Euro area—Low growth and entrenched inflation suggest stagflation

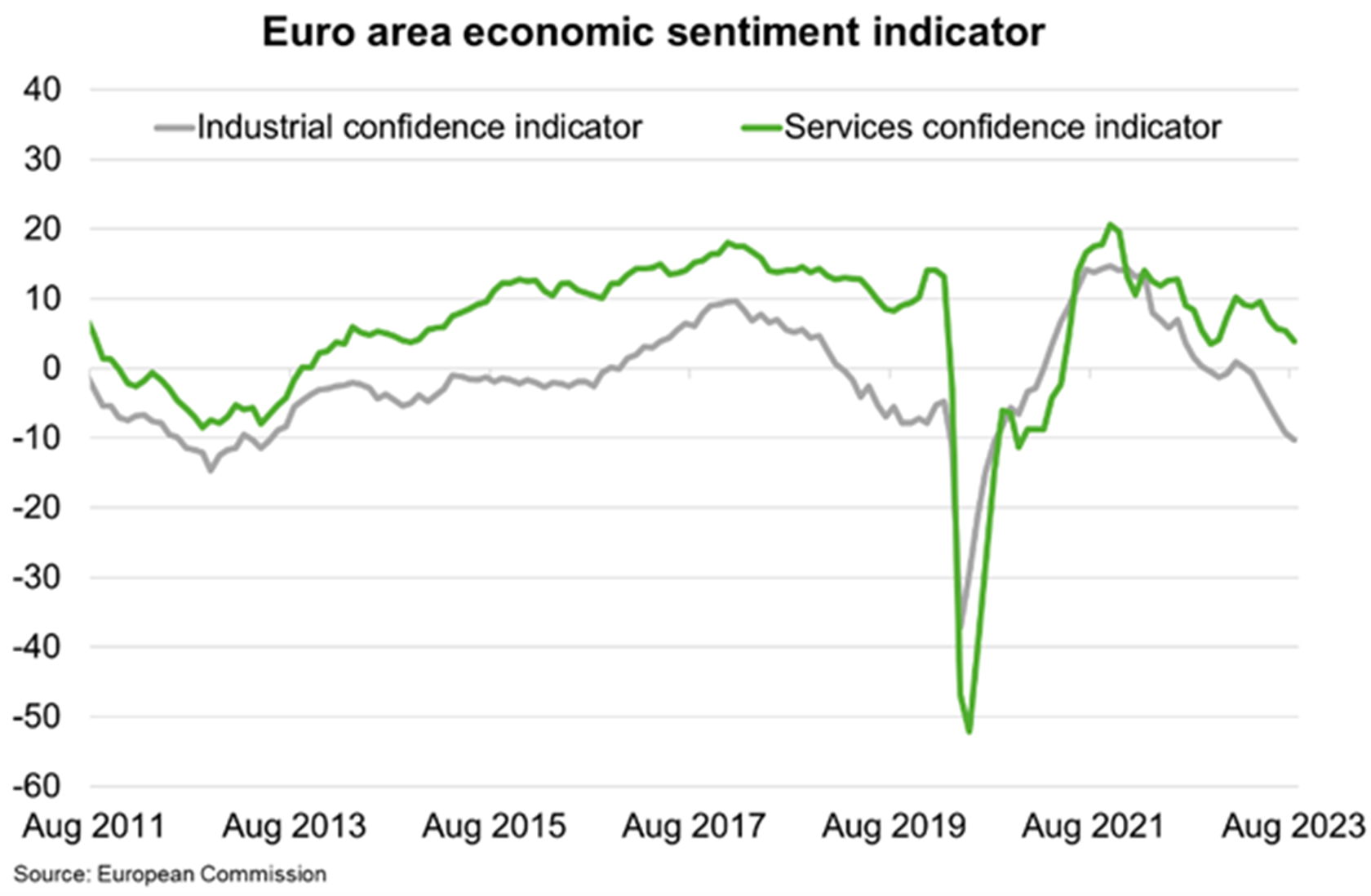

The world’s third-largest economy, the euro area, stagnated over the first half of the year as GDP eked out 0.1% q/q growth in both Q1 and Q2. Economic indicators suggest no improvement in Q3. Retail sales and industrial production fell in July while the closely watched IFO business climate index showed German companies were increasingly pessimistic in August. Moreover, both the European Commission’s economic sentiment indicator (Chart) and the purchasing managers indices (PMI) suggest demand weakness previously confined to the manufacturing sector has spread to services. Indeed, the services PMI fell into contractionary territory in August.

Meanwhile annual inflation remained broadly steady at 5.2% in August, well down from a peak of 10.6% in October last year, but well above the 2% target. The European Central Bank (ECB) forecasts inflation ‘to remain too high for too long’, falling gradually from 5.6% in 2023 to 3.2% in 2024 and 2.1% in 2025. As such, the ECB hiked interest rates for the 10th consecutive time, by 25 basis points to a record 4.0% this month. While interest rates may have peaked, they will continue to be transmitted forcefully, via tightened financing conditions and weaker bank lending.

Reflecting the dampening impact of higher rates on domestic demand and the weaker international trade environment, the ECB lowered their economic growth projections significantly, to 0.7% in 2023 and 1.0% in 2024. While Spain and France are expected to fare relatively well amid robust tourism, Germany is likely to contract this year. Heavy reliance on manufacturing and trade have exposed Germany, Europe’s powerhouse economy, to disrupted global supply chains, higher energy prices and global economic slowdown. That said, euro area economic momentum should recover over time, as the exceptionally strong labour market, which has seen record low unemployment rates, falling inflation and rising wages underpin consumer spending.