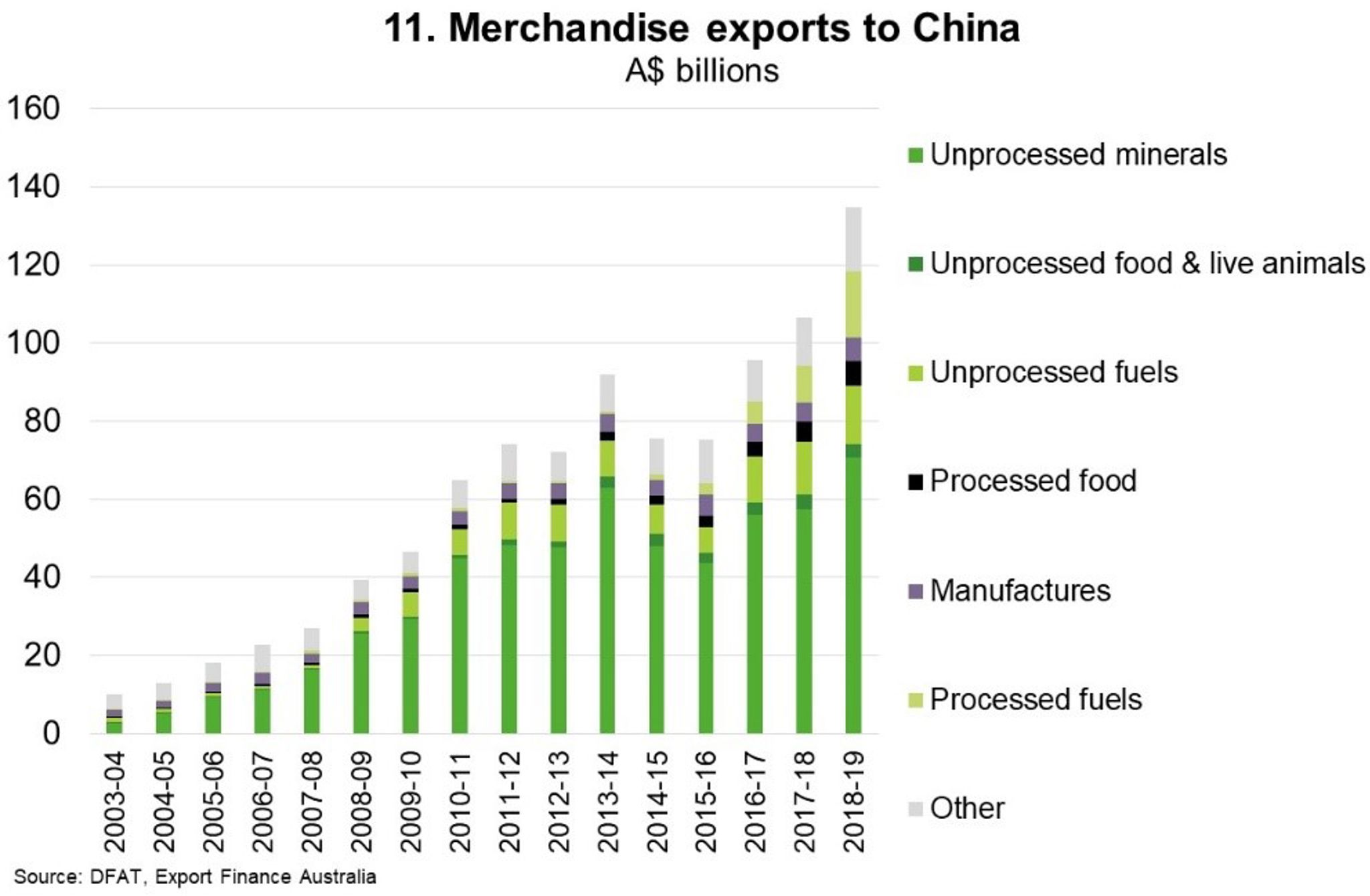

Targeted stimulus measures have supported Chinese domestic demand to date and helped offset the effects of the US–China trade dispute. So far, authorities have been wary that aggressive policy easing would prompt additional borrowing and add to China’s heavy debt load (US$42 trillion, equivalent to 306% of GDP or 17% of global debt). But were growth to fall by more than expected, Chinese policymakers would likely revisit options. Lower growth and rising debt would fuel currency depreciation pressures, sparking capital outflows. Such a scenario poses significant risks to Chinese demand for Australian mineral exports (Chart 11), and the global economy and financial stability more broadly.

4. Geopolitical and social tensions

Given the muted outlook, populist backlash against economic malaise, globalisation and inequality (Chart 2) could worsen. To date, a surge in mass protests—for instance, in Bolivia, Chile, Ecuador, Egypt, France, Spain, Hong Kong, Iraq, Iran and Lebanon—have generated mainly domestic consequences. But to the extent that countries respond with policies that restrict the movement of goods, capital, labour, technology and data, the consequences will be increasingly global. And an escalation of such events, combined with other risk factors, could have outsized effects on confidence more broadly.

Geopolitical risk factors are concentrated in the Middle East and east Asia. The worsening situation in Hong Kong could see a forceful crackdown in 2020 that undermines the ‘one country, two systems’ self-governance principle. If the United States determines that Hong Kong is not ‘sufficiently autonomous’ from China to justify its ‘unique treatment’ under US law, this would exacerbate longer-term Sino-US overall tensions. Given Hong Kong’s status as a global hub for finance and trade, the implications of civil unrest are potentially of global importance. The Middle East is a continued source of tension. In Iran, US-led sanctions are fuelling violent unrest not seen in decades. Mass protests have erupted in Iraq and Lebanon, the latter of which is in an economic crisis. Yemen is engaged in a protracted civil war and Israel has been without a government for over a year. Turkey’s incursion into Syria has introduced many new risks. An escalation of civil violence or instability could trigger higher volatility in commodity markets or a severe oil price spike.

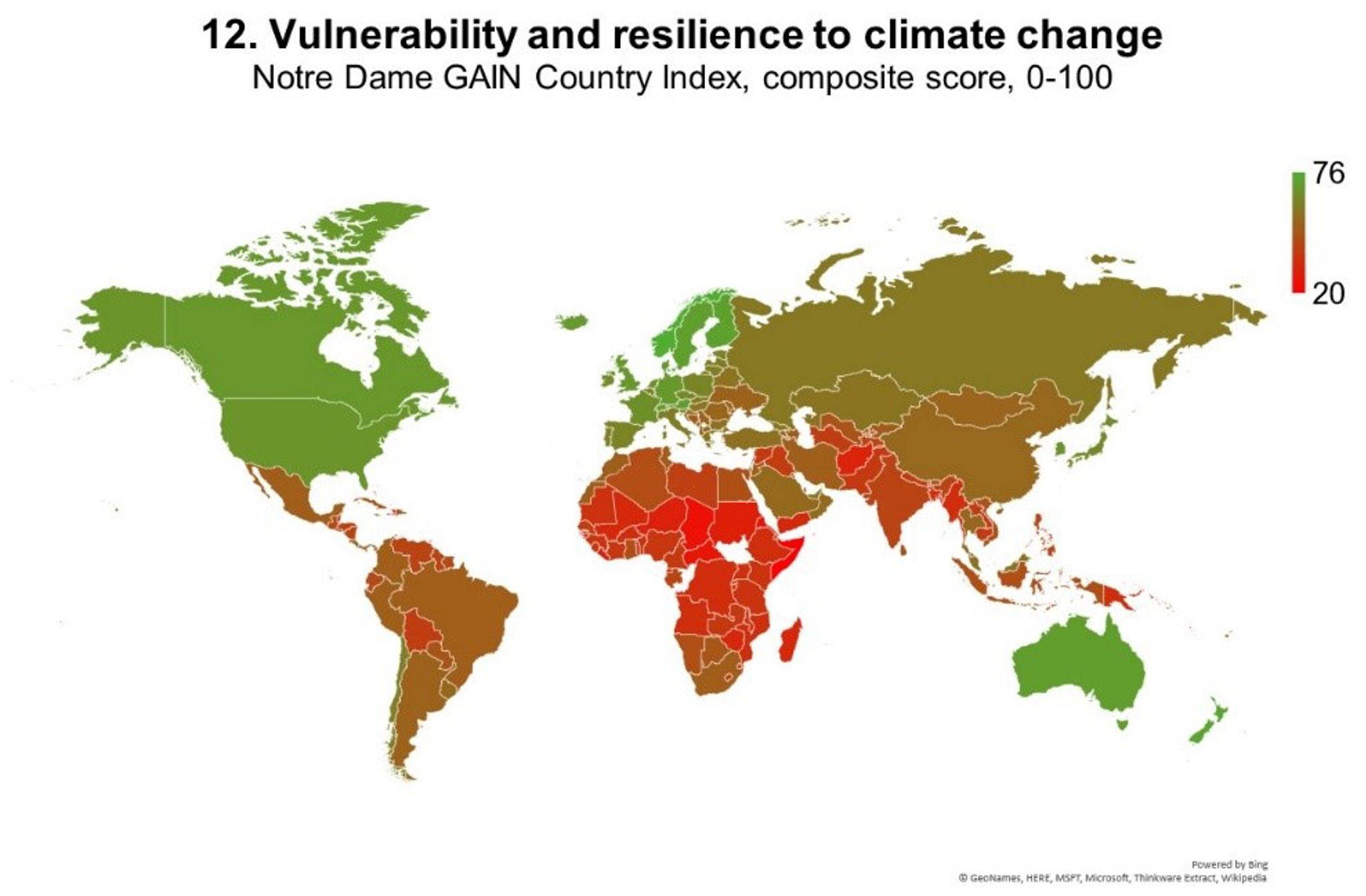

5. Medium term threats – climate change, inequality, deteriorating productivity

The Intergovernmental Panel on Climate Change warned in October 2018 that, at current rates of increase, global warming could reach 1.5°C above preindustrial levels between 2030 and 2052. This could inflict severe and persistent economic losses across many economies as extreme weather events become more frequent and destructive (Chart 12). Meanwhile, the ongoing increase in income paid to capital owners versus workers, along with future strides in artificial intelligence and automation, could worsen income inequalities and further fuel social tensions. Last, deteriorating productivity could exacerbate weak investment and reduce potential economic growth in many advanced economies.