Hong Kong – Protests disrupt the economy

The uncertainty from the protests is damping economic activity in an economy that is home to Australia’s largest commercial presence in Asia.

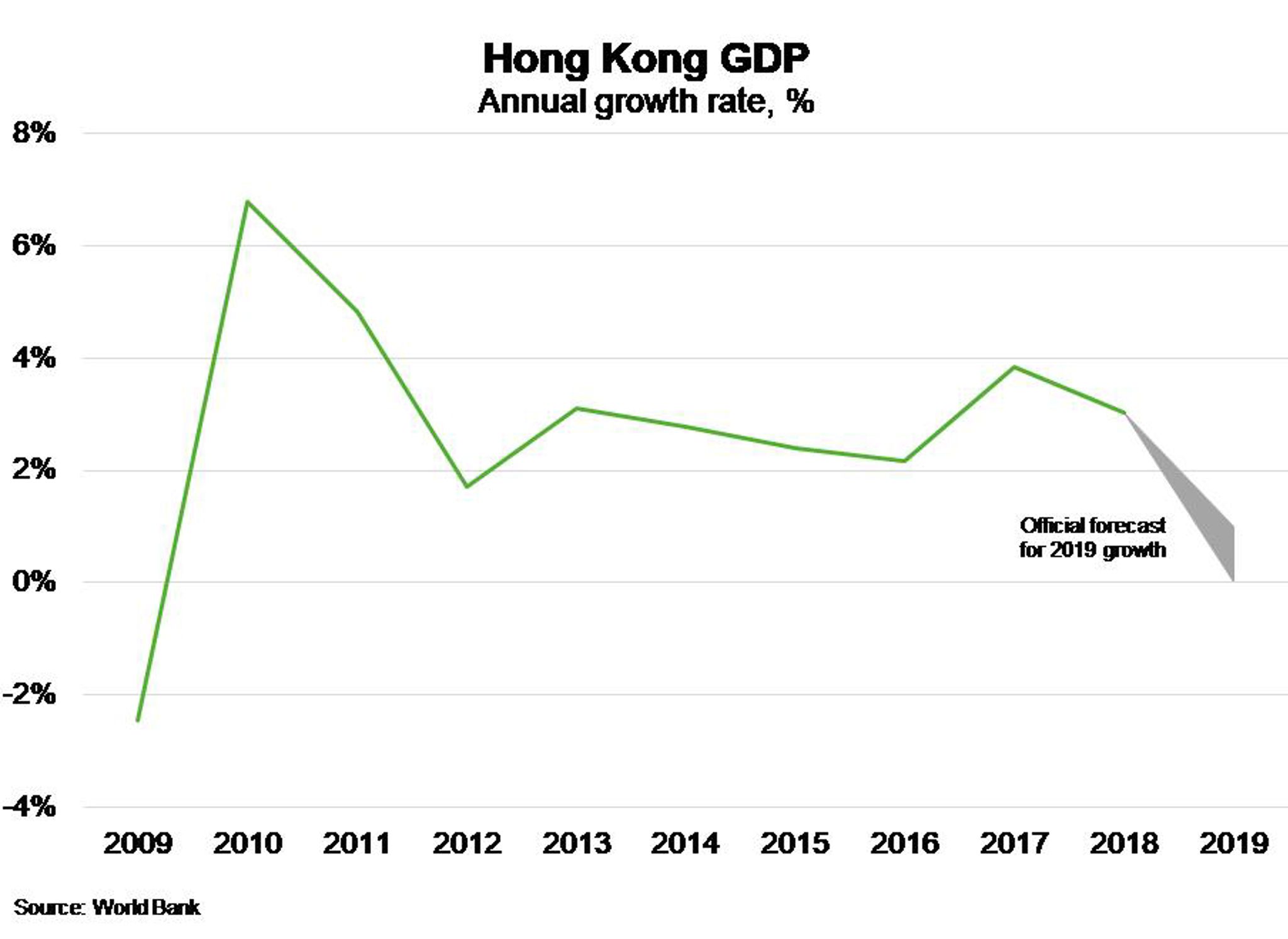

Now in their fourth month, the protests were originally sparked by a bill from Chief Executive Carrie Lam that would have allowed the extradition of suspects to mainland China. That bill was subsequently withdrawn, but protests have now broadened into a wider movement, which is disrupting an economy already struggling from weaker global trade. The government has announced a stimulus package to support the economy after lowering its growth forecast for 2019 from 1-2% to 0-1%. Hong Kong Financial Secretary Paul Chan has warned that Hong Kong could slip into a technical recession. Credit rating agency Moody’s recently downgraded Hong Kong’s rating outlook to negative, this followed Fitch Ratings’ earlier downgrade on Hong Kong’s long-term foreign-currency-issuer default rating to “AA” from “AA+”.

The outlook remains uncertain. If the situation escalates and prompts a sharper crackdown by the authorities, business investment and tourism will be further discouraged. Then again, if an agreement is negotiated, the outlook will improve. A shadow may linger over international investment given the potential for another conflict to arise. For now, it looks as though uncertainty will persist, further damping economic growth.

Hong Kong is home to Australia’s largest commercial presence in Asia. Transparency, rule of law, first-class regulation and proximity to other large markets make it an attractive location for Australian businesses. There are barriers for businesses operating in the city, however, including high levels of inequality, restrictive zoning practices, and high real estate prices. In 2017-18, Hong Kong was Australia’s seventh largest service market, valued at over $3 billion. The recently signed free trade agreement between Australia and Hong Kong guarantees access to the growing services market in Hong Kong, and ensures zero tariffs for Australian exporters. Any deterioration in the economy is likely to hit demand for Australian service exports especially hard.