World—Fragmented globalisation will erode living standards

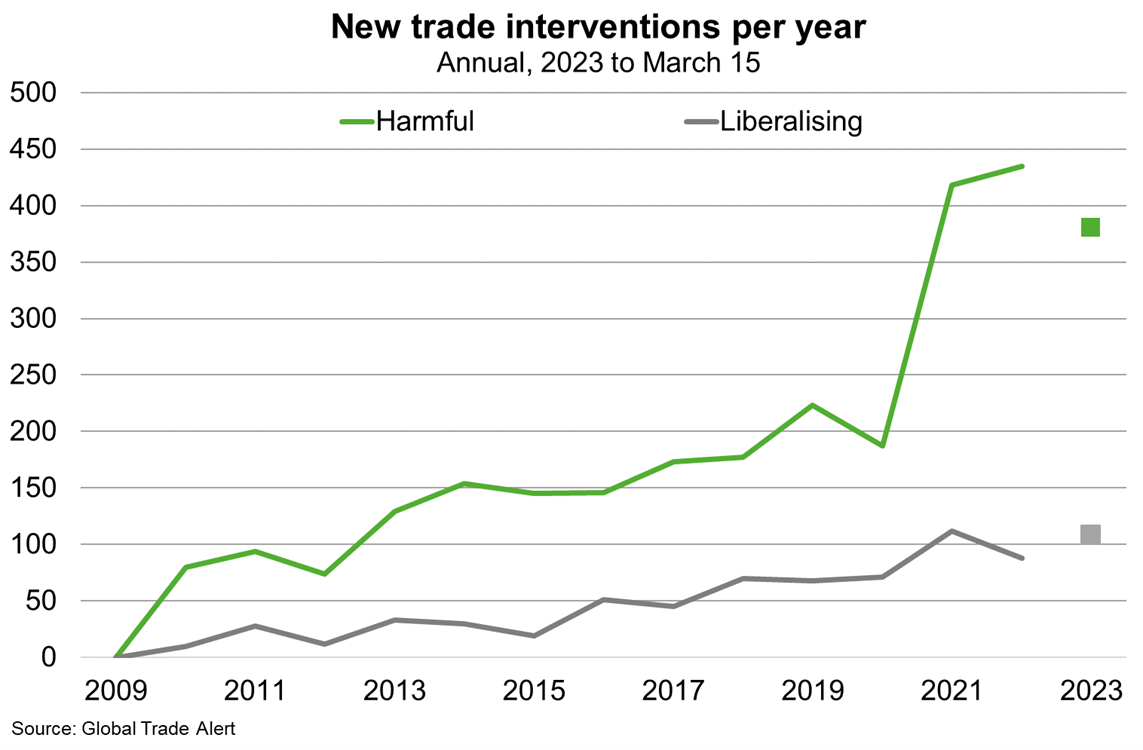

For decades, growing economic and financial interconnectedness appeared to provide unassailable benefits—lower consumer prices, greater economic efficiency, faster technology diffusion and far less extreme poverty. But cross-border flows of goods and capital have plateaued since the GFC and in some polities public support for economic openness has declined. Trade was then disrupted by the COVID-19 pandemic and Russia’s invasion of Ukraine. From 2016 to 2021, harmful new trade interventions worldwide tripled (Chart), particularly in high-tech sectors linked to national security or strategic competition.

In this context, companies are transferring focus from the efficiency to the resilience of their supply chains. This has seen inventory management move from “just in time” to “just in case”, but more recently, production locating in countries that are trusted and reliable (so-called “friendshoring”) or simply nearby (“nearshoring”). Globalisation may slow or even reverse in some sectors. Indeed, geoeconomic confrontation—including sanctions, trade wars and investment screening—made its debut in the World Economic Forum’s top three near term global risks this year.

Geoeconomic fragmentation will increase inflation and lower growth potential. The IMF estimate that the cost to global output from trade fragmentation could range from 0.2% to 7%—equivalent to the combined annual output of Germany and Japan. If technological decoupling also occurs, IMF studies suggest some countries could see losses of up to 12% of GDP. If fragmentation extends to restrictions on cross-border migration, reduced capital flows, and less international cooperation in a more shock-prone world, the full impact would be even larger. This would be especially challenging for trade-intensive emerging markets in the Asia Pacific region that dominate Australia’s export profile.