US—Banking stress signals financial stability risks as interest rates rise

The collapse of Silicon Valley Bank (SVB) and Signature Bank—the second and third largest bank failures in US history—triggered panic in financial markets, quickly engulfing Credit Suisse as investors fretted about the stability of the global financial system. Other US regional banks, including First Republic Bank, are under significant pressure, receiving funding support from large banks and financial regulators to shore up liquidity.

Four factors reduce the likelihood of a repeat 2008-09-style GFC. First, banking stress appears to reflect idiosyncratic rather than system-wide problems. SVB’s collapse manifested in a mismatch between the bank’s assets and liabilities, rather than credit problems. SVB invested its large deposit base in long-dated US government securities, which plunged in value as interest rates rose rapidly. When forced to sell these assets at a loss to meet deposit withdrawals, SVB’s stability was brought into question, prompting further deposit withdrawals and its eventual collapse. In February, US regulators said the country's banks had unrealised losses of US$620 billion on securities, which could become actual losses should banks need to sell securities to meet liquidity needs. But so far, wider US banking problems are in a handful of small-to-mid size banks concentrated in specific sectors, such as technology and cryptocurrency. Meanwhile, problems at Credit Suisse reflect years of mismanagement and compliance and governance issues. Second, quick action by US authorities to insure customer deposits and provide liquidity facilities to banks have helped to shore up confidence. UBS’s purchase of Credit Suisse also helped reassure investors and bank customers. Third, significant financial reforms since the GFC have made US (and European) banks more resilient. Fourth, the economic backdrop is better; the US economy is growing, albeit on an increasingly fragile path, and unemployment is low.

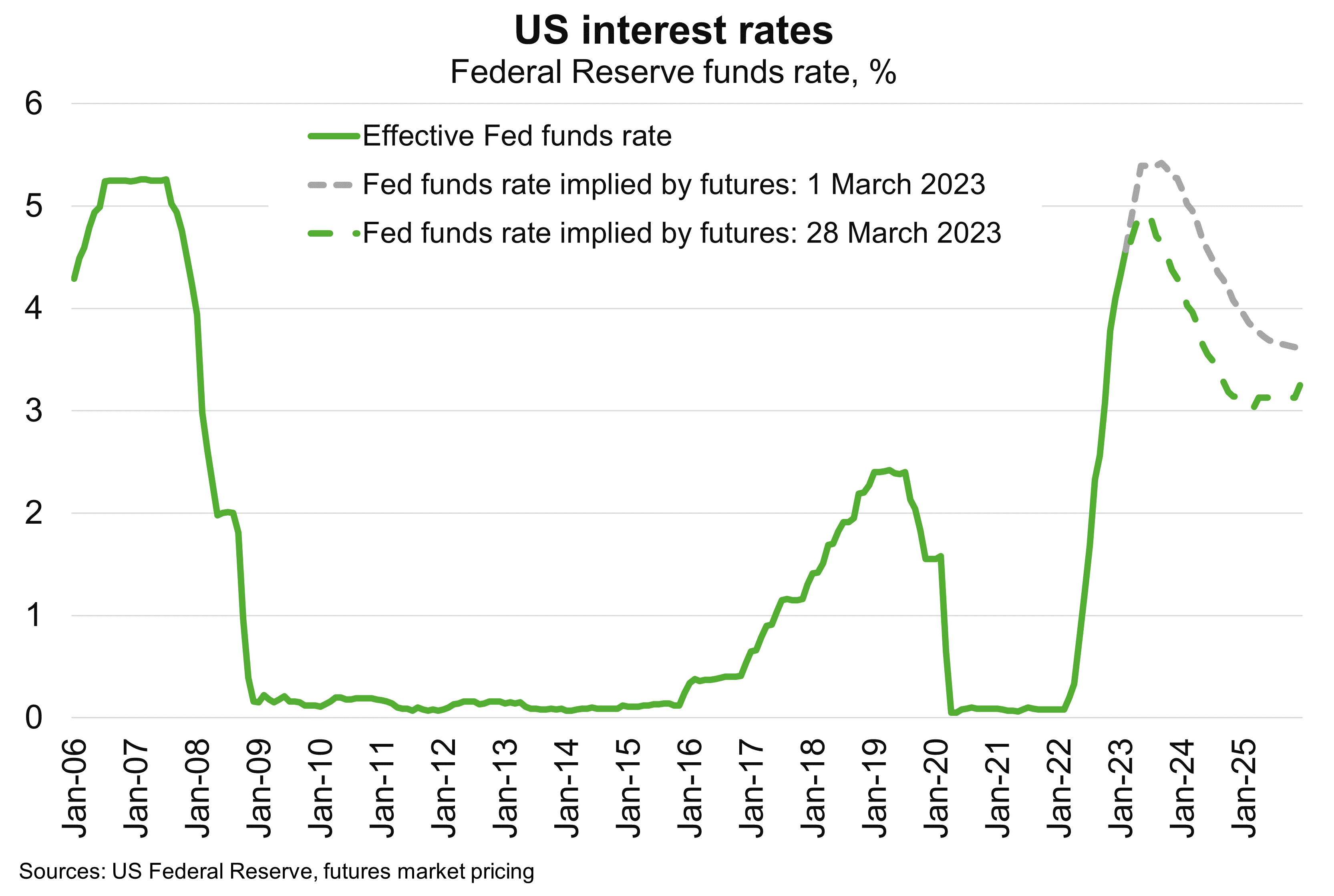

That said, the sharp tightening in monetary policy over the past year has exposed vulnerabilities in the global banking system. Investors are sharpening their focus on the balance sheets and funding costs of banks. And more attention is being paid to banks' portfolio risk management and the maturity profile of their assets. Other small and mid-size US banks—that are exempt from central bank supervision due to an easing in banking regulations legislated in 2018—are most at risk. Banks may become more conservative in their lending to safeguard their liquidity positions. That may further retrench credit to businesses and stymie global economic activity, dampening prospects for exporters. Significantly, recent banking stress has seen market expectations shift toward lower US (and Australian) interest rates (Chart). But whether this rates profile eventuates remains uncertain, as US monetary policymakers face the difficult battle of containing still-high inflation while managing financial stability.