Australia—Global FDI declines as Australia invests more in Asia

Global foreign direct investment (FDI) flows declined 24% over the year to 2022 to around US$1.3 trillion after a major telecommunications firm operating in Luxembourg withdrew capital, according to the OECD. Excluding Luxembourg, global FDI flows declined 5% over the year to 2022. The OECD report shows reduced inbound direct investment in major recipient countries—China and the US—and further weakness in global mergers and acquisition activity as investors respond to tighter global financial conditions, ongoing geopolitical tensions and concerns about the global economy. In general, lower investment activity and rising barriers to international trade and cross-border financial flows are contributing to weaker long term global growth prospects.

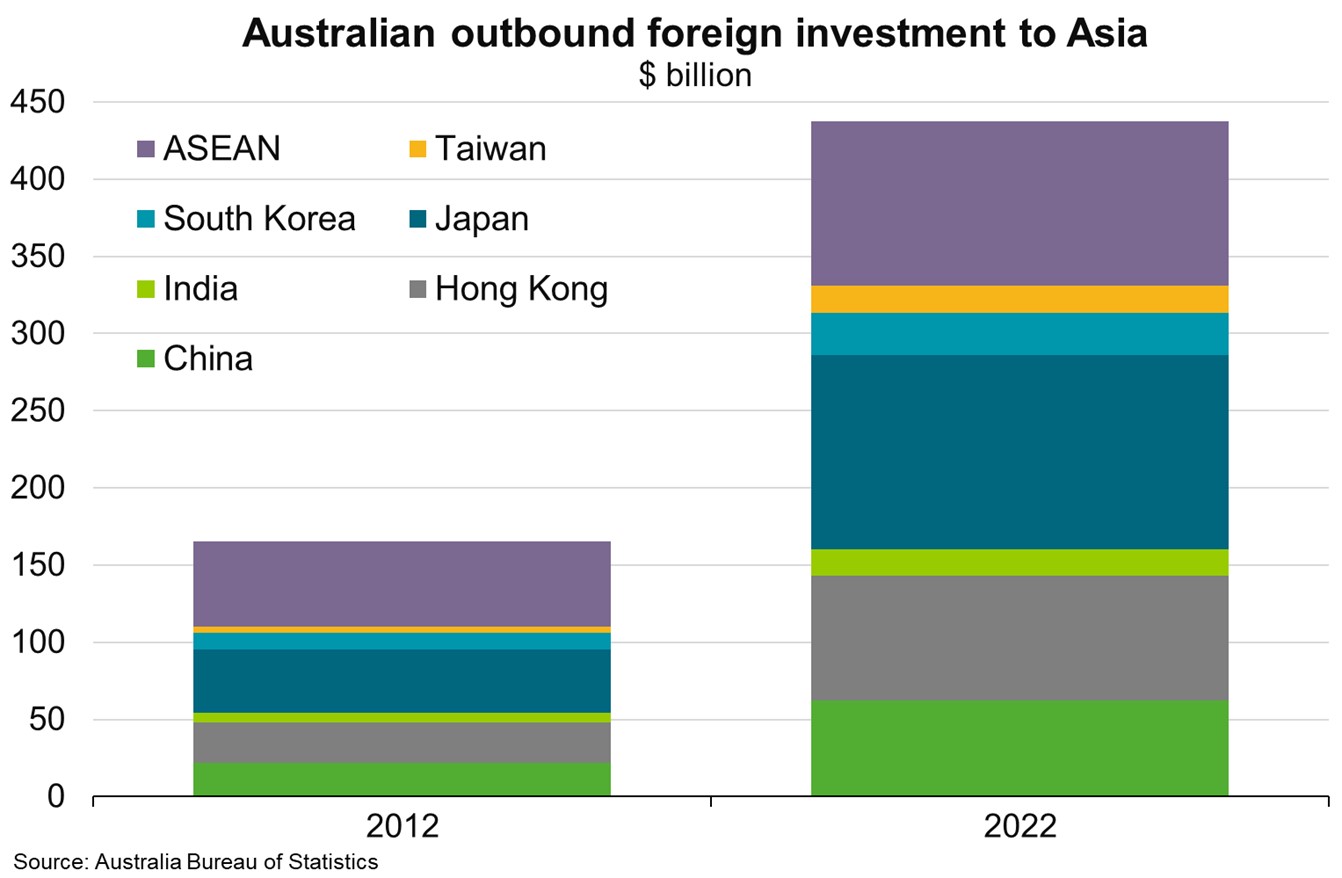

Bucking the global trend, Australia’s outbound foreign investment continued to rise in 2022. The US and the UK remained the two largest destinations for Australia’s outbound foreign investment, totalling over $1.9 trillion and accounting for 52% of Australia’s investment abroad in 2022 (including direct and portfolio investments). But although the US and UK still dominate as outbound investment destinations, Australia’s investment in Asia is growing at a slightly faster rate than that to the rest of the world. Australia’s investment in China, Hong Kong, India, Japan, South Korea, Taiwan and the ASEAN economies amounted to more than $437 billion in 2022, up from $165 billion in 2012 (Chart).

Asia is proving resilient to the global economic slowdown—the IMF expects the region to grow faster in 2023 than 2022 and contribute 70% of global growth. This offers significant opportunities for Australia to boost its investment in the region. Favourable demographics in countries such as India and Indonesia, rising urbanisation and industrial development, increasing regional economic engagement, and in some countries, a focus on structural reforms to ease impediments to doing business also enhance prospects for Australian investment in Asia. That would support growth in Australia’s exports—including traditional resources, food and beverages, education, tourism and healthcare.