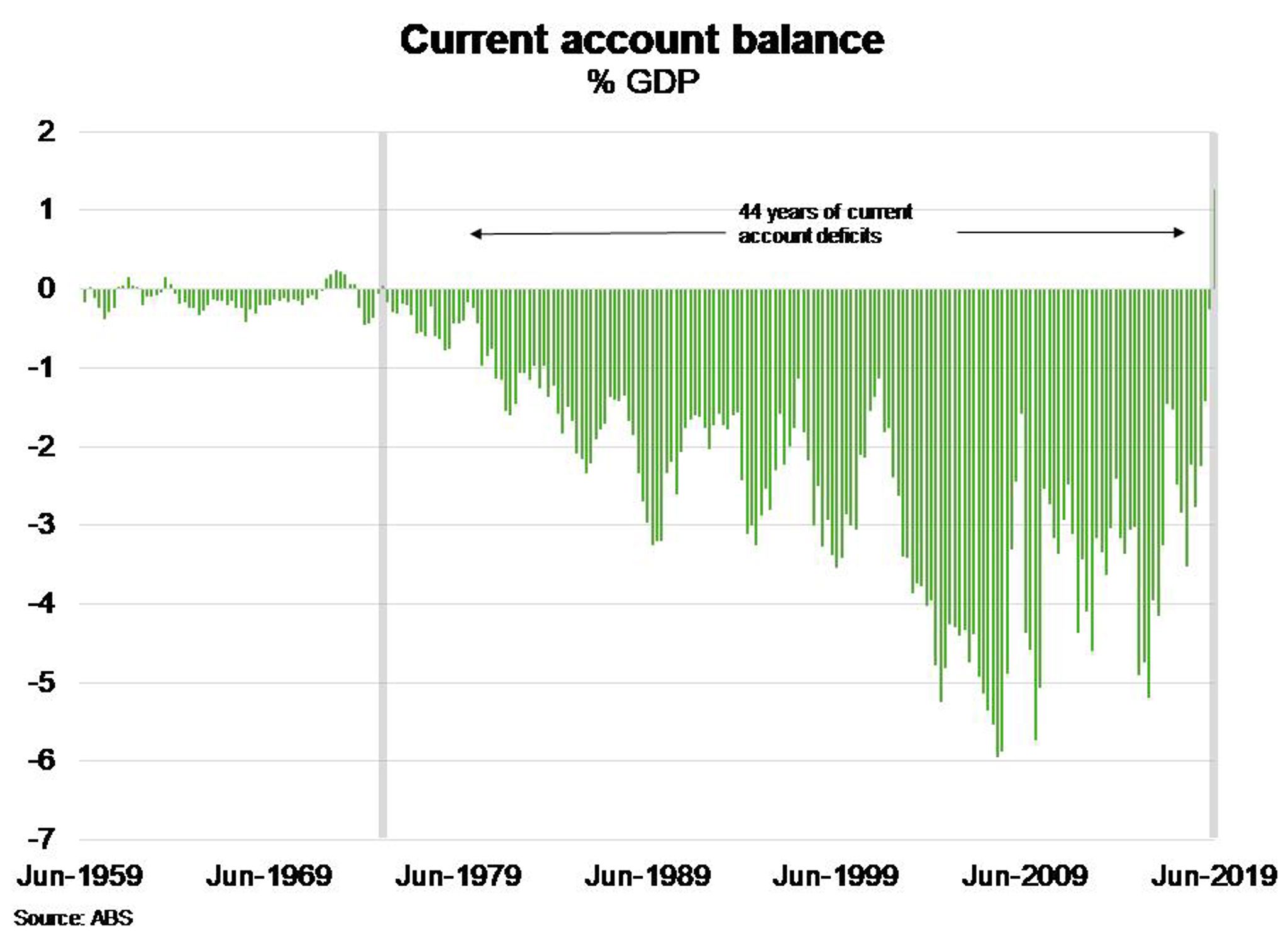

Australia – First current account surplus in 44 years

Australia has recently recorded a current account surplus for the first time since 1975 thanks to higher volumes of Australian resources exports and higher prices.

The $5.9 billion June quarter surplus was driven by a record trade surplus of $19.9 billion as resource exports surged on the back of increased Chinese demand. A current account surplus means that Australia receives more from the rest of the world in export revenues, dividends and interest payments than it pays out.

Australian exports have increased sharply since 2016 as Chinese authorities ramped up stimulus in response to a slowing economy and trade tensions with the United States. Much of this stimulus has been directed at the construction sector, which uses vast quantities of Australian iron ore and coking coal. This increase in export volumes has coincided with a rise in world prices for key Australian exports, partly due to supply disruptions in Brazil.

A big economic story of 2019 – the collapse of global bond yields – has also been a positive for the current account. Recent months have seen relatively sharp falls in long-term government borrowing costs as well as short-term interest rates in Australia. For a nation that holds $1 trillion worth of net foreign debt, lower financing costs will be a significant positive for the net income deficit – moderating the income payments Australians make to foreigners more than the payments foreigners make to Australians. As a rough guide, national income increases by approximately $10 billion a year for every year-long percentage point decrease in interest rates.

Conditions are set to be supportive for the current account in 2019-20. Continued stimulus to the Chinese economy will underpin Australia’s trade balance, while lower interest rates are helping to narrow the net income deficit. And although some of the improvement in export earnings will be lost by way of higher profits and dividends paid to foreign owners of Australian companies, the moderation of Australian interest rates relative to those overseas will help to contain the net income deficit. As commodity prices moderate, the expectation is that the current account balance will move back towards its long-run average (deficit).