Eurozone – Manufacturing weakness raises recession risk

The Eurozone economy is coming under renewed pressure as manufacturing output sags further.

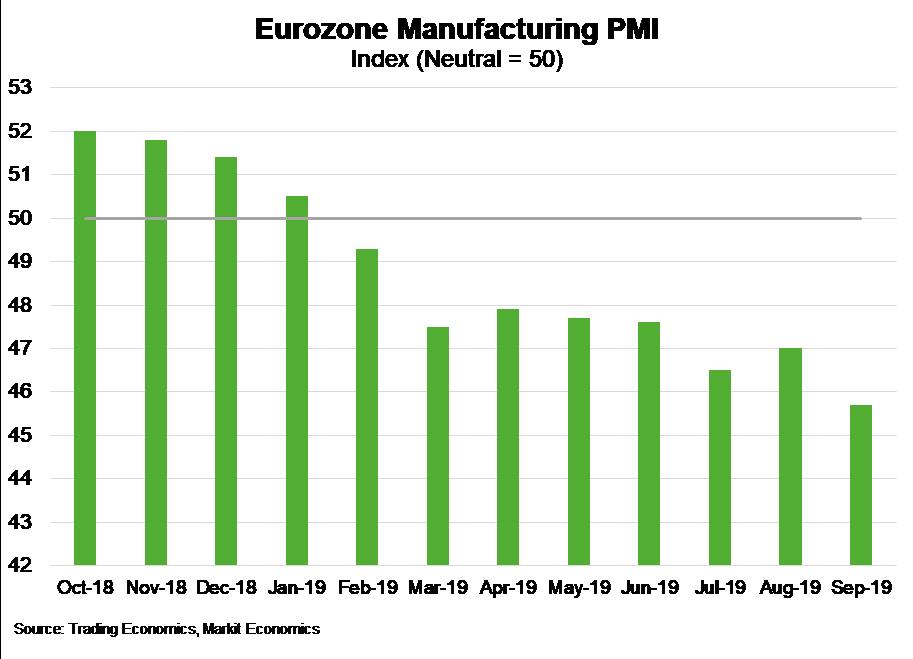

Manufacturing activity entered recessionary territory in 2019, a worrying sign for the beleaguered region. The IMF points to a broad-based slowdown in industrial output resulting from weaker external demand (including from China) and repercussions from global trade tensions and impacts of uncertainty on confidence and investment. The IHS Markit Eurozone Manufacturing Purchasing Managers Index (PMI) fell to a 7-year low of 45.7 in September, down from 47 in August – a reading below 50 indicates contraction (Chart). Germany, the region’s manufacturing powerhouse, saw its manufacturing PMI fall to 41.7 in September from 43.5 in August, the worst reading in more than a decade.

Escalating trade tensions between China and the United States have contributed to the weakness. Worse still, the WTO recently granted the US permission to levy US$7.5 billion in tariffs on EU imports.

The manufacturing slowdown may be spreading to the services sector. The Eurozone Services PMI also fell in September, to an 8-month low of 51.6 (from 53.5 in August). Conditions in the wider economy are also soft, with annual GDP growth in the Eurozone falling to 1.1% in the June quarter, the weakest growth since 2013.

The European Central Bank has responded with renewed stimulus. In September, it cut its deposit rate to a record low of -0.5% and indicated it would restart bond purchases at a rate of 20 billion euros a month. It also urged countries to use fiscal measures to help support economic growth. But even with fiscal and monetary stimulus, growth is set to remain slow through 2019.

Australia exported more than $11 billion worth of goods to the Eurozone in 2018, an increase of almost 50% from a recent trough in 2014. The soft economic backdrop, and risk of a sharper economic slowdown in the Eurozone, threatens to undo some of that advance.