Japan – Increased foreign investment scrutiny in sectors related to national security

Proposed new rules on foreign investment could restrict access for Australian investors to key sectors of the world’s third largest economy – especially direct investors.

The Japanese government plans to lower the ownership threshold for foreign investment approval from 10% to 1% in companies regarded as sensitive to national security. The sectors deemed strategically significant under the new law are likely to include military technologies, aerospace, resource and transportation infrastructure, and communications and broadcasting. The changes are expected to be legislated in the coming year.

Also under consideration is a requirement for foreign shareholders to give notification before making changes in management, such as nominating board directors, and selling core businesses.

Though the government has announced some exemptions for portfolio investors, it is still uncertain what will count as portfolio investment. Overall, the measures are likely to deter foreign direct investment into Japan.

The restrictions follow steps in other major economies including the United States and Europe to tighten foreign investment rules due to national security concerns. Governments are becoming worried that foreign-owned companies may gain access to sensitive technology and confidential data.

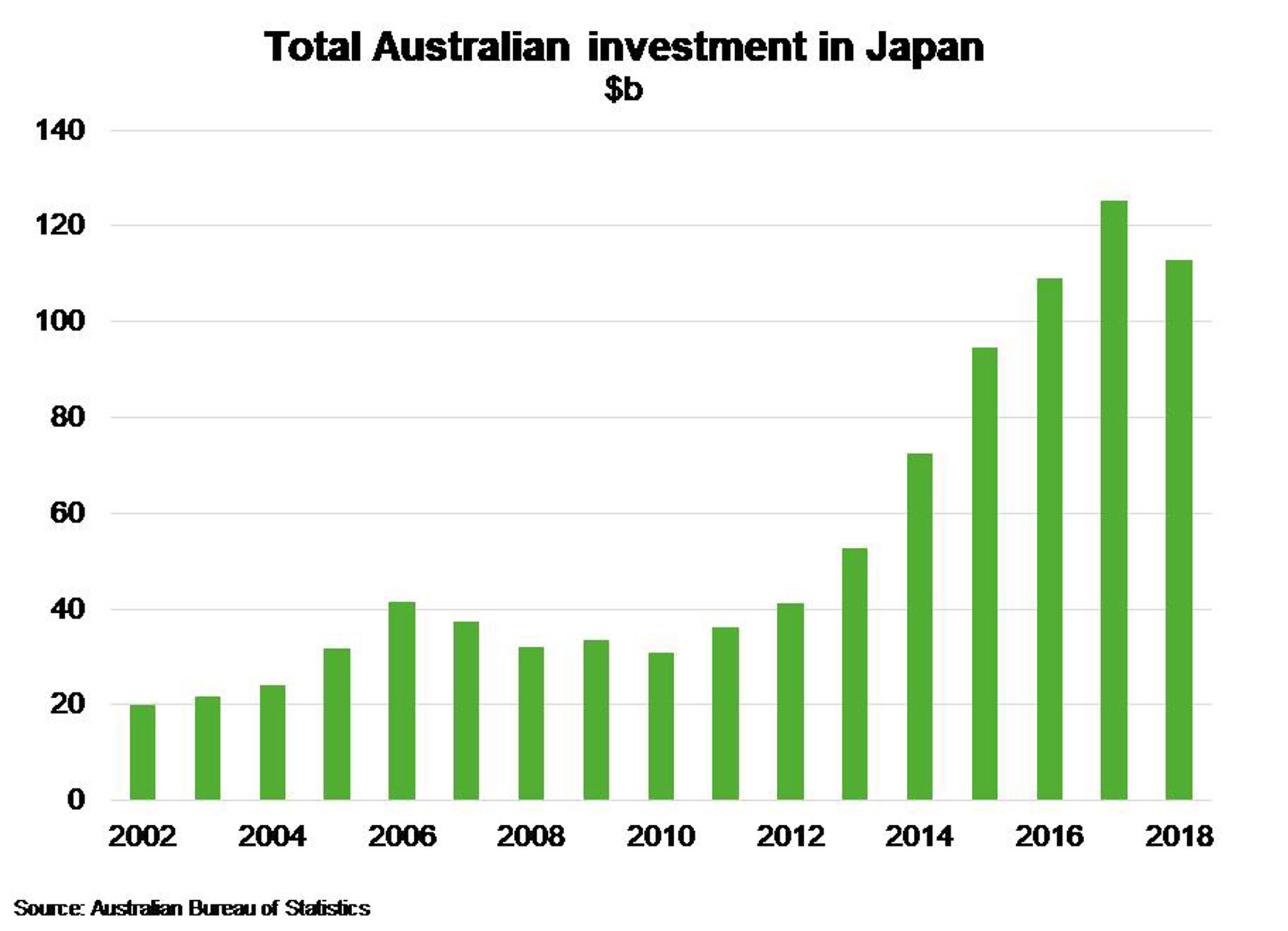

Total Australian investment into Japan – spanning both portfolio and direct – was $113 billion in 2018, having increased at an average annual rate of 16.5% for the past five years (Chart). While foreign direct investment makes up a relatively small share of total Australian investment in Japan ($1.3 billion in 2018), it has nearly tripled in the past five years. The introduction of tighter investment controls would increase scrutiny of future Australian investments in sectors deemed related to national security.