Emerging markets (EMs) face significant risks to growth and financial stability in 2020. Although the IMF projects a recovery in EM’s GDP growth in 2020, protracted trade and geopolitical tensions, including Brexit-related risks, poses downside to the outlook. This could hinder investor sentiment and lower capital inflows into EMs. Although higher government spending can provide some support, governments with large debt burdens will find it more difficult to stimulate their economies.

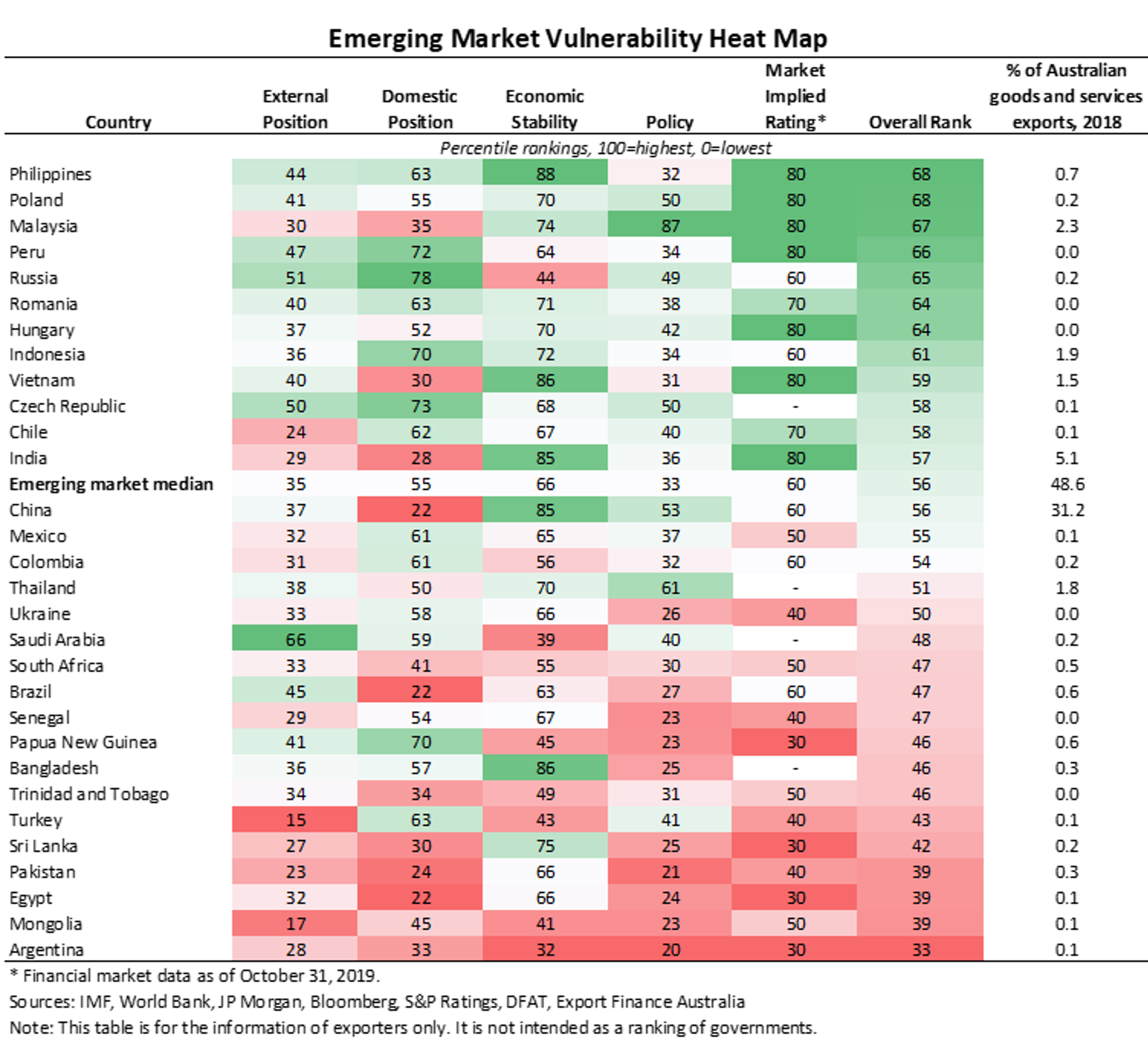

To assess the countries most exposed to these risks, Export Finance Australia have reviewed a selection of EM countries on five indicators.

- External position—what is the external debt and reserves position? Is the current account in deficit and how far has the currency deviated from its long-term average?

- Domestic position—how leveraged is the private and public sector?

- Economic stability—what is the growth and inflation outlook? How reliant is the country on commodity exports, given the volatility in global commodity prices?

- Policy effectiveness—how effective is the regulatory environment and how severe are political risks?

- Market implied ratings—market risk premiums on foreign currency denominated bonds are used to give an indication of market risk appetite.

On the positive side, Philippines, Malaysia, Indonesia, Vietnam, India, China and Thailand – which accounted for 45% of Australian goods and services exports in 2018 – rank in the top half of the table. These countries benefit from large, growing economies that supports their capacity to withstand shocks. They also have stronger institutional and business environments and healthier fiscal and external positions than other EMs. As a result, investor appetite in these markets is stronger.

Argentina, Mongolia, Egypt, Pakistan, Sri Lanka and Turkey start from a relatively weaker position to handle potential shocks in 2020. In general, these countries have poor public and external finances, slow growing economies and weak governance and institutions. Notably, though, these countries account for less than 1% of Australia’s goods and services exports, indicating minimal direct exposure.