Indonesia—Faster economic growth faces headwinds in 2022

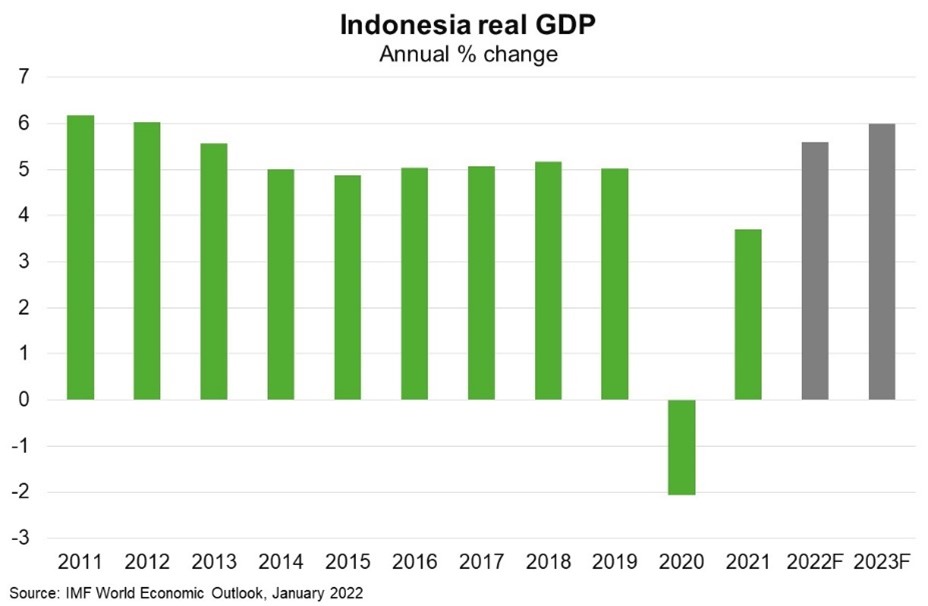

Indonesia’s economy is recovering steadily after a strong COVID-19 surge from June through August 2021 constrained domestic demand. GDP ended 2021 above its level before the pandemic, after growth rebounded to 5% year-over-year in Q4 2021. High global prices for Indonesia’s commodities supported exports in 2021 and are likely to do so again in 2022. The IMF forecasts real GDP to grow 5.6% in 2022 after a 3.7% increase in 2021. If achieved, that would be the fastest growth since 2013 (Chart).

But headwinds to the recovery are emerging. The government has stepped up public activity restrictions in Jakarta and Bali through February amid the rapidly spreading Omicron variant. Renewed pressures on the healthcare system could require the government to impose tighter social and business restrictions for even longer. Indonesia’s export ban on coal hit exporters in early 2022, albeit only temporarily after authorities recently lifted the ban. Still, given higher commodity prices have driven much of the recent increase in exports and investment, a marked decline in world growth and commodity prices would threaten the recovery. Given its high dependence on capital inflows into local equity and bond markets and elevated external debt, Indonesia is also vulnerable to a sharper than expected rise in US interest rates and local currency depreciation; although it is in a better position to manage tightening financing conditions compared to the 2013 Taper Tantrum. Indonesia may also raise interest rates if domestic inflation continues to rise in 2022, which would weigh on the consumption rebound.

Beyond the pandemic, economic growth should receive a boost from reforms to strengthen the business climate and public finances, but this is subject to effective policy implementation. Indonesia is Australia’s 13th largest export partner, taking $7.1 billion of goods and services exports in 2020 (1.6% of total exports).