Pakistan—Protests threaten to derail crucial US$3 billion IMF program

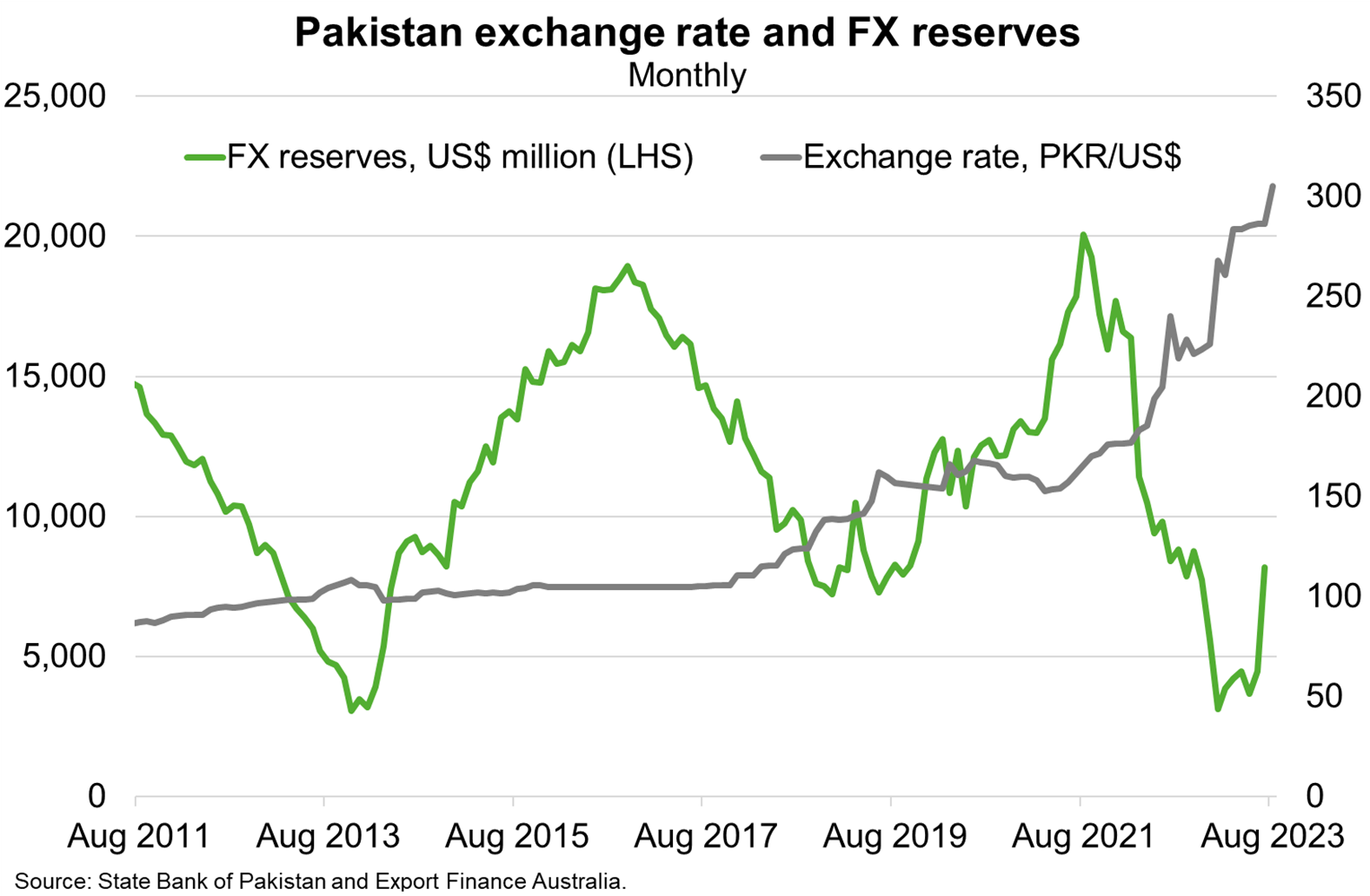

Pakistan’s economic crisis reflects devastating 2022 floods, the commodity shock from Russia’s invasion of Ukraine, significant tightening of external financing conditions and domestic policy backsliding. Sovereign default was narrowly avoided in June after Pakistan secured a US$3 billion bailout from the IMF and US$3 billion of additional financing from Saudi Arabia and the UAE alongside the refinancing of loans from Chinese banks. Nonetheless, Pakistan’s economic challenges are complex and multifaceted and financing risks remain exceptionally high according to the IMF, given enormous public debt rollover needs and limited foreign reserve buffers (Chart). Confidence is weak and private credit rating agencies have downgraded Pakistan as financial stability deteriorates.

IMF funding is tied to the implementation of economic reforms, including decisive fiscal consolidation to restore debt sustainability. In particular, authorities committed to gradually aligning power tariffs with cost recovery levels to reduce heavy losses in the energy sector that have seen regular widespread power outages. Exacerbated by a weakened rupee that has increased the cost of fuel imports, these reforms have seen the cost of electricity double in the past three months. The IMF expects inflation to average 26% in FY2024. The inflationary environment, coupled with a material slowdown in economic activity, has triggered nationwide protests.

Pakistan’s difficult economic circumstances provides the backdrop for upcoming national elections, scheduled in January 2024. The fractious electoral environment is likely to increase the risk of political instability and distract Pakistan’s key institutions from pursing much needed reforms. Australia’s 30th largest export market, taking $1.7 billion in goods and services exports in 2022, is likely to remain a difficult place to do business.