Economic outlook

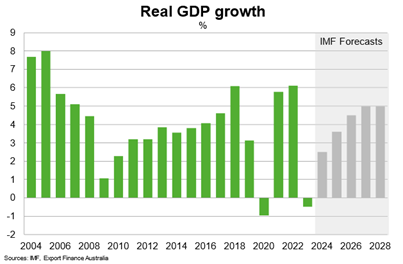

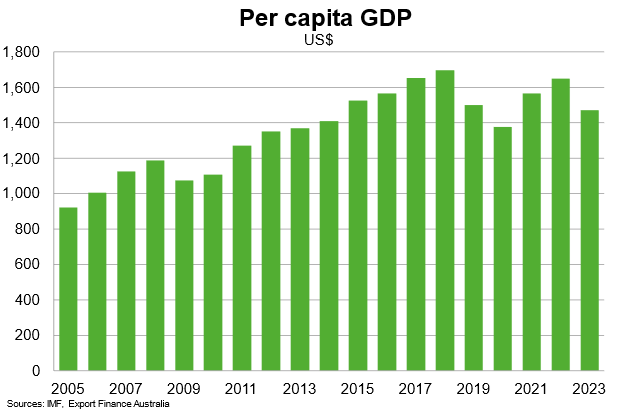

The IMF estimates Pakistan’s economy contracted 0.5% in 2023, reflecting declines in private investment, consumption and government spending amid global macroeconomic headwinds. Among key sectors, agriculture output grew in 2023 as damage to infrastructure and land following the 2022 floods remained an ongoing hurdle; import restrictions and higher production costs led to a contraction in industrial production; while the services sector shrank due to spillover effects of slower agriculture and industrial sector activity.

The IMF expects growth to recover to 2.5% in 2024, supported by further recovery in agriculture output following recent floods. Phased and gradual easing of import restrictions should support recovery in industrial sector activity. The services sector—particularly wholesale and retail trade, and transport and storage—should grow in line with the broader economic recovery. Economic growth should also receive support from continued bilateral financing inflows and financial support related to the IMF program. On the other hand, remittances are likely to decline marginally due to slower growth in host countries.

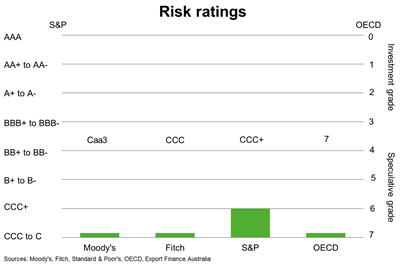

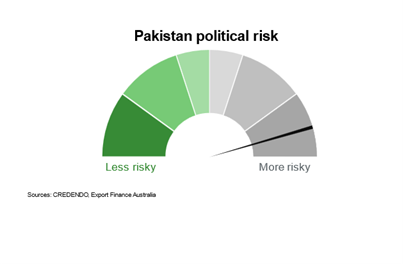

Progress has been made on IMF-led reforms, with Pakistan meeting nearly all of its latest quantitative and structural benchmarks, according to the IMF’s January 2024 review. The IMF noted economic growth, the fiscal position and foreign reserves have improved. But heightened political uncertainty and social tensions following recent elections suggests the new government is likely to face challenges implementing necessary reforms.

Risks to the outlook are tilted to the downside. Continuously large external debt payments, tight global financing conditions and the high domestic policy rate could put sharper than expected downward pressure on the economic recovery. Liquidity risks are high, as foreign reserves remain low and external debt payments are large. Import controls could be maintained, which hinders the ability of businesses to import critical inputs into export-oriented sectors. Protracted and elevated food and energy price inflation also remains a risk, alongside vulnerability to natural disasters.

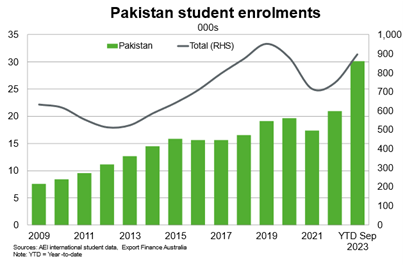

The IMF projects real GDP to expand by an average of 4.5% per year between 2025-28. Longer term, infrastructure investments through projects in the China-Pakistan Economic Corridor (CPEC) and significant increases in power supply can help address some of Pakistan's economic constraints and strengthen its growth potential. Pakistan’s young and growing population presents both opportunities and challenges. IMF-led macroeconomic reforms, should they be maintained, would offer wider benefits to the economy and public and external finances. However, forecasts would be at risk if there is significant backsliding on reforms that exacerbates existing economic vulnerabilities.