Bangladesh — Sovereign bond to boost infrastructure and growth

The Bangladeshi government is planning to issue a maiden US dollar sovereign bond in 2020 to boost infrastructure development and diversify the economy beyond the garment sector. Rising infrastructure investment bolsters an already-strong growth outlook. The IMF projects real GDP to grow on average 7.3% per annum over the five years to 2024, remaining among the world’s fastest growing economies.

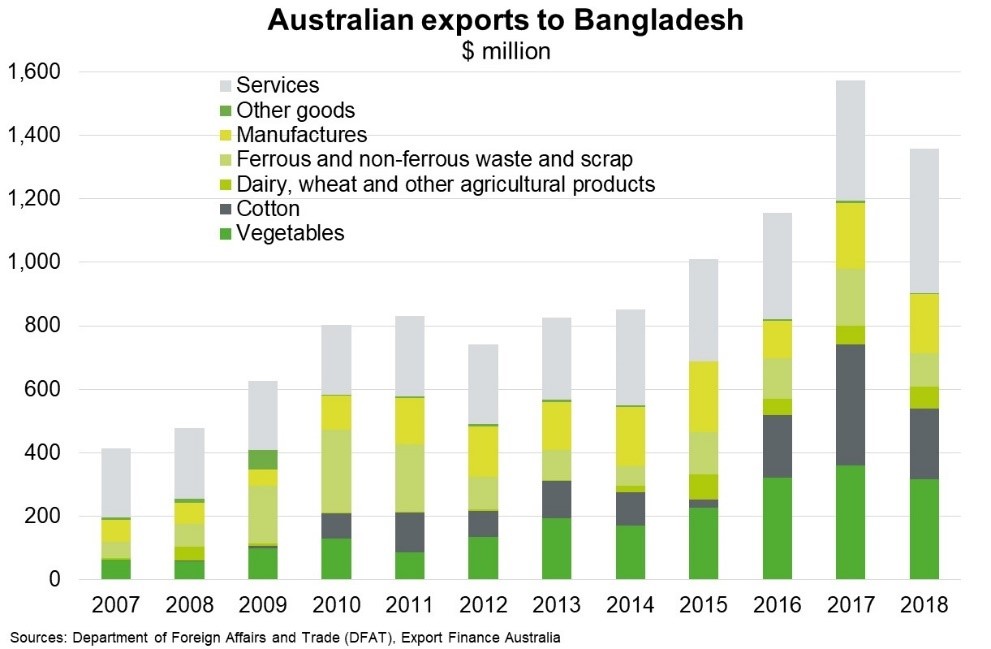

Development of Bangladesh's railways, roads and port infrastructure offers opportunities for Australian exporters of energy, transport, telecommunications and mining services and equipment. Energy is a key focus of the Bangladeshi government as the country faces power supply shortages. At present, exports of mining, energy and manufactured products to Bangladesh remain very small. But total goods exports have grown 25% per year since 2008 to average about A$1 billion per annum in 2017 and 2018, pointing to significant potential gains for Australian exporters ahead.

As Bangladesh’s economy expands, the IMF projects GDP per capita will rise to more than US$2,800 in 2024, up from an estimated US$1,900 in 2019. Rising incomes and increasing living standards will support growing demand for Australian vegetables, dairy and wheat, which accounts for 35% of goods exports to Bangladesh. Cotton exports will continue to benefit from ongoing growth in Bangladesh’s competitive ready-made garments sector.

Rising Bangladeshi incomes boosts export opportunities for Australian services firms, including education and tourism. Australia is increasingly recognised as the preferred international education destination for Bangladeshi students, receiving more than 7,200 students in 2018, the highest level since 2009. Services exports to Bangladesh reached A$455 million in 2018, nearly double the levels of 2013.