Australia—Resources exports to diversify amid clean energy transition

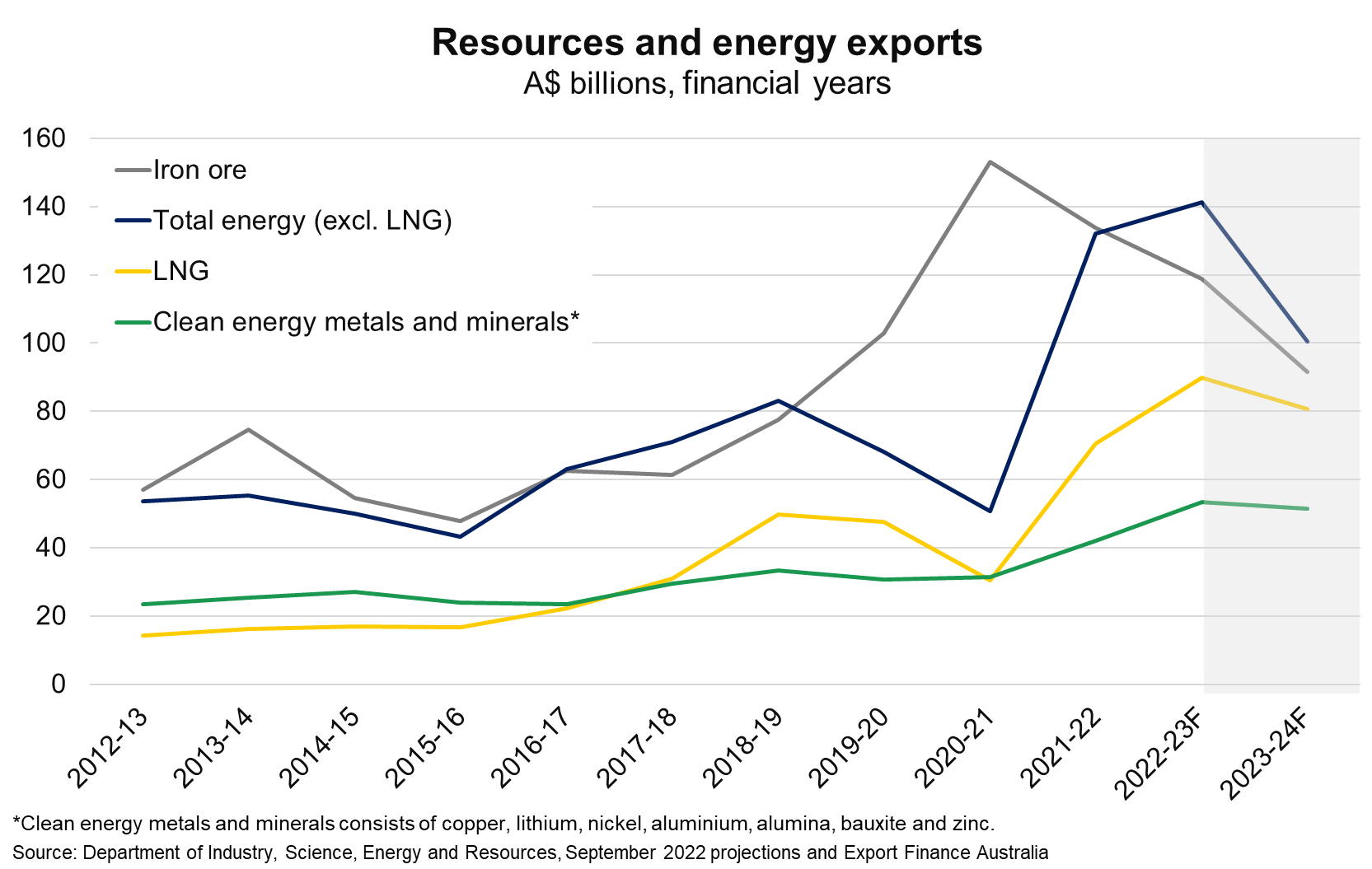

Australia’s resources and energy exports are forecast to reach a record $450 billion in 2022-23, surpassing last year’s record of $422 billion. Declining exports of iron ore by value will be offset by rising exports of LNG and metals and minerals used in clean energy technologies, as global economies decarbonise (Chart). Earnings are then predicted to fall but remain high at $375 billion in 2023-24.

Iron ore exports are forecast to gradually ease from $134 billion in 2021-22 to $95 billion in 2023-24. This reflects more modest growth in blast-furnace steelmaking from major producers (EU, US and China), as the world transitions to lower emissions. Rising supply from Australia and Brazil will also face weaker demand related to a slowing global economy and China’s housing market downturn. Fossil fuels exports are poised for another strong year in 2022-23, reflecting high prices for thermal and coking coal amid energy supply problems (largely related to Russia’s invasion of Ukraine). Thereafter, exports of oil, thermal and coking coal will fall as demand for, and prices of, carbon-intensive products weaken.

Australia will benefit from the growing demand for metals and minerals used in low-emission technologies given its large and diverse resource base. The clean energy transition will significantly increase demand for metals used in the manufacturing of electric vehicles and renewable power generation facilities. For instance, solar panels use large quantities of copper, silicon, silver and zinc, while wind turbines require iron ore, copper, and aluminium. The International Energy Agency projects mineral demand for use in electric vehicles and battery storage could grow at least thirty times by 2040. Reflecting this, Australia’s exports of copper, nickel, lithium, zinc, alumina, aluminium and bauxite are set to hit more than $53 billion in 2022-23, 70% more than they earned in 2020-21. Moreover, the outlook for LNG exports remains strong compared to other fossil fuels, bolstered by comparatively lower carbon emissions from production and combustion.