Global—Supply chain pressures may have peaked

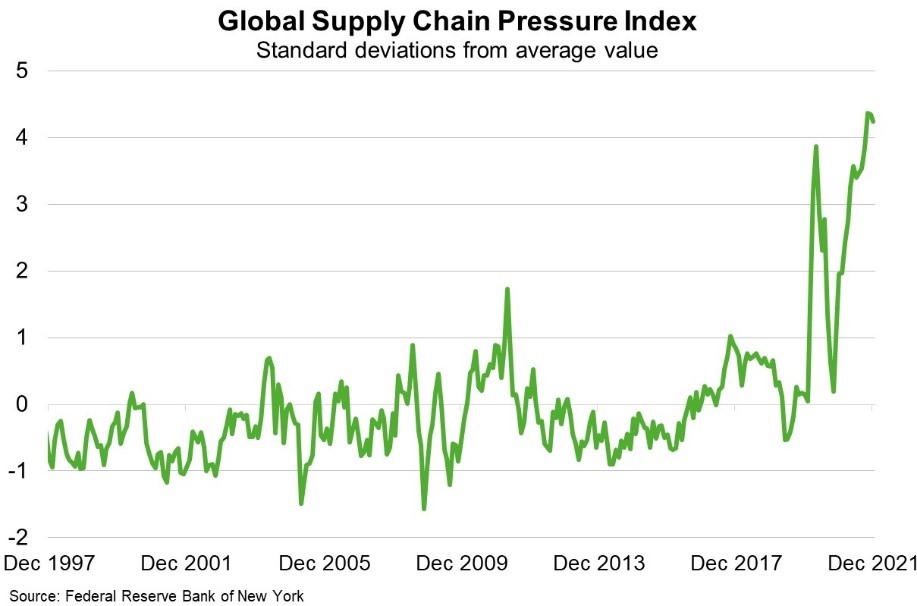

Last year saw an unprecedented bounce in demand for consumer goods combined with factory and port shutdowns, mobility restrictions and labour shortages that disrupted logistics networks, increased freight costs and delayed deliveries. Indeed, 11.5% of global vessel capacity was effectively unavailable in late 2021 due to port delays. A new gauge of global supply constraints produced by the Federal Reserve Bank of New York indicates such pressures were most acute in October 2021. The index—which is based on 27 variables, including costs of cargo (airfreight, container shipping and bulk shipping) with manufacturers’ delivery times, backlogs and inventories—remains well above pre-pandemic levels, but ticked lower in both November and December 2021 (Chart).

Surging Omicron infections have since created more challenges, and operational disruptions and bottlenecks are unlikely to be resolved for at least one more year. However, normalising supply will be facilitated by higher vaccination rates that allow for eased mobility restrictions and the shift in consumption back to services. Meanwhile, supply networks will adapt to COVID-safe production protocols with investments in supply security and plant efficiency. That said, continued positive momentum assumes China’s ‘zero-COVID’ policy does not lead to new, disruptive shortages in manufacturing, distribution and ports.

As supply strains ease, there is a risk of an overcorrection. But once the market stabilises, freight rates may settle at a level appreciably higher than prior to the pandemic. Major shipping firms saw record profits in 2021 despite elevated costs and disruptions, which may see greater market concentration. Increased freight rates would likely reduce exports of low-value commodities reliant on container shipping. It may also see companies reduce the length of their supply chains.