Papua New Guinea—Progress on IMF reforms and LNG investment boosts prospects

Progress on IMF reforms and LNG investment boosts prospects

PNG is making strong progress on the US$918 million 38-month IMF program approved in March 2023. Following completion of the first program review in November, the IMF provided an additional US$88 million in budget support. All performance criteria were met regarding the three reform pillars: fiscal consolidation, alleviating foreign exchange (FX) shortages by transitioning to a market clearing exchange rate, and enhancing governance and anti-corruption frameworks. Although subsequent IMF-mandated reforms are likely to prove more onerous, continued progress is required to secure crucial financial support from development partners. Such efforts are vulnerable to domestic political risks from early 2024—once the moratorium on no-confidence motions against the Prime Minister ends—if it leads to a shift in the government’s policy priorities.

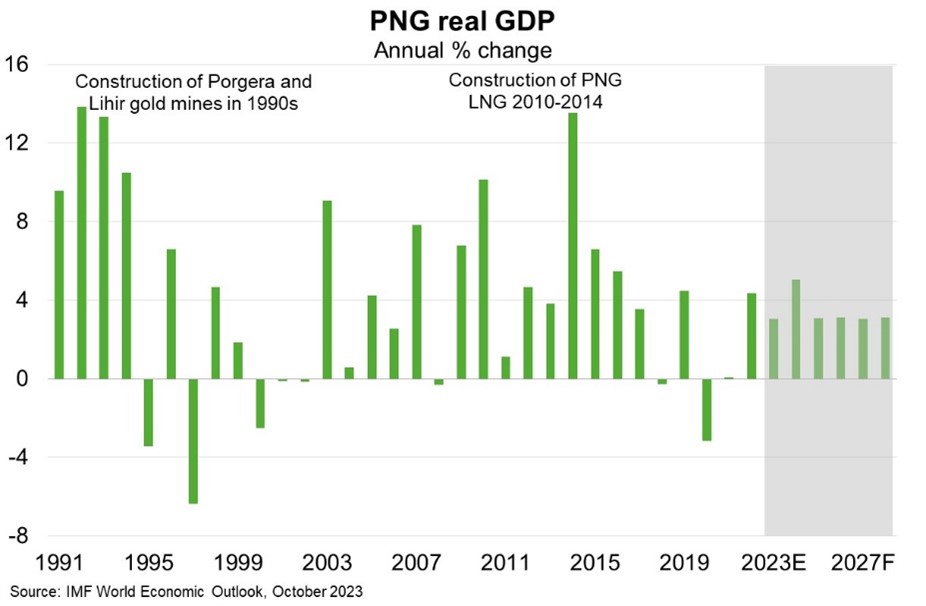

Momentum on gas projects further brightens PNG’s longer term economic prospects. The Total-led US$12 billion Papua LNG project (about 60% of GDP) is progressing toward a Final Investment Decision, expected in early 2024. PNG’s other mega gas project—ExxonMobil’s US$10 billion P’nyang gas upstream development, including an additional train at the existing PNG LNG facility—is poised to commence construction in 2028 once the Papua LNG plant is operational. Construction of large LNG projects provides upside to the IMF’s current economic forecasts (Chart), and would raise government revenue, help alleviate FX shortages and exert upward pressure on the PNG kina. This, in turn, would reduce the costs of structural reforms, including depreciation pressures from the shift toward a market-clearing exchange rate. The expected resumption of production from the Porgera gold mine in 2024 further supports prospects for GDP growth and FX inflows.

The continuation of IMF-led reforms and construction of large gas projects bolsters export and investment opportunities for Australian businesses. PNG was Australia’s 25th largest export market in 2022.